LayerZero’s Boosted Valuation of $3B an ‘Outlier’

Ledger and LayerZero have garnered valuations worth billions of dollars with fresh funding rounds over the past week

Aleksandra Sova/Shutterstock modified by Blockworks

The crypto space has seen two companies raise billion-dollar valuations in the past week, with one experiencing a significant value bump that has become rare in recent months.

One crypto advisory firm partner called the latest fundraise in the space — and its tripled valuation — an “unusual” case, but noted that it “makes sense.”

Investors valued crypto protocol LayerZero at $3 billion as part of a $120 million fundraise led by a16z and Sequoia Capital.

“There is no longer any question that the future of crypto and web3 is multi-chain, [and] LayerZero has built critical infrastructure that makes that possible,” Ali Yahya, a general partner at a16z, told Blockworks in an email. LayerZero is already handling more transactions to and from major ecosystems than the native bridges.”

Ilya Volkov, CEO and co-founder of fintech platform YouHodler, said the crypto industry could witness a pick-up in multibillion dollar company valuations, particularly in certain segments.

“I believe we’ll see some unicorns among companies who successfully integrate crypto into traditional finance,” he said. “Other good examples will include companies who successfully utilize the blockchain technology for common, everyday use cases.”

LayerZero previously closed a $135 million round in March 2022, which valued it at roughly $1 billion.

Hardware wallet company Ledger also raised most of a $109 million funding round that valued it at roughly $1.4 billion, Bloomberg reported last week.

Unlike LayerZero, Ledger’s raise valued the company about the same as a round in 2021 did.

A crypto funding rebound?

The implosion of Terra’s algorithmic stablecoin last May was among a slate of events that amplified the industry’s most recent bear market. Crypto exchange FTX, which was once valued at $32 billion, filed for bankruptcy last November. The company’s collapse was responsible in part for spurring a further decline in crypto funding.

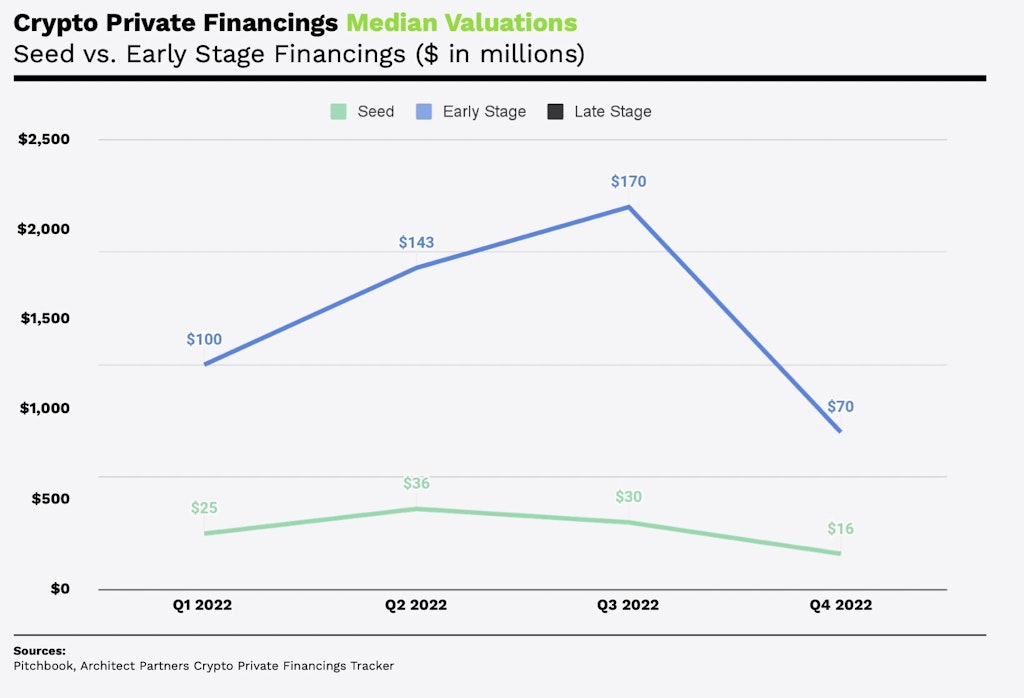

A report by advisory firm Architect Partners found that while crypto private financings hit a record last year, late-stage financings slowed down during the second half of 2022.

From the first quarter in 2022, to the year’s last quarter, median seed and early-stage valuations dropped 36% and 30%, respectively.

The report argued that decreased valuations were necessary for the crypto industry, stating that “high-flying and indefensible valuations fostered an irresponsible investing and operating environment.”

Steve Payne, a partner at Architect Partners, said late-stage technology valuations overall are down about 50% from a year ago, adding that crypto deals are consistent with this.

He called LayerZero an “outlier.”

“We aren’t seeing many $100 million-plus capital raises,” Payne told Blockworks. “But this one makes sense — it’s building out infrastructure for web3 developers, not focused on trading [or] speculative use cases.”

The capital injection by more traditional venture capital firms, such as Sequoia, Samsung Next and BOND, reflects what he called “a familiar model for Web2 investors.”

LayerZero’s three-fold valuation rise is “unusual” according to Payne, however.

“Most recent rounds have [been] closer to flat rounds,” he said. “This one reflects a rapid increase in usage and concomitant valuation increase.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.