Hedge Fund Manager Kyle Bass: “We are Already at -12% Real Rates”

One macro investor believes that the United States is already at minus 12% real rates, despite government data showing minus 1.16%.

- Bass, founder and chief investment officer of Hayman Capital Management, believes the government is downplaying inflation and real yields have a long way to fall

- Those turning to digital assets, particularly younger investors, may want to rethink their strategy, according to Bass.

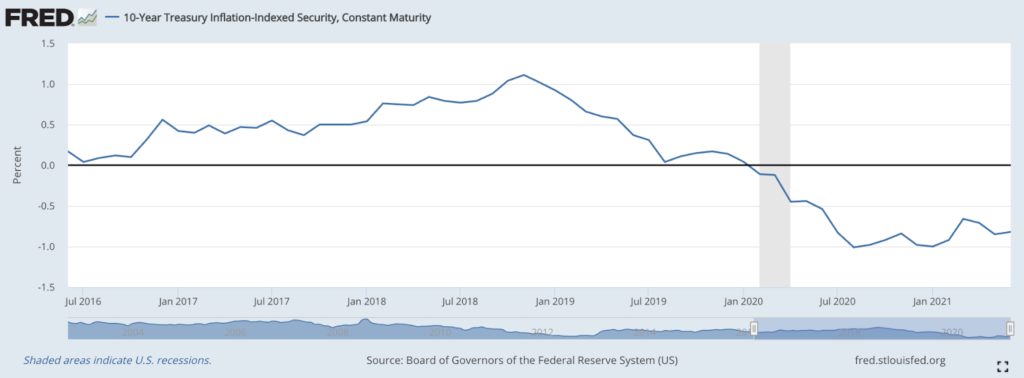

10-year Treasury real yields, which reveals the expected inflation impact over the next decade, fell to a record low last week. However, Kyle Bass, founder and chief investment officer of Hayman Capital Management, said that inflation is being downplayed, meaning negative real rates are actually much lower.

In fact, he believes the United States is already at minus 12% real rates. This is far lower than the minus 1.16% data that the Department of Treasury is reporting on the yield on 10-year Treasury Inflation-Protected Security (TIPS) bonds.

“They’re never looking to cause damage to anyone’s savings or university endowments or pensions,” Bass said, referring to the Federal Reserve, during a recent podcast interview. “They feel like they are the financial gods of the world and that they are smarter than everyone and that they see how the world’s working, and yet chain-weighting allows them to lie about inflation.”

Chain-weighting is a way to measure the consumer price index (CPI) that takes into account consumer spending habits and possible product substitutions they may be making. It is often considered the superior inflation measure because it considers changes in consumption and production that result from price changes.

The personal consumption expenditures price index, the Fed’s preferred inflation indicator which excludes food and energy, rose 3.5% in June, but Bass and other economists believe inflation may be much higher.

“Any problems that lead to the under-measuring of inflation is highly likely done by design to reduce reported inflation readings, in service of the US bond market, so that the US government can more easily issue debt at negative real rates,” Luke Gromen, founder and president of Forest for the Trees LLC, added.

Bass agreed, adding that reporting higher inflation numbers does not “serve” government officials.

“Look at the average price of a car, it has tripled in the last 30 years, it’s over 300% higher, and yet the amount of auto inflation in the calculation of the CPI is 5% over that 30-year period,” Bass said. “They chain-weight everything. You’re never going to see real inflation numbers printed by the US government. It doesn’t serve their purpose.”

The yield on TIPS bonds has hovered slightly below minus 1% for about a year, and the trend is likely to continue with current fiscal policy. With rising inflation, bond holders are likely to sell to avoid losing money.

As interest rates rise, the government has to pay more interest on debt, leading to more money printing and even higher inflation. It’s a “debt death spiral,” Gromen said.

“The challenge is that the system is already straining under whatever negative real rates are today,” said Gromen. “Is it minus 12%? Minus 6%? It’s minus 1.2%, according to the US government.”

Investors wondering how to navigate the negative real rate landscape should turn to assets like real estate or commodities as a hedge against inflation, Bass said.

“How do we all invest our family’s savings, the savings of others, if we’re a fiduciary, what do we do to avoid negative 12% real rates of return?,” Bass said. “And I just think the answer is in productive hard assets.”

Those turning to digital assets, particularly younger investors, may want to rethink their strategy, Bass pointed out.

“I don’t know where it’s going to go over time, but I’d be willing to bet that we’re not going to see trillions of dollars in global cap of private crypto for long,” Bass said.