Chorus One Releasing Prototype To Capture MEV on Solana

MEV is the additional revenue made by rearranging the order of transactions in a block — and Chorus One wants to capture it on Solana

Yoann184/Shutterstock.com modified by Blockworks

Blockchain infrastructure company Chorus One has released a white paper and an open-source prototype that can enable validators to capture maximum extractable value (MEV) on the Solana network.

Although characteristics of Chorus One’s prototype are similar to Ethereum’s Flashbots’ block-building marketplace, because of the technical differences between the two blockchains, the Solana solution does not require a public mempool, as it does not follow the marketplace model.

On Ethereum, MEV is the additional revenue made by rearranging the order of transactions in a block. Validators aggregate transactions into blocks and are looking at ways to build a block that is more profitable for them.

By contrast, on Solana, a block processor is known ahead of time, and nodes will deliver transactions to a sole validator who will be responsible for proposing a block in a slot — this also contributes to the faster block processing times on the network when compared to Ethereum.

As transactions go straight to a block and users don’t have a buffer period to reorder transactions, the marketplace model to capture MEV, which works on Ethereum, would have significant downsides if replicated on Solana.

The proposed solution by Chorus One, dubbed “the decentralized extraction by validators,” will introduce a modified Solana client that will handle MEV opportunities in the banking stage of the validator, Thalita Franklin, a research analyst at Chorus One, told Blockworks.

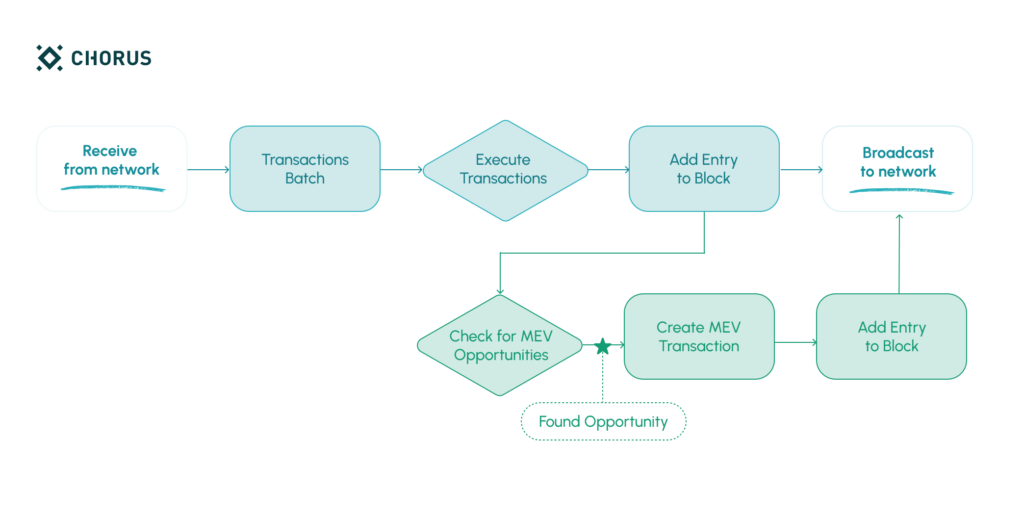

In this solution, validators will check after every batch of user transactions to see if it could have created an MEV and add transactions if it notices that there is an opportunity. This modification of the transaction process will not introduce new network requirements or protocol changes.

Source: Chorus One

Source: Chorus One“Because the solana-MEV client does not introduce any new central coordination point, it enables a diverse set of validators to flourish without creating new censorship risks,” the company said in its white paper.

Adding that, “Unlike the block building marketplace, the Solana MEV client would bring more transparency and democracy around MEV to Solana, without degrading performance, or thwarting Solana’s main networking innovations.”

It is important to note that the Solana MEV prototype will be wholly open sourced — available under a free software license — and is not meant to be a competitor to other MEV solutions on the network.

“Chorus One is not doing this commercially and we’re not releasing a full-fledged product,” Hari Iyer, marketing manager at Chorus One, told Blockworks. “We [have been] working on this for the last few months and now are releasing a prototype so that the community can test it out.”

Iyer notes that through this open-source solution, the Solana community can eventually evolve this white paper into “something more,” and that Chorus One itself is not looking to maintain the prototype in the future.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.