BNY Mellon Report Takes On Bitcoin Valuation

Last month BNY Mellon revealed it would soon custody bitcoin and other digital assets for asset managers the same way it handles their other more traditional holdings. This month it invested in Fireblocks, the Israeli digital assets infrastructure startup whose technology is underpinning BNY Mellon’s custody service.

- New report compares bitcoin to gold and highlights the stock-to-flow ratio in an attempt to evaluate the digital asset’s price and role in the real economy

- BNY Mellon plans to be a key player in the new financial world

The Bank of New York Mellon issued a report over the weekend comparing bitcoin to gold and highlighting the stock-to-flow ratio in an attempt to evaluate the digital asset’s price and role in the real economy.

“In today’s environment, where the intrinsic value of fiat currencies is increasingly being questioned, it is important to consider the value of alternative currencies such as bitcoin,” the report said.

“Ultimately, bitcoin valuation will likely be a combination of several models and be constantly evolving, especially as it gains mainstream acceptance,” it said later in the report.

BNY Mellon, a $41 trillion-asset bank and the oldest bank in the US, has said digital assets are “becoming part of the mainstream” and that it plans to be a key player in the new financial world. Last month it revealed it would soon custody bitcoin and other digital assets for asset managers the same way it handles their other more traditional holdings. This month it invested in Fireblocks, the Israeli digital assets infrastructure startup whose technology is underpinning BNY Mellon’s custody service.

The Stock-to-Flow Ratio

The stock-to-flow ratio is “one of the more interesting” valuation concepts, according to the report. It measures the abundance of a particular resource and assumes that scarcity drives value.

Critics of the stock-to-flow ratio maintain that supply doesn’t define price, gold’s movement is explained by the purchasing power of the dollar and gold trades are based on inflation or currency debasement expectations.

But many aspects of valuation are a relative exercise, and the stock-to-flow model pegs relative scarcity to an asset widely accepted as an alternative currency and store of value.

“Recall the problem of valuing bitcoin from a traditional currency basis due to a lack of relativity,” it said. “In many forms, the stock-to-flow model is elegant (and potentially flawed) in its simplicity. It provides that relativity to link bitcoin with a much more established gold market.”

The gold alternative

Commodities have the largest stock-to-flow ratios and historically, gold has had the highest. Gold and bitcoin are increasingly being perceived as alternatives to each other, depending on investors’ comfort level.

Gold’s stock-to-flow ratio is currently over 50, bitcoin’s is in the 20s, according to the report — meaning it will take 20-something years to double the total stock of bitcoin at the current rate of production.

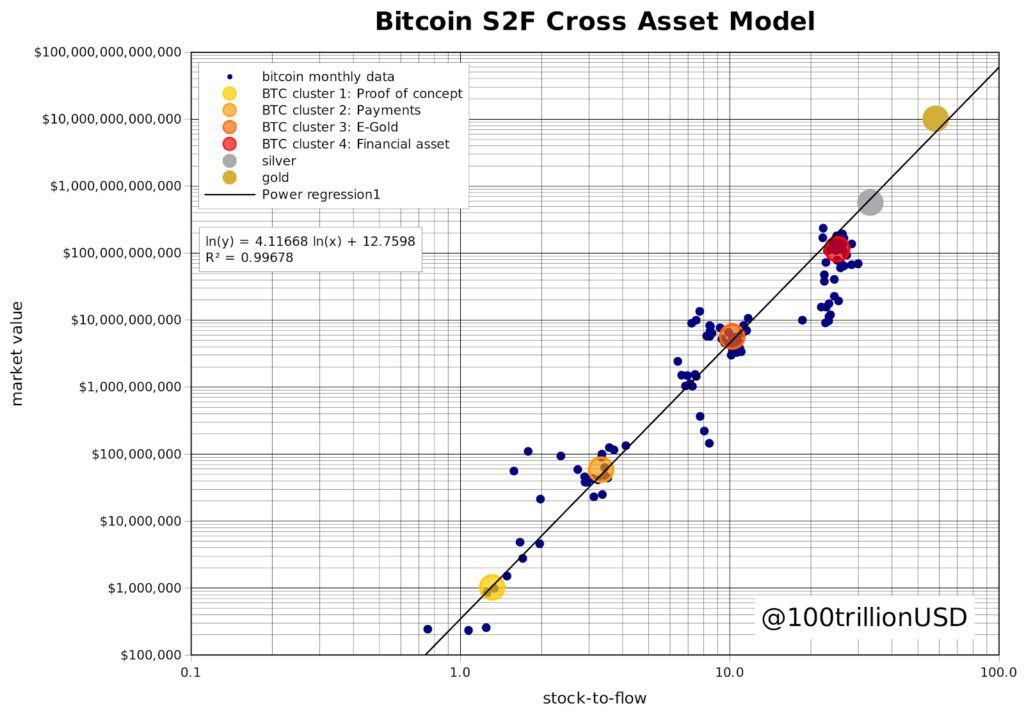

Source: PlanB

Source: PlanB

According to the Dutch institutional investor PlanB’s developing stock-to-flow cross asset model (S2FX), bitcoin is currently in the red dot, financial asset cluster of the chart above.

In the stock-to-flow cross asset model, bitcoin evolved into a new type of asset with different properties in each phase. PlanB outlines four: the proof of concept phase (stock-to-flow 1.3 and market value $1 million); bitcoin for payments (stock-to-flow 3.3 and market value $58 million); e-gold (stock-to-flow 10.2, market value $5.6 billion); and bitcoin as a financial asset (stock-to-flow 25.1 and market value $114 billion).

“As bitcoin gains more mainstream momentum and is viewed more like gold, the scarcity value (as measured by stock-to-flow) and subsequent halving will ultimately drive prices to the gold dot cluster and implied total market value,” the report’s authors wrote.