Court of International Trade halts the Tariff bonanza

In a unanimous decision, the US Court of International Trade has ruled that Trump’s IEEPA tariffs are unlawful

President Donald Trump | The White House/"Trump showing a chart with reciprocal tariffs" (CC license), modified by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

In a major blow to the Trump administration’s pursuit of global sweeping tariffs, the US Court of International Trade ruled that tariffs implemented via IEEPA were unlawful. This includes reciprocal tariffs and Fentanyl-related levies placed on certain countries.

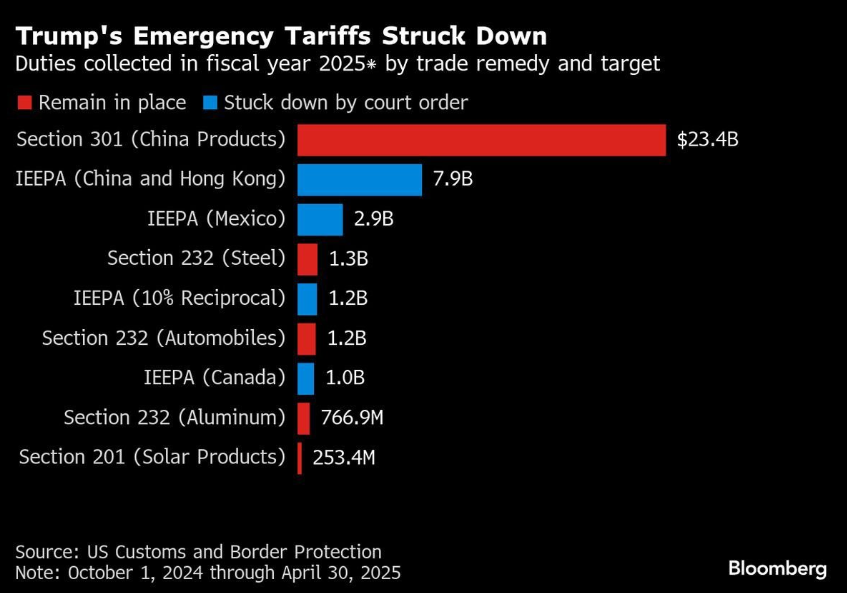

The breakdown of what’s been impacted can be seen below:

On net, this move takes the effective tariff rate from 10.4% to approximately 3.4%, as calculated by Bloomberg Economics.

The Trump administration was quick to appeal the decision. The matter now moves to the Court of Appeals for the Federal Circuit. The government also said it will seek “emergency relief” from the Supreme Court to pause yesterday’s ruling should the appellate court not do so.

Peter Harrell, attorney at Carnegie Endowment, broke down some of the nuances around the ruling in a post on X:

“The Government,” said Harrell, “has 10 days to comply with the ruling, and has already appealed to the Court of Appeals for the Federal Circuit. The Appeals Court may stay the CIT decision pending an appeal, but I expect an appeal to move quickly — weeks, not months.

“If the decision is upheld, importers should eventually be able to get a refund of tariffs paid to date. But the government will probably seek to avoid paying refunds until appeals are exhausted.

“The CIT’s opinion was elegantly reasoned and complex. It held that the ‘Liberation Day’ tariffs are unlawful because if Trump wants to use tariffs to address the trade deficit — the stated basis for the Liberation Day tariffs — he has to use other provisions of law, including Section 122, which authorizes tariffs to deal with balance of payments issues, but which limits tariffs to 15% and 150 days. IEEPA may allow tariffs, but not tariffs to address the trade deficit.”

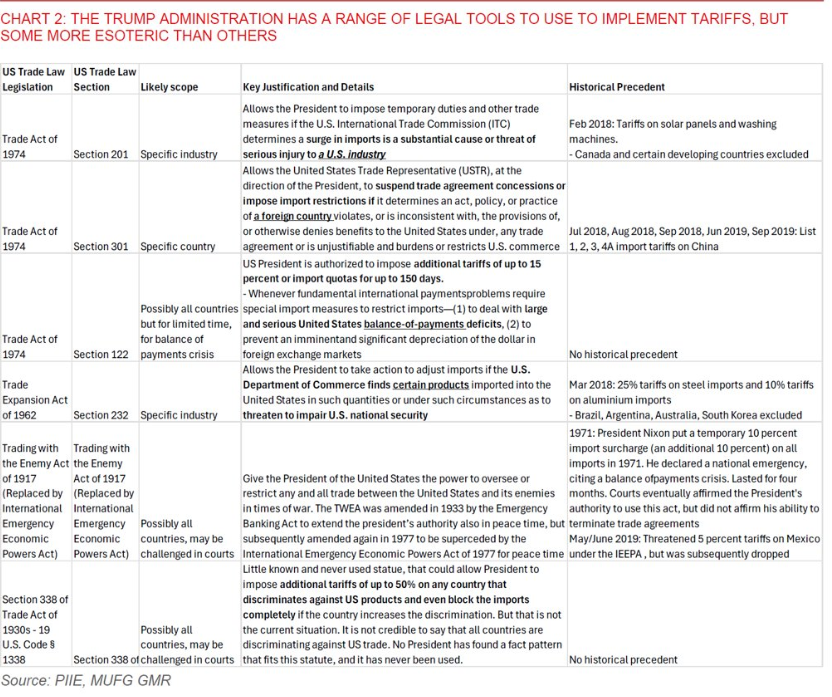

That point about there being other routes for the Trump administration to pursue to implement tariffs is crucial, as that is likely where the administration’s next vector of attack will come.

In the table below, we can see there are plenty of esoteric avenues that can be pursued for implementing tariffs if the Trump administration is truly committed to doing so:

Overall, this judicial ruling marks the next leg of trade uncertainty, as opposed to a resolution of it. Markets will now need to digest the following: a tariff implementation fight likely heading to the Supreme Courts, more esoteric legal routes to pursue more tariffs and a potential surge in imports hitting US shores as companies try to get in as many goods as they can while tariffs sit at a (likely) temporary floor of 3.4%.

Where do we go from here? Your guess is as good as mine. Stay nimble.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.