Looming US Interest-Rate Hikes Continue to Shake Up Global Markets; Gold Dips as Dollar Strengthens: Markets Wrap

“(We) believe that the FED is only making the case for bitcoin stronger, as it doesn’t seem they’ve implemented any systems to curb inflation. This strengthens the idea behind a monetary system that can’t print dollars at will; the US has printed almost 25% of all circulating dollars in the last 16 months,” Michael Rabkin, head of institutional sales and global partnerships at DV Chain, wrote in a note to Blockworks.

Blockworks exclusive art by Axel Rangel

- To sum up the last 24 hours, strong dollar and deflationary pressures are causing capital to reallocate toward more innovative tech and away from commodities and inflation-sensitive sectors of the market.

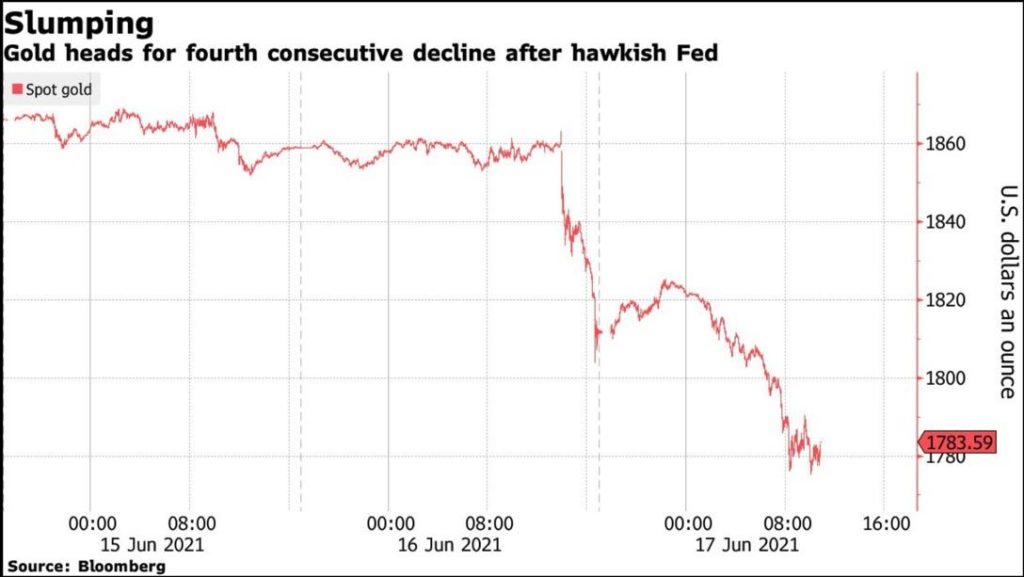

- Gold dropped below $1,800 intraday — a benchmark low of six weeks — to $1,775 after Fed chairman Jerome Powell talked of scaling back bond purchases the day before.

The Federal Reserve announced two more interest-rate hikes by the end of 2023 and hinted at future tapering after the Federal Open Market Committee’s (FOMCs) two-day policy meeting. A tumultuous day for commodities like gold and long-term treasury yields ensued.

To sum up the last 24 hours, strong dollar and deflationary pressures are causing capital to reallocate toward more innovative tech and away from commodities and inflation-sensitive sectors of the market.

Gold dropped below $1,800 intraday — a benchmark low of six weeks — to $1,775 after Fed chairman Jerome Powell talked of scaling back bond purchases the day before. It was a jarring shift for the precious metal that had been climbing the five days leading up, according to Bloomberg.

Commodities

Most commodities followed suit.

- Crude oil opened at $71.65 per barrel and fell midday to $69.94 and inched back up to $70.92 by close.

- Silver and copper also scaled back. Both weathered to $26.02 and $4.17, respectively.

Insight

“We have a negative outlook, expecting gold to fall to $1,600 an ounce over the next six to 12 months,” UBS Group AG analyst Giovanni Staunovo said in an interview with Bloomberg. “At some point the Fed will not talk about taper but also implement it.”

Fixed income

- Long-term treasury yields sunk too. Essentially, growth and inflation expectations are falling as indicated by the flattening yield curve a day after the semi-hawkish Fed announcement.

- The 30-year bond yield took an intraday plunge to 2.049%, the hardest it has fallen since February. And the 10-year treasury tumbled to a yield day low of 1.472% at 12:25 pm ET.

Equities

Finally, equities around the world are still adjusting after Powell’s market-moving comments on Wednesday afternoon.

- Europe’s Stoxx 600 Index fell for the first time in 10 days early Thursday morning, falling -.12% to 459.29 by 4:00 pm ET.

US stocks were a mixed bag.

- The S&P 500 flatlined, teetering between small gains and losses, but was down -.04% to 4221.86 at 4:00 pm ET.

- The tech-heavy Nasdaq crept up to 14,161 by 4:00 pm ET.

- The Dow was in the red at 33,823, shedding -0.62% by 4:00 pm ET.

Insight

Michael Rabkin, head of institutional sales and global partnerships at DV Chain, weighed in on how Wednesday afternoon’s FOMC announcement could impact cryptocurrencies, which only took a slight dip and seemed not to be significantly impacted.

“(We) believe that the FED is only making the case for bitcoin stronger, as it doesn’t seem they’ve implemented any systems to curb inflation. This strengthens the idea behind a monetary system that can’t print dollars at will; the US has printed almost 25% of all circulating dollars in the last 16 months,” he wrote in a note to Blockworks. “It also seems that they are still heavily worried about the impacts of Covid going forward, which is why they held interest rates where they are, but at the end of the day, that still does nothing to curb inflation and just strengthens the case for BTC and other crypto currencies at this time.”

Crypto

It was a flatline day for crypto markets with a slight dip after 12:00 pm ET.

- Bitcoin is trading at $37,792 as of 4:00 pm ET, down around -3.02% over the past 24 hours

- Ether is trading at $2,332 as of 4:00 pm ET, falling around -3.1% over the past 24 hours

- ETH:BTC is up 0.76% to .062 as of 4:00 pm ET

- VIX is down -5.4% to 17.18 at 4:00 pm ET

In other news

Initial jobless claims were the highest they’ve been in over a month. It was an unexpected increase of 37,000 to 412,000 from the week before, the report listed Thursday morning.

We’re watching out for…

- The Bank of Japan’s monetary policy decision tomorrow.

That’s it for today’s markets wrap. I’ll see you back here on Friday afternoon.