Inflation Heats Up as Economic Data Comes In

While the Fed insists that inflation effects will be fleeting, Americans continue to worry.

Source: Shutterstock

- Weekly initial jobless claims fell to a 14-month low while retail sales stalled and consumer sentiment worsened

- Alternatively, Fed governor Christoper Waller said in a speech Thursday that “The economy is ripping, it is going gangbusters”

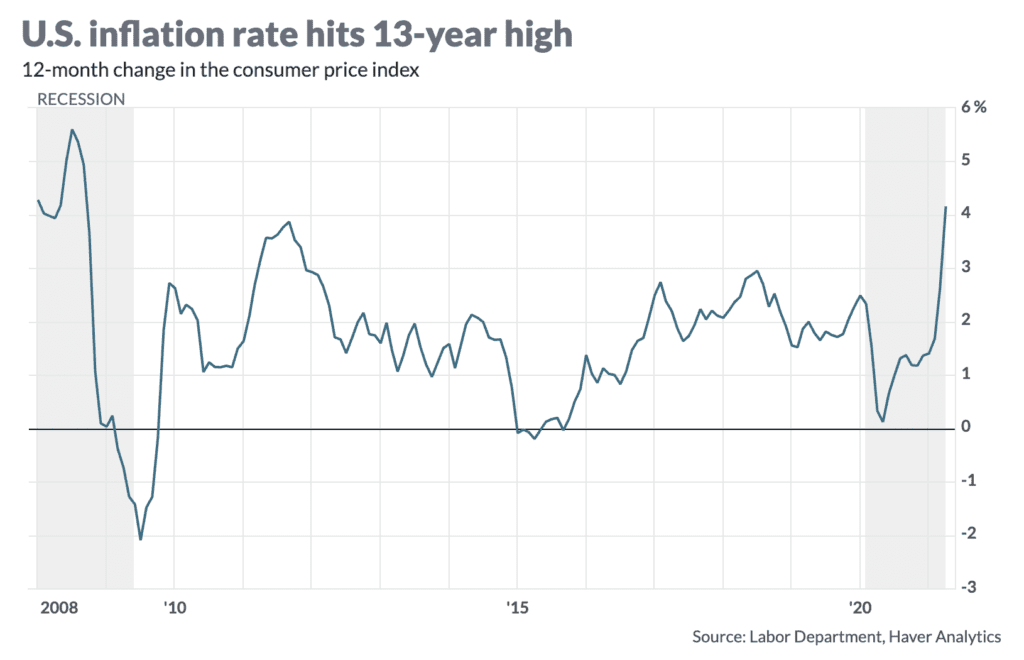

After years of running below the Federal Reserve’s target, the inflation rate surged in April to 4.2% over the past 12 months, a 13-year high. Meanwhile, consumer sentiment slumped and retail sales stalled.

The Fed, which has been trying to downplay inflation fears for months, has said it is willing to tolerate higher inflation for some time, given that rates have been under the 2% target for several years. The Fed slashed interest rates to near-zero last year and has been pouring money into the economy through massive bond purchasing, and there is no sign central bankers intend to withdraw support any time soon.

“The economy is ripping, it is going gangbusters,” Fed governor Christopher Waller said in a speech Thursday.

“The takeaway is that we need to see several more months of data before we get a clear picture of whether we have made substantial progress towards our dual-mandate goals,” Waller said, referring to the Fed’s targets of sustained 2% inflation and full employment.

While the Fed insists that inflation effects will be fleeting, Americans continue to worry. Consumer prices rose 0.8% in April from March, data from the Bureau of Labor Statistics Wednesday showed. Federal spending remains high and many employers are raising wages to compete with unemployment benefits.

Investor bets on inflation have risen to 2.5%, the highest since 2013 and up from less than 1% in 2020, but growth expectations remain strong nonetheless.

“Inflation expectations among bond investors have risen to the highest level since 2013, but at the same time, investors’ 1-year forward expected earnings growth is stronger than at any time since at least 1990,” wrote Jim Paulsen, chief investment strategist at The Leuthold Group, in a recent note.

The University of Michigan’s index of consumer sentiment fell to 82.8 in May, the lowest since February. April’s reading was the highest since the start of the pandemic, 88.3.

Retail sales remained unchanged in April, signalling that March’s highs can likely be attributed to stimulus check spending, data from the Commerce Department showed Friday. Economists had predicted a 1% increase from March’s 10.7% surge.

Retails sales data encompasses information about consumer spending on goods and services, including healthcare and food purchases. American householders have saved an extra $2.3 trillion since the start of the pandemic, which should help to support spending in coming months.