Bitwise files for first Chainlink ETF with SEC

Filing seeks to expand regulated crypto exposure, with Coinbase Custody as fund custodian

Art by Crystal Le

This article was generated with the assistance of AI and reviewed by editor Jeffrey Albus before publication.

Bitwise Asset Management filed an S-1 registration statement with the US Securities and Exchange Commission on Aug. 26, 2025, seeking approval to launch the first US spot Chainlink (LINK) exchange-traded fund.

The fund is designed to track the CME CF Chainlink–Dollar Reference Rate, a benchmark price for LINK, and would give investors regulated access to the token without requiring direct custody.

Coinbase Custody Trust Company is named as the proposed custodian for the ETF, according to the SEC filing.

The filing comes as asset managers expand beyond Bitcoin and Ethereum ETFs, which won approval in 2024 following years of legal disputes and regulatory hesitation. Bitwise has previously submitted applications for funds tied to Solana, NEAR Protocol, and other tokens, reflecting a broader push to bring alternative crypto assets into the ETF market.

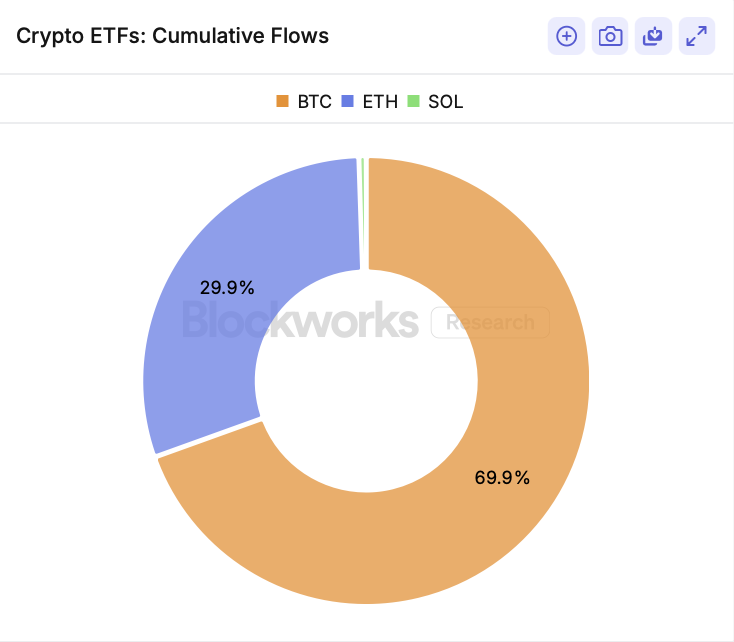

According to Blockworks Research, Bitcoin ETFs have amassed roughly $77.9 billion in cumulative flows, compared to about $23.2 billion for Ethereum ETFs and just $162 million for Solana ETFs.

The scale of these products has emboldened asset managers to expand into alternative tokens like Chainlink.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.