CrossTower Research: Tether Mints Follow Strong Price Action

Research from CrossTower suggests that Tether mints follow strong price action, and not a weak market as some might have suggested.

Source: Shutterstock

- Critics of Tether often point to its frequent USDT minting near periods of market volatility to suggest a conspiracy that Tethers are minted in order to stabilize, and prop up the market

- CrossTower research suggests that Tether minting has had no material impact on price and rather follow capital flow

Is Tether issuance timed to support the rise of the price of bitcoin during periods of market volatility? No, says a new paper from CrossTower Research.

A common belief amongst those skeptical of the merits of the digital asset market is that Tether (USDT) is minted in large measure to support the growth in the price of bitcoin.

Tether Limited certainly lends itself to conspiracy. With its outsized role in the broader crypto market — USDT accounting for 70% of all volume on centralized exchanges — and opaque structure with questionable holdings, it has been described recently as a company that seems to be “practically quilted out of red flags.”

But often reality is less interesting than imagination.

Tether is currently the fourth-largest digital asset by market cap, according to CoinGecko data, with $69 billion USDT in circulation. Its closest stablecoin competitor, Circle’s USDC, has a market cap of just over $33 billion.

The Tether tie

The belief that there was, or is, some deliberate relationship between Tether mints and the price of bitcoin first began in 2018 when an anonymous report was published — “The Tether Report” — which claimed that 40% of bitcoin price growth could be attributed to Tether.

Another paper from University of Texas at Austin finance professors John Griffin and Amin Shams argued that even though the positive price action from Tether minting was small, sometimes just 1%, if timed correctly during periods of market volatility there were “substantial aggregate price effects” downstream.

“These distortive effects, when unwound, could have a considerable negative impact on cryptocurrency prices,” they wrote. “Our findings support the historical narrative that dubious activities are associated with bubbles and can contribute to further price distortions.”

CrossTower notes that many of the crypto derivatives and futures contracts are denominated in USDT, which has contributed to the growth of the stablecoin alongside the popularity of crypto derivatives.

CrossTower points to Tether’s use in dodging Chinese capital controls as one of its many utilities which have led to its continued market dominance despite the numerous questions around it.

“With growing institutional investment into the crypto market, we would expect an increase in the amount of Tether being created,” the company stated in the report.

Price action

According to CrossTower’s analysis of pricing data, Tether mints do not follow weak price action, nor do they have a material impact on price.

CrossTower found that Tether’s mints, usually occurring on a Monday, followed lower bitcoin and ether prices that occurred simply because of reduced crypto trading over the weekend. However, other mints that occurred were related to positive price action in the 30 days or seven days preceding the mint.

When minting occurs, pricing action doesn’t change much over a median average. CrossTower noted that those days during which mints preceded a positive price move occurred during a broader bull market trend.

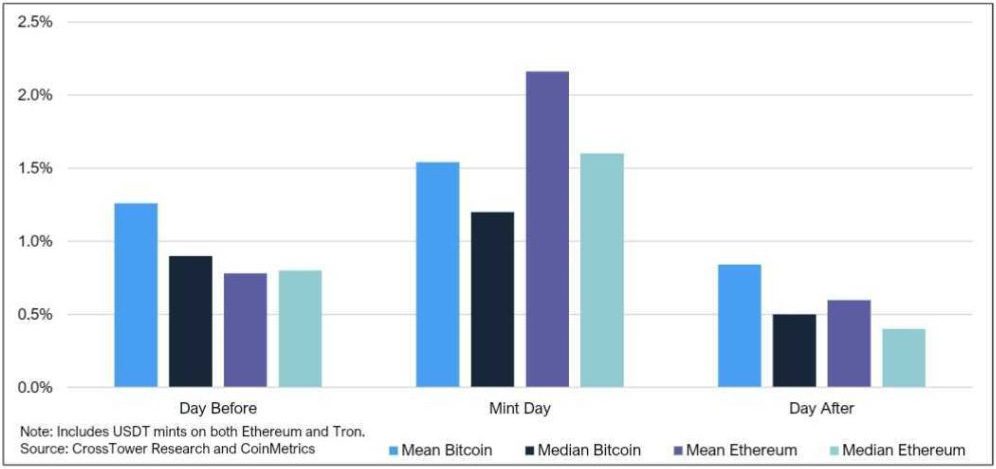

CrossTower says that, for bitcoin, the mean price increase on the day of minting ranged from 1.5% to 1.9%; however the day before the mean price increase ranged from 1.0% to 1.9% — the day-to-day price increase was not materially different from the broader trend.

Furthermore, the day after the mint, CrossTower’s research showed bitcoin’s gains were rather subdued, with a mean price increase ranging from 0.7% to 1.2%.

Price movement around a Tether mint day for mint sizes >$100M; Source: CrossTower Research

Price movement around a Tether mint day for mint sizes >$100M; Source: CrossTower Research“All in, our findings suggest that USDT mints could have led to higher bitcoin, but largely disproves the notion that these mints were predicated on negative price performance in the days before,” wrote CrossTower. “We note that there are simply too many confounding factors that make it difficult to attribute the price movements of bitcoin solely to mints of Tether. It could also simply reflect that Tether mints are reflective of real inflows into the crypto ecosystem.”

This story was updated on October 11, 2021, at 5:27 pm ET

Are you a UK or EU reader that cant get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.