ETH killers are still no closer to doing the deed

Solana is the crowd favorite to potentially flip Ethereum somewhere down the line, and it tends to feel realistic at times

WindAwake/Shutterstock modified by Blockworks

This is a segment from the Empire newsletter. To read full editions, subscribe.

Nobody really wonders what the next bitcoin will be anymore.

That’s because Bitcoin won. There’s no “next” Bitcoin. Bitcoin is the next bitcoin and it’s already here. Better to build something else.

It’s natural, then, that a fixation on the next Ethereum would then take over.

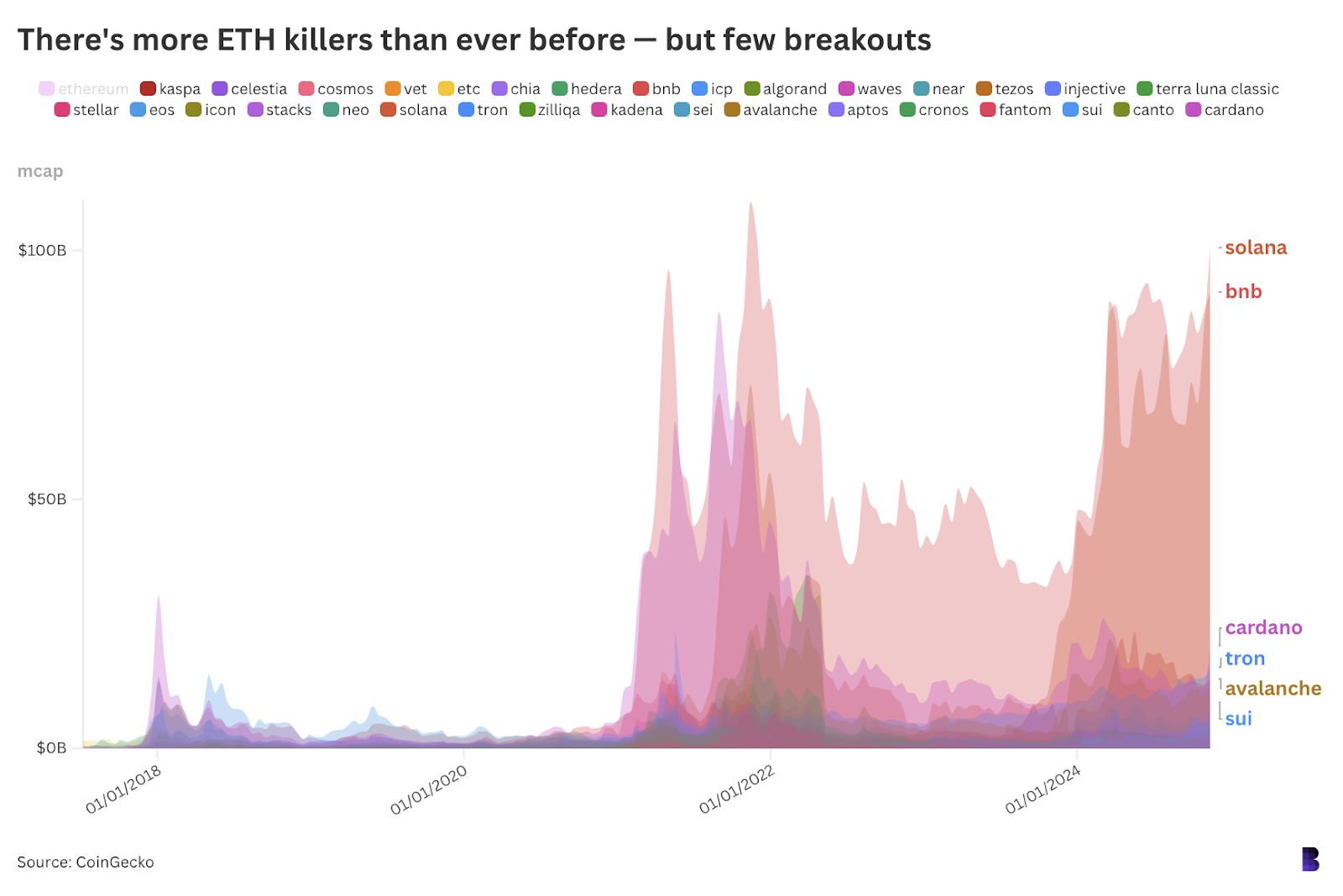

After almost a decade of smart contract platforms launching to rival Ethereum, we now have more than 30 coins which you might consider would-be ETH killers.

That includes tokens for newer chains like Sui, Sei, Celestia and TON, as well as older networks such as Cronos, Cardano, Fantom and EOS.

Over the past three years, only 10 have outperformed ETH. TRON’s ETH ratio has jumped about 140%, for instance, while TON’s has doubled.

SOL has appreciated 26% against ETH since this time in 2021, but over the past year it has swelled by 140%.

Solana is indeed the crowd favorite to potentially flip Ethereum somewhere down the line. And while it tends to feel realistic at times, the market is quietly saying otherwise in the current moment.

The first step is stripping away all the noise. In this case, that’s bitcoin.

We’ve already established that Bitcoin doesn’t compete with Ethereum (and most other general-purpose smart contract platforms, for that matter), leaving little reason to compare the two directly.

