Nasdaq’s reported guidance to DATs ‘unlikely to stifle overall demand’

Bitwise investment strategist expects end to “the wild-west phase of public companies …turning into crypto vehicles”

Mauryce Caesar/Shutterstock and Adobe modified by Blockworks

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe.

Because companies accumulating crypto (aka digital asset treasuries, or DATs) have created quite the buzz this summer, it’s worth addressing reported guidance such firms are getting from a major exchange.

The TL;DR, you ask? Nasdaq told companies listed on its exchange that their shareholders, “under certain circumstances,” would need to approve plans to raise money to buy crypto, Yueqi Yang reported.

I got ahold of a rep at Nasdaq, who declined to comment.

But let’s take a moment to clarify something. The exchange has not created any new rules specific to crypto-linked companies. Any guidance given to industry firms deals with adhering to existing standards (feel free to peruse those here).

Among the companies reportedly in the crosshairs here was Heritage Distilling, Finality Capital Partners’ David Grider’s X post shows.

My colleague Byron Gilliam — author of The Breakdown newsletter — gave this take yesterday: “That doesn’t seem like a lot to ask — shouldn’t shareholders get to vote on such a major change of direction?”

Put simply, I agree. And others — like Federico Brokate, head of 21Shares’ US business — tell me they too are not surprised, given exchanges long prioritizing investor protection.

“Transitioning to a digital asset treasury significantly alters a company’s risk and return profile, making it crucial for boards and investors to be aligned in their understanding and approval of such a strategic move,” the ex-BlackRock exec said.

Bitwise senior investment strategist Juan Leon added: “The change reinforces a trend: institutional investors are increasingly embracing crypto, but looking for transparency and governance standards.”

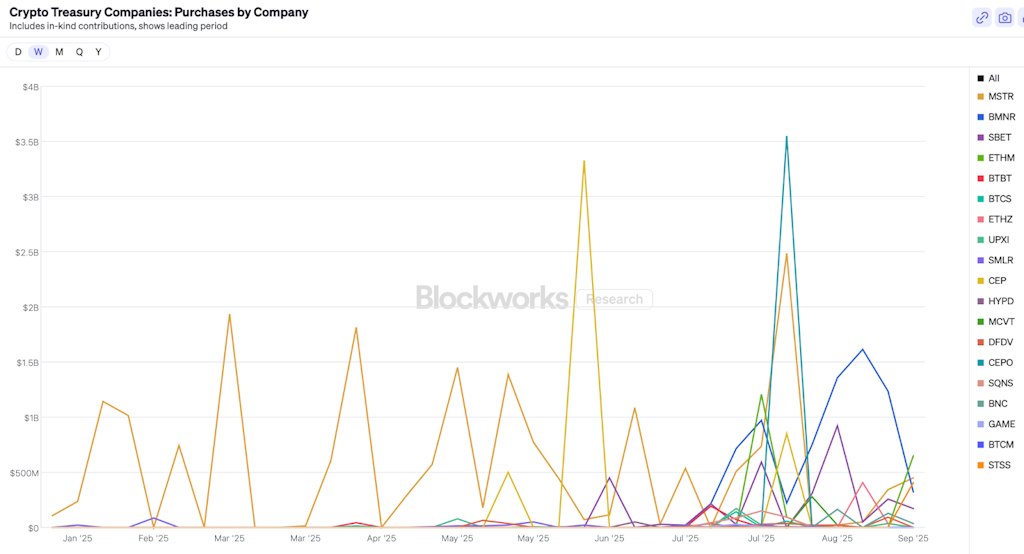

The more important question seems to be how this would impact what has become a bit of a craze. The splash of colors on the right side of this chart show how many more companies have begun stockpiling bitcoin, ether and other tokens this summer:

Shares of Strategy — holder of a bazillion or so bitcoin (636,505 BTC, in actuality) — dipped Thursday, seemingly in response to the report.

BitMine Immersion, which boasts the largest corporate ETH treasury and also saw a share price decline Thursday, felt the need to share an X post in the story’s wake.

“We don’t anticipate this rule will significantly deter corporate interest in adding crypto to balance sheets,” Brokate noted. “While it may introduce some delays as boards and shareholders assess the risks and benefits, it’s unlikely to stifle overall demand.”

Leon agreed about Nasdaq’s reported guidance potentially slowing adoption, particularly for smaller companies seeking to replicate MSTR’s model. Over the longer term, it could “concentrate the crypto treasury strategy among better-capitalized, high-conviction firms willing to navigate the governance process,” he added.

That doesn’t seem like a bad thing at all — and could help investors more easily navigate a subsector some remain skeptical of. Perhaps you saw what Nic Carter and Blockworks’ own Michael Ippolito had to say about these vehicles as far back as May.

“For investors, that means the wild-west phase of public companies casually turning into crypto vehicles is ending,” Leon explained.

Perhaps only a handful of these crypto-accumulating machines reach scale and withstand the test of time. But we’re likely to see many more quietly putting a small percentage of reserves toward BTC, for example, as a hedge against uncertainty.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.