Crypto stock digest: Listing updates, COIN vs. HOOD

Some investors favor HOOD’s diversified model over COIN’s more cyclical, crypto-driven profile

Roisa/Shutterstock and Adobe modified by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

Buzz around crypto-linked stocks has proved unrelenting.

As shares of such companies continue to hit major exchanges, a few more could also join one of the best-known indexes.

Shares of American Bitcoin — a self-labeled “bitcoin accumulation platform” backed by the Trump Family — became available on the Nasdaq today after a stock-for-stock merger with Gryphon Digital Mining. ABTC opened at $9.22, shot up to above $14 and was back near its opening price by 1:30 p.m. ET.

The company’s listing comes a day after crypto platform Gemini revealed its expected IPO of ~16.7 million Class A common stock shares (estimated price at $17-19 each). The stock would trade as GEMI on the Nasdaq Global Select Market.

But let’s go back to crypto equities already available, as it seems Robinhood (HOOD) and Strategy (MSTR) getting into the S&P 500 could only be a matter of time.

Since launching crypto trading in 2018, Robinhood has doubled down on the segment with bigger plans. The trading app also met with the SEC’s crypto task force yesterday:

As many investors — rightly or wrongly — compare HOOD to Coinbase, an Aug. 29 report by Blockworks Research analyst Marc Arjoon gives us a side-by-side view of both.

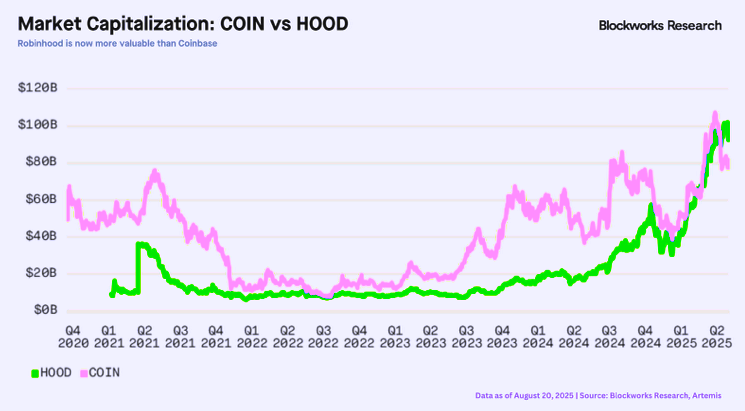

HOOD has materially outperformed COIN year to date — with the stock prices up 156% and 18%, respectively, over that span.

“This divergence is likely due to COIN’s equity story remaining tethered to crypto prices and volume, while HOOD has demonstrated resilience by broadening its revenue base across equities, options, crypto, and prediction markets, thereby capturing a wider slice of retail financial activity,” Arjoon wrote.

Robinhood’s market cap recently surpassed Coinbase’s, “underscoring how investors are assigning a premium to HOOD’s diversified growth and monetization model over COIN’s more cyclical, crypto-driven profile,” he added.

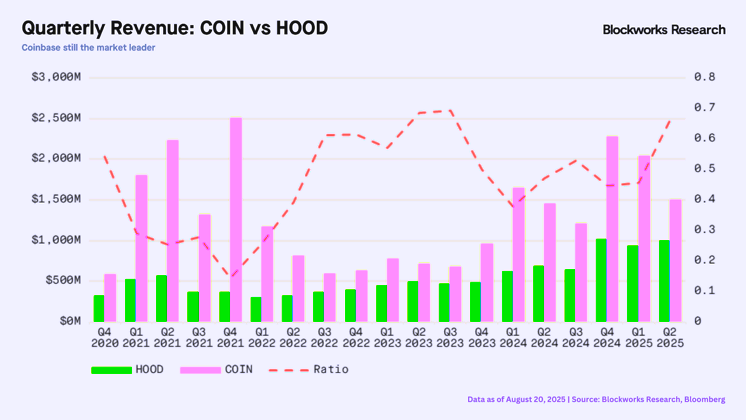

Coinbase has sought to diversify its revenue streams in recent years, with some success. Though its Q2 transaction revenue declined 39% quarter over quarter, its stablecoin revenue grew 12% (with average USDC balances held in Coinbase products reaching $13.8 billion).

The company now looks to build what it calls an Everything Exchange — enabling many more assets to trade in a “one-stop shop” on crypto rails.

So COIN has the revenue advantage over HOOD, but shows “far greater cyclicality” in that realm, Arjoon notes:

Let’s also touch on another company some think could soon enter the S&P 500: Strategy. You might recall the largest corporate bitcoin holder (now with 636,505 BTC) joining the Nasdaq 100 index in December.

MSTR stock is down ~14% in the past month. Benchmark analyst Mark Palmer attributed that to a compressing market premium to its underlying bitcoin holdings and a choppy macro environment.

You might have seen Strategy take some heat (on Crypto Twitter, at least) for relaxing what Palmer noted is a “self-imposed constraint.” The company told investors in late July that it would only use its common-stock ATM to buy bitcoin when its mNAV was at least 2.5x — aiming to prevent it from issuing equity when the stock traded too close to the value of its underlying BTC.

But around the time MSTR’s mNAV slid toward 1.6x, Strategy said it may tactically issue shares to meet fixed obligations and “when otherwise deemed advantageous” even if mNAV is below 2.5x. That gives it the option to buy bitcoin with equity even during premium troughs.

“The company’s subsequent decision to adjust course when the guideline itself became counterproductive by starving the program of cheap capital exactly when bitcoin weakness created attractive entry points was an appropriate move,” Palmer argued in a Tuesday note.

Palmer reiterated his buy rating of MSTR and its price target of $705 (it stood at ~$335 this afternoon).

Finally, on the aforementioned Circle and Bullish: CRCL shares were trading for about ~$118 Wednesday afternoon — up 280% from its $31 IPO price. BLSH’s ~$54 stock price was about 50% higher than its $37 IPO price.

More to come here, no doubt.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.