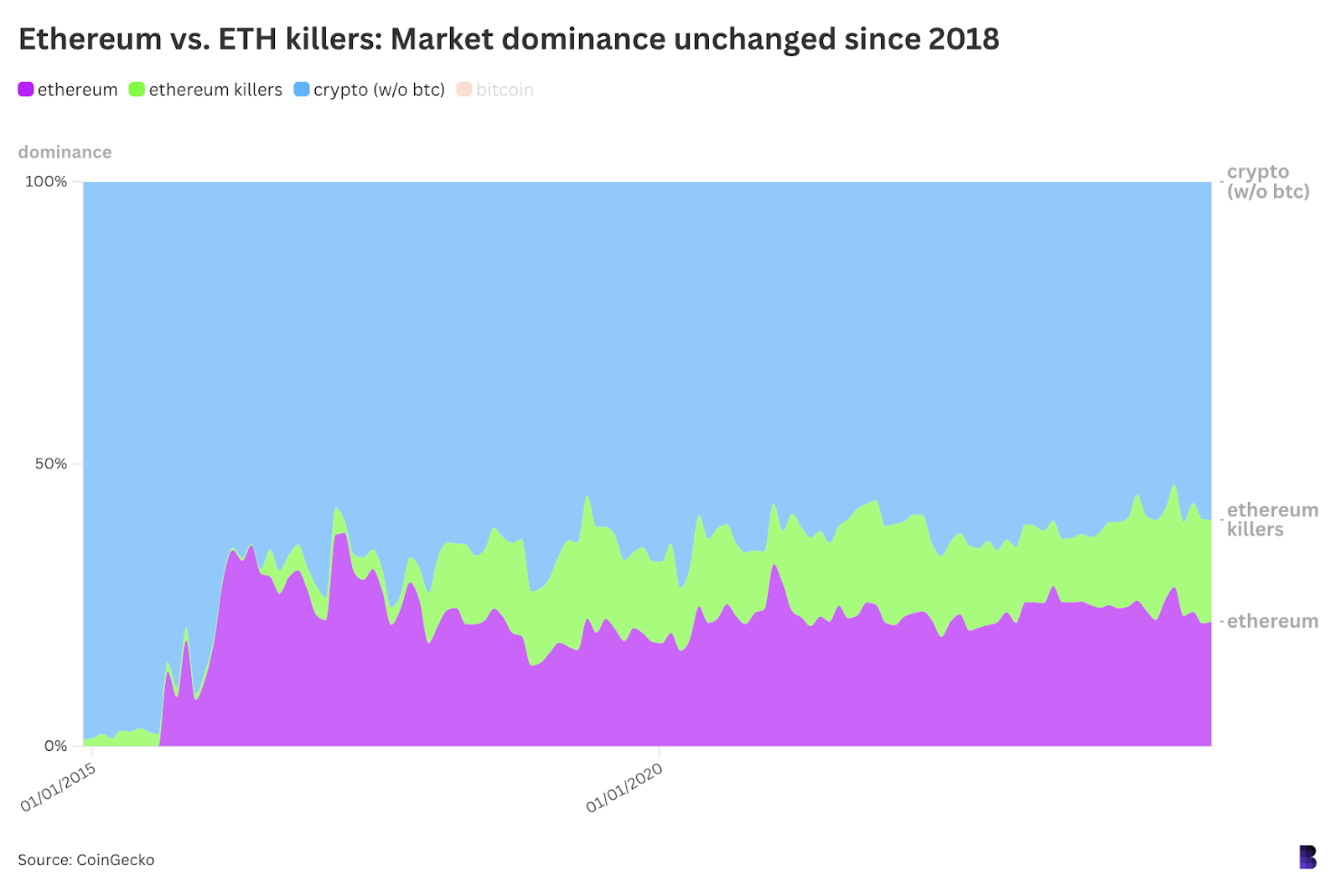

Now, let’s separate ETH and the so-called ETH killers from the rest of the crypto market. We’re left with three segments: Ethereum (in purple below), Ethereum killers (green) and crypto without bitcoin (blue).

This chart shows the market dominance of each of the three categories over the past 10 years, a period that started just before Ethereum mined its first block in 2015.

Notice that Ethereum’s share of the crypto market excluding bitcoin has practically stayed the same for almost three-quarters of the chart.

Right now, it’s around 22%. Halfway through 2022 it was at under 20%, and five years ago it was less than 15%.

Ethereum killers, meanwhile, altogether make up 18% of the non-bitcoin crypto space, which is about where it was in late 2018 and 2021.

What that says is that Ethereum isn’t really budging in terms of market share. It’s growing at a similar scale and pace to everything else that isn’t bitcoin.

All while a rotating cast of smaller coins go through their own trajectories, with most losing significant ground against ETH, whether across three-year timeframes or one month.

The chart above bundles all the ETH killers together and lays them flat against each other.

Clearly, the market is betting on SOL and BNB to continue encroaching on Ethereum’s territory. Both enjoy a market cap of about $100 billion, and there’s an enormous gap between those two and all the others. Cardano is the next best with $20 billion.

At the same time, ETH is headed for $400 billion as we digest the reality of a five-year development cycle for Ethereum’s next big upgrade, Beam Chain, which would help it stay relevant in a world littered with alternative super-fast layer-1s.

Just like how Bitcoin has broken off from the crypto market and now mostly exists within its own orbit, it could be that Ethereum is destined for similar treatment.

In which case, it’s hard to see it going anywhere.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.