Bitmain Sells 30K Miners to Marathon Digital for $120M

With the new purchase, the company’s total miners will increase about 30% to approximately 133,000 bitcoin miners, producing 13.3 EH/s, said Fred Thiel, Marathon Digital’s CEO.

Fred Thiel, CEO, Marathon Digital

- Marathon anticipates all 30,000 miners to ship from Bitmain between a six-month period from January 2022 and June 2022

- If all of Marathon’s miners were running today, the company’s hash rate would represent approximately 12% of the bitcoin network’s total hash rate, it said.

China’s largest maker of cryptocurrency mining machines, Bitmain, has sold 30,000 miners for $120.7 million to Marathon Digital, a publicly-listed digital asset technology company that mines cryptocurrencies, according to a press release on Monday.

Beijing-based Bitmain is no stranger to selling mining equipment. Within the blockchain mining space, it has shipped billions of application-specific integrated circuit (ASIC) miners, accounting for 75% of the global market, according to its website. ASIC miners are electrical circuits designed to mine bitcoins and other cryptocurrencies.

Marathon anticipates all 30,000 miners to ship from Bitmain between a six month period from January 2022 and June 2022, it said. With the new purchase, the company’s total miners will increase about 30% to approximately 133,000 bitcoin miners, producing 13.3 EH/s, said Fred Thiel, Marathon’s CEO.

“Increasing our percentage of total network’s hash rates increases our probability of earning bitcoin, and given the uniquely favorable conditions in the current mining environment, we believe it is an opportune time to add new miners to our operations,” Thiel said.

If all of Marathon’s miners were running today, the company’s hash rate would represent approximately 12% of the bitcoin network’s total hash rate, which was approximately 109 EH/s as of August 1, the company said. For reference, 1 EH/s is one quintillion hashes per second.

“As a result, once all miners are fully deployed, our mining operations will be among the largest, not just in North America, but globally,” Thiel said.

In general, many mining firms are moving operations from China to North America, after Beijing banned bitcoin mining in June. The “great mining migration” out of China has become a decentralizing force and drive in moving a sizable portion of mining companies to North America in search of new homes for mining facilities, Blockworks previously reported.

In recent months, Beijing called for a crackdown on China’s crypto mining industry, which was home to over 65% of global mining capacity. According to reports, more than 90% of China’s bitcoin mining capacity is expected to close, just weeks after the ban in China’s Qinghai province was announced.

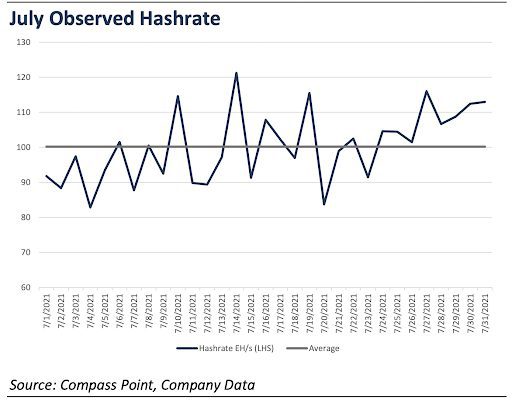

Separately, the observed global hash rate for July dropped about 20% from 120.1 EH/s in June to 100.3 EH/s in July, according to Glassnode data shared in a recent report by Michael Del Grosso, a managing director at Compass Point Research & Trading. A lower global hash rate essentially equates to an easier ability for existing operations to mine bitcoin, the note said.

Compass Point also estimates that the global hash rate will be 2% higher by the end of 2022, but wrote that their estimates might be overly conservative due to the unclear and eventual outcome from the Chinese mining displacements.

Marathon shares (MARA) were last trading up $1.05, or 3.8%, at 28.68 as of 2 pm ET on Monday.