Market Players: World Bank’s ‘Environmental Concerns’ for El Salvador’s Bitcoin Pursuit is ‘Lazy Excuse’

“People don’t realize that (El Salvadorians) need this and can actually use bitcoin to better themselves,” Carlos Betancourt, co-founding principal of BKCoin Capital, said during an interview with Blockworks.

Source: Shutterstock

- World Bank invested over $12 billion into fossil fuel projects since the 2015 Paris climate accord, according to a report

- Latin Americans would rather accept bitcoin as payment instead of their local currency because it’s worthless and “people are not willing to be suppressed anymore,” Betancourt said

The World Bank said this week it could not help El Salvador’s implement bitcoin as legal tender, due to “environmental and transparency shortcomings,” a spokesperson told Reuters, but some market players argue that this is a “lazy excuse.”

“We are committed to helping El Salvador in numerous ways including for currency transparency and regulatory processes,” said a World Bank spokesperson in an email to Reuters. “While the government did approach us for assistance on bitcoin, this is not something the World Bank can support given the environmental and transparency shortcomings.”

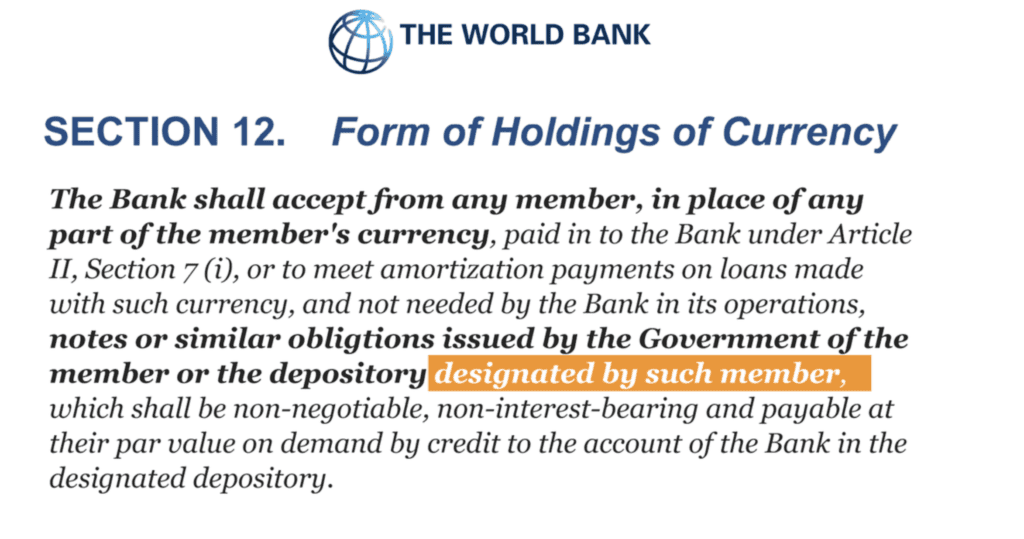

But according to the World Bank’s Articles of Agreement, it might have to accept bitcoin as a currency from El Salvador if it fits the bill of the following:

Some crypto professionals find the World Bank’s argument of environmental and transparency shortcomings as an excuse and say it’s a matter of time before bitcoin is adopted worldwide.

“We’re just seeing the initial technology adoption, whether it be emails or blockchain there’s always resistance,” said Kevin Kang, co-founding principal of BKCoin Capital, which is a digital asset quantitative hedge fund with $65 million in assets under management.

“We can’t imagine the world without email now and history repeats itself. It’s about technology we’re familiar with and the World Bank hasn’t done its research…and I find it a bad joke that their concerns are on fossil fuels,” when the World Bank contributes to it, Kang said.

The World Bank has invested a hefty amount of money – more than $12 billion – into fossil fuel projects since the 2015 Paris climate accord, according to a 2020 report by Berlin-based environmental group Urgewald. The World Bank also accepts gold as a payment, despite gold mines emitting nearly 1 ton of carbon dioxide per ounce of gold produced, S&P Global Market Intelligence reported.

“You don’t hear people arguing about ATMs using so much energy or asking when will they go carbon neutral? Yet, blockchain is one of the most carbon neutral things out there,” Kang said.

People who are critical of bitcoin often point out how mining the cryptocurrency harms the environment, but 76% of bitcoin miners are using renewable energy, Yassine Elmandjra, a blockchain and cryptoasset analyst at Cathy Wood’s Ark Investment Management, said in an interview with CNBC.

No longer “willing to be suppressed anymore”

The World Bank’s response and denial to help El Salvador implement bitcoin came after the country’s Finance Minister Alejando Zelaya stated that it asked the World Bank for technical assistance to implement bitcoin as an official method of payment.

“People don’t realize that (El Salvadorians) need this and can actually use bitcoin to better themselves,” Carlos Betancourt, co-founding principal of BKCoin Capital, said during an interview with Blockworks.

He added that El Salvadorians can download applications on their phones, become educated and use bitcoin as payment, which would give the people the ability to transact between each other with something of value.

“At the end of the day there will be a whole transformation,” Betancourt said. “A lot of Latin Americans are essentially poor and it’s hard for folks down there to open bank accounts. Fact is, they may not be able to open a bank account or might not have the means to open one, but they do have cell phones and those have become a means of transaction.”

Latin Americans would rather accept bitcoin as payment instead of their local currency because it’s worthless and “people are not willing to be suppressed anymore,” Betancourt said.

In addition to this, inflation is “crazy high” in Latin American countries and using the US dollar as an alternative is not providing the same benefits to Latin Americans anymore, Kang said.

“The USD has gotten worth less and less, so (these countries) are looking for alternatives and bitcoin may be volatile, but it’s nothing compared to their own inflation,” Kang said.

Recently, other Latin American countries’ politicians have expressed similar support for the adoption of bitcoin as legal tender, further driving normality of the cryptocurrency. Politicians from nations including Brazil, Paraguay, Panama, Argentina and Mexico have expressed positive sentiments and support for the cryptocurrency.

As more countries adopt bitcoin, volatility will subside as well and “it should become the norm,” Kang added.