Optimism scores $5M+ Ronin deal for L2 tech

The news followed a flurry of bids from major L2 providers

Ronin and Optimism modified by Blockworks

This is a segment from The Drop newsletter. To read full editions, subscribe.

After receiving bids from Arbitrum, Polygon, zkSync, and Optimism, gaming-focused Ronin has announced it’s going to use Optimism’s tech to transform itself from an Ethereum sidechain into a full Ethereum L2.

“This was a highly contested battle between L2 providers,” Ronin cofounder Jeffrey “Jihoz” Zirlin said. “This move opens up Ronin’s upgrade to Proof of distribution which will create more rewards for the builders.”

Ronin will join the likes of Base, Unichain, Worldchain and Kraken’s Ink, who also use Optimism’s codebase for their respective L2s.

Arbitrum had placed the first offer, a move that ultimately did not appear to land in its favor.

And in case you missed Optimism’s final bid, it offered 5 million OP tokens, contingent on hitting certain revenue metrics with 500,000 OP upfront — plus support from Eigen Labs, Conduit and Boundless. Ronin said this translates to an addition of about $5 million to $7 million to its treasury via OP, ZKC and Eigen tokens.

In a post about the news, Optimism cofounder Mark Tyneway said: “Don’t get caught up in the recent alt L1 narratives, it’s still incredibly attractive to launch an OP Stack based L2.”

Bidding chains ultimately expected to gain net revenue from Ronin joining them — and so were willing to offer some financial and resource perks upfront (though some of the offers were contingent on Ronin hitting certain targets).

As Arbitrum Gaming Ventures’ David Bolger argued in part of his response to my tweet about their first bid: “Ronin is a billion dollar ecosystem with a massive opportunity ahead.”

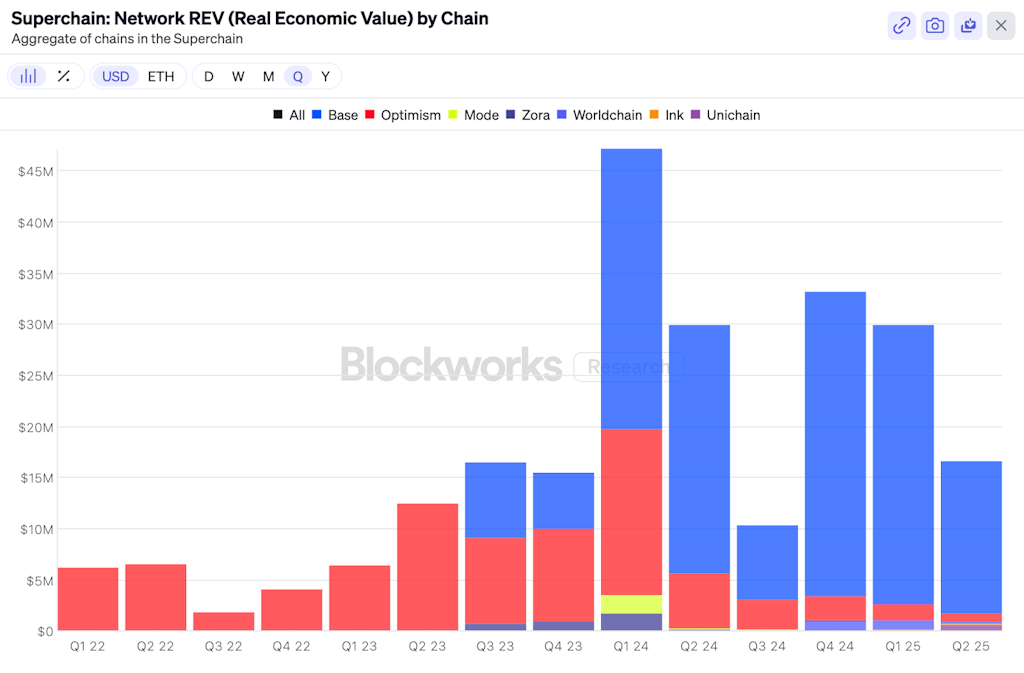

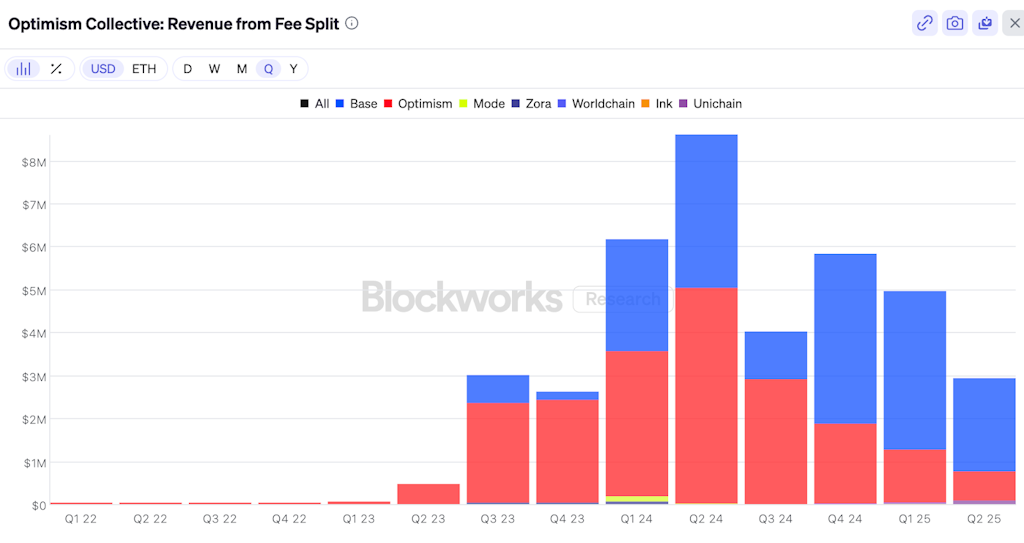

Last year, the Optimism Collective saw over $24.6 million in fee split revenue, Blockworks Research data shows.

In Q1 and Q2 this year, 73% of Optimism Collective’s fee split revenue has come from Base.

Unichain, Ink, and Worldchain make up a much, much smaller percentage of that pie — and currently resemble small blips on the fee revenue chart.

We don’t yet know how much Optimism will stand to make from Ronin, but the gaming chain is far smaller than Base (Ronin has about $54M in TVL while Base has over $4.7B in TVL, per DeFi Llama).

Ronin could certainly benefit from a closer proximity to Base’s ecosystem, though. And while crypto gaming currently feels quiet right now, Optimism does stand to benefit from having the team behind one of the most successful blockchain games of all time among its ranks.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.