‘Potatoz’ Props Up 9GAG NFT Sales Volumes to Start 2023

After a rocky year in 2022, the sales of popular NFT projects have begun to gain traction, with sixth-month-old ‘The Potatoz’ taking the top spot over a 24-hour period on OpenSea

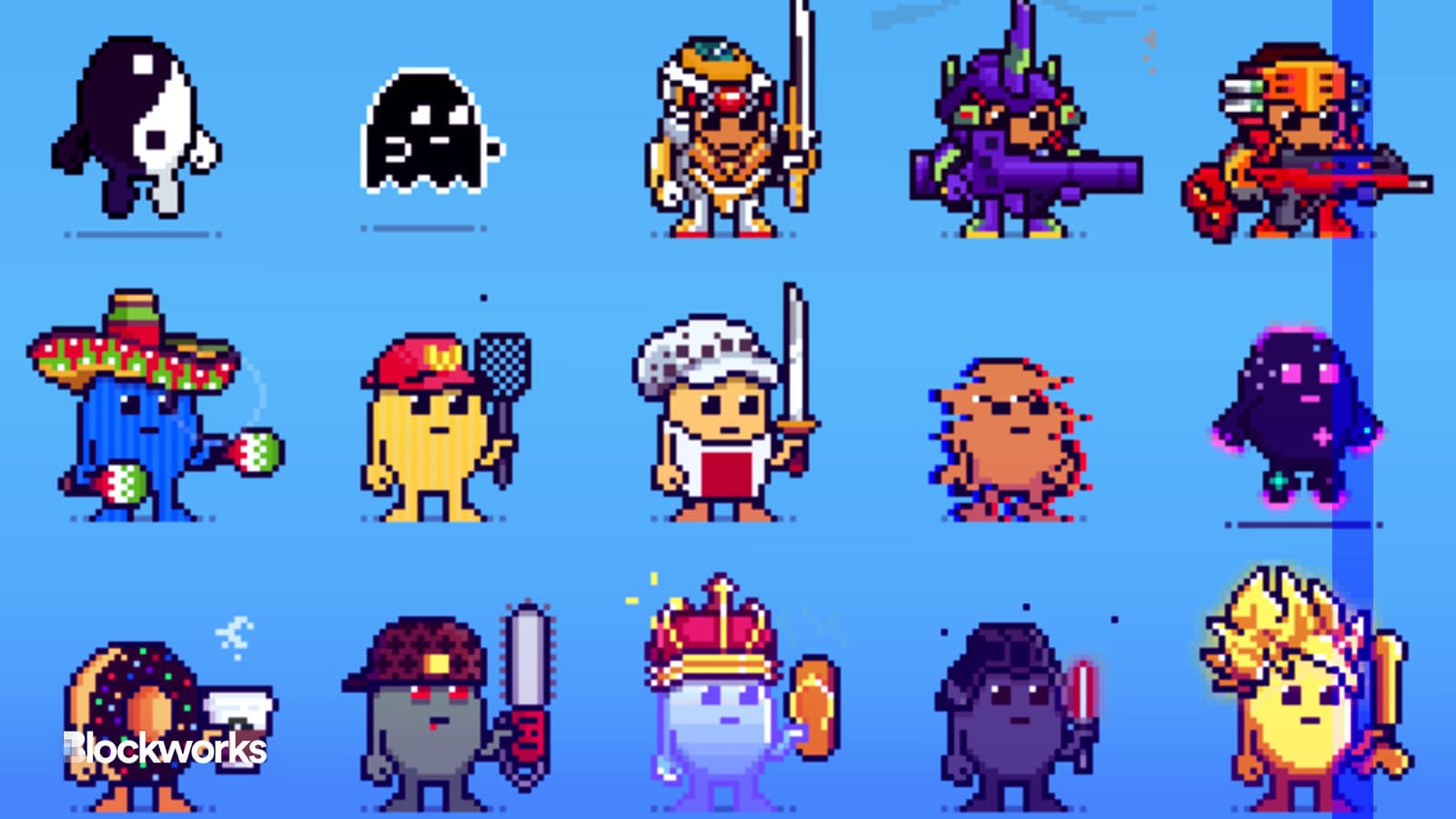

Source: OpenSea

The new year has begun to shake up the leaderboard for major NFT projects, with six-month-old “The Potatoz” surging to the top overnight across some of the industry’s leading marketplaces.

After surviving a choppy debut in June following an overdone digital assets market, Potatoz is proving resilient despite declining interest in the sector. As a collection of 9,999 “utility-enabled” profile pictures (PFPs), its NFTs feature rarity-powered traits inspired by internet memes and pop culture.

Daily sales volumes recorded over a 24-hour period for the project are up 136% to 800 ETH ($14,545,11) on both OpenSea and Rarible — overtaking the volume for Yuga Labs’ Bored Ape Yacht Club collection by a margin of more than 25%.

Potatoz, with a floor price beginning at 2.38 ETH ($4,327), represents a fraction of the total cost to purchase a Bored Ape, whose initial entry price starts anywhere between 73.7 to 81.5 ETH ($133,269 to $148,178).

Glancing across an aggregate of existing marketplaces, Potatoz has now climbed to third place this week, just behind Bored Apes and Larva Labs’ Crypto Punks, CoinMarketCap data show.

All three assets are in the PFP category, which sprung up in popularity amid a speculative bubble that began in early 2021 before collapsing a year later. In Potatoz case, the NFTs provide access to Memeland, a web3-focused venture studio, with high-profile advisors and backers, including Gary Vee, Adrian Cheng, Kevin Rose and Tim Ferris.

The art/collectibles segment of NFTs has served as a powerful onboarding mechanism for the broader crypto industry in recent years, crypto exchange Coinbase wrote in a recent report.

“Importantly, this use case for NFTs significantly lowered the barriers to entry for creators,” the exchange wrote in December. “On OpenSea alone, creators have earned over $1 billion in aggregate royalties in 2022.”

Coming closely behind Potatoz and Bored Apes on OpenSea and Rarible, sits Savage Nation, a project spun up in late December centered around 10 unique fighters from the dystopian metaverse of Arcadia.

Peering across a seven-day period from Dec. 28 through to Jan. 4, CryptoPunks remains a dominant collection and has more than doubled the sales volume of Bored Apes across most marketplaces.

Those projects are followed by Yuga Labs’ Otherdeed for Otherside and Mutant Ape Yacht Club collections in third and fourth place respectively, while Pudgy Penguins come in fifth on the leaderboard.

Potatoz, meanwhile, has begun its ascent over the same period — slotting in at eighth place across most of the industry’s leading marketplaces.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.