The bigger picture for DATs as consolidation begins

Corporate crypto ownership can “lift up” blockchain ecosystems to help spur institutional adoption, SharpLink Gaming co-CEO says

ReserveOne CEO Jaime Leverton | DAS New York 2022

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

Not all digital asset treasury companies (aka DATs) will last forever. Some just won’t be able to hack it. Others will, as we saw this week, get gobbled up by a competitor.

But there’s a bigger picture for this segment that we should be mindful of.

Just before I was set to take the Korea Blockchain Week stage with executives from ReserveOne, Awaken Finance and TON Strategy, the moderator for the panel before us noted the fast-growing DAT landscape.

He went on to say that all these companies accumulating large amounts of various crypto assets probably isn’t going to end well.

Minutes later, I posed that skepticism to my panelists — two of whom are running DATs. ReserveOne CEO Jaime Leverton’s response: There’s certainly an opportunity for consolidation.

“I don’t love to shop, but I do love shopping for companies,” she quipped.

Speaking of consolidation, Strive said Monday it had agreed to acquire Semler Scientific in an all-stock deal. SMLR was among the first companies to follow MicroStrategy’s lead in adopting bitcoin as its primary treasury reserve asset in 2024.

This latest deal could position Strive as the sector’s consolidator of choice, Benchmark analyst Mark Palmer said in a research note.

“By using equity as currency, Strive effectively arbitrages the discounts at which bitcoin treasuries have traded, capturing bitcoins per share at attractive levels while likely causing some peers to consider similar moves before they become targets themselves,” Palmer added.

Leverton said the Strive-Semler transaction “took a lot of us by surprise.” Still, she noted: “There’s room for many, many corporations to be successful as they offer different flavors to the investors, which is important in a healthy ecosystem.”

ReserveOne — looking to list on the Nasdaq in Q4 via a merger with M3-Brigade Acquisition V Corp. — seeks to differentiate itself by deploying a diversified strategy (set to hold bitcoin, ether, solana, cardano and XRP). TON Strategy looked to be different by, well, choosing to amass TON.

Then there are a number of companies competing with peers accumulating the same token — whether that’s BTC, ETH or SOL.

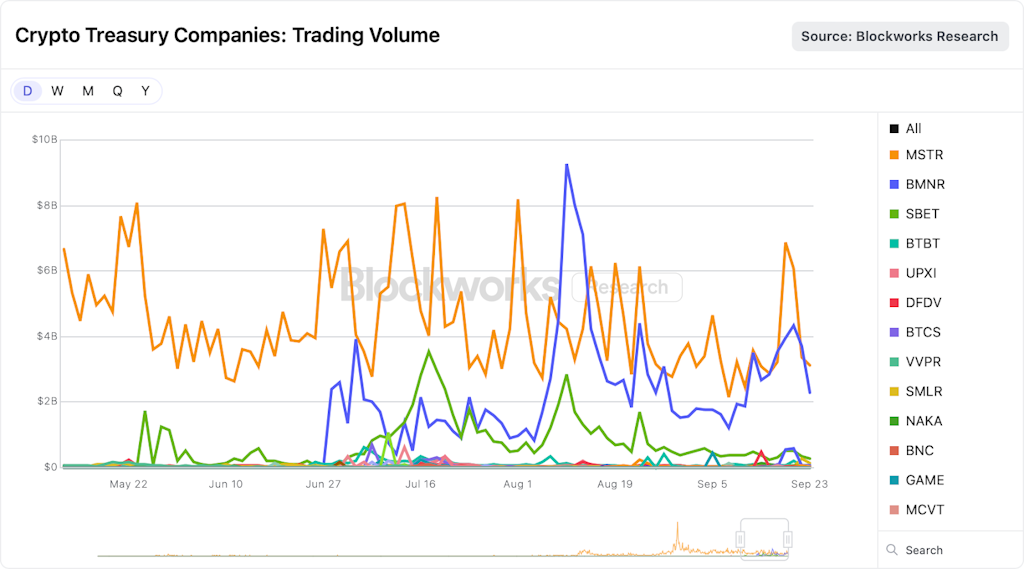

One metric critical to a DAT’s survival: solid daily average trading volume, SharpLink Gaming co-CEO Joseph Chalom said during the panel after us — particularly as these companies seek to raise money via at-the-market (ATM) facilities.

While Michael Saylor-led Strategy typically leads this category, Blockworks Research data shows BitMine Immersion and SharpLink Gaming usually sitting at No. 2 and No. 3, respectively.

BitMine Immersion holds ~2.4 million ETH tokens — more than 2% of the asset’s overall supply. It looks to ultimately get to 5%. As of last week, SharpLink Gaming held 838,152 ETH.

But Chalom, a former BlackRock executive, argued the bigger picture for DATs on the Seoul stage.

“Are we fighting over $4 trillion of crypto market cap? Or is our target the $700 trillion of traditional finance market structure that we believe should be on a decentralized network that’s trusted, that’s programmable, that’s digital-native, that [has] atomic, instant settlement?” he said. “If you look at it that way, it doesn’t matter who gets to 5% first. What matters is, are you promoting your protocol?”

His point: DATs are not just vehicles that accumulate crypto. Getting hung up on these companies’ current mNAVs, for example, is thinking small. An entity owning billions of dollars worth of ETH, after all, can lend, borrow, run transactions, validate, secure transactions, etc.

“We’re going to lift the community, we’re going to seed and support protocols and over time we’re going to help accelerate institutional adoption of digital assets,” Chalom explained. “It’s going to transform the world.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.