Crypto M&A Deals Hit Record High in 2022, Despite Downturn

Deal count eclipses 200 for the first time, though value of crypto acquisitions about a third of what it was in 2021

Blockworks exclusive art by Axel Rangel

Crypto mergers and acquisitions were up last year despite the value of such transactions falling significantly, as increased activity by non-crypto firms looking to get more involved in the segment could signal even more deals going forward.

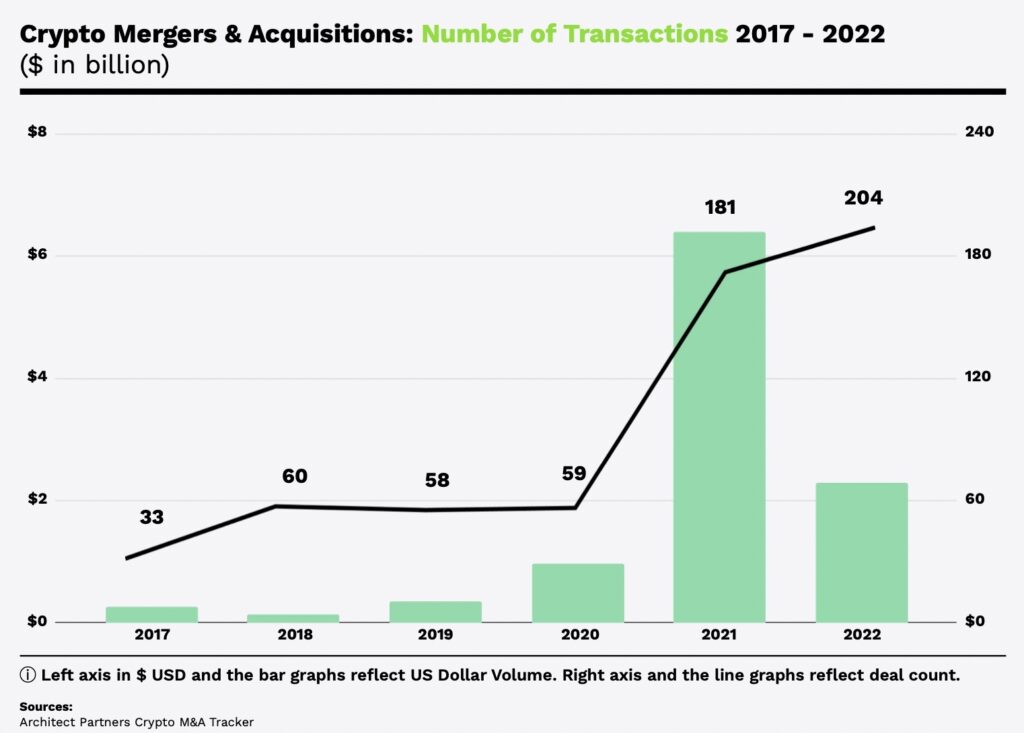

Deal count in the segment was 204 in 2022, according to a report by advisory firm Architect Partners — an all-time high and up 13% from 181 during the prior year.

But the value of all crypto M&A deals fell by 64% year over year, from roughly $6 billion in 2021 to about $2 billion last year.

The dollar volume of crypto M&A represents just 0.3% and 0.4% of the tech and financial services sectors, respectively, Architect Partners data shows.

“The downturn in transaction value perfectly correlated with the exposure of massive counterparty risk and both hidden and disclosed leverage permeating the sector,” the report states.

Deals between traditional, crypto firms also up

Still, deals in which a non-crypto native company acquires a crypto firm, which Architect Partners calls “bridge transactions,” also increased, amounting to 36% of all 2022 crypto M&A transactions.

The London Stock Exchange Group (LSEG), for example, bought cloud-based technology provider TORA the following month for $325 million. The buy included an order and execution management system and portfolio management system for customers trading equities, fixed income and digital assets.

Ryan McCullough, told Blockworks he believes bridge transactions are the biggest indicator of future M&A in the segment.

“Traditional groups will continue to invest heavily in the space via acquisition,” he said. “We saw bridge M&A pick up last year and expect that trend to continue despite a slowdown in the beginning of 2023.”

Other larger deals, like LSEG’s buy of TORA, happened early in the year before segment-altering events such as the crash of Terra’s algorithmic stablecoin and crypto exchange FTX.

January deals included Coinbase’s $275 million acquisition of derivatives exchange FairX and Silvergate’s roughly $200 million buy of Facebook-led Diem Association’s blockchain and crypto infrastructure.

Blockchain.com made headlines in March after it bought Singapore-based Altonomy for $250 million in an effort to boost its institutional business.

Most active acquirers

Digital entertainment company Animoca Brands was the sector’s most active acquirer last year, buying Grease Monkey Games, Eden Games, Darewise Entertainment, WePlay Media and Pixelnyx.

Second was now-bankrupt FTX, as well as its US affiliate not included in the November bankruptcy filings, which combined bought four companies in 2022 — Liquid, Good Luck Games, Bitvo and Embed Financial Technologies.

The theme of acquirers targeting decentralized applications, games, exchanges and marketplaces reflect “the strategic imperative to capture and onboard more users,” the Architect Parners report notes.

The only companies to buy three entities last year were SmartMedia Technologies and WonderFi, while about a dozen firms made two acquisitions, according to the report.

Among those with two buys in 2022 was Binance, which purchased Indonesia crypto exchange Tokocrypto and Japan-based Sakura Exchange BitCoin (SEBC).

Galaxy Digital revealed its second acquisition of the year just days before the start of 2023, committing to buy Argo Blockchain’s Helios bitcoin mining facility for about $60 million.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.