NFT Sales Volume Drops 20% in November

The total sales volume of five top NFT marketplaces extends on October’s decline, on the back of macroeconomic factors and the FTX debacle

Blockworks exclusive art by Axel Rangel

November’s combined NFT sales volume across the five top marketplaces clocked roughly $394 million, the lowest recorded this year.

Data provided by DappRadar and compiled by NFT gaming platform Balthazar DAO show volume across OpenSea, Magic Eden, X2Y2, LooksRare and Solanart dipped more than 20% collectively compared to the previous month of October.

November extended the declining trend as the demise of major exchange FTX shook faith in digital assets at the beginning of the month, which also rocked spot market prices.

Marketplaces were chosen based on the highest all-time volume recorded, Balthazar said. Representatives for all five marketplaces did not immediately respond to requests for comment.

Magic Eden, the only outlier of the five recorded platforms and Solana’s largest marketplace, managed to ride out the turmoil with a 60.9% increase in sales volume month over month.

“Blue-chip Solana-based NFT projects, including DeGods and y00ts, have seen positive price appreciation for the year, spotlighting the faith that traders and investors have in this sector of the NFT market,” an analyst at Zerocap told Blockworks.

Interestingly, the less popular Solana-based NFT marketplace, Solanart, was the worst affected among the top five — declining 93% from $6.25 million in October to just $410,000 by November.

While sales overall have been on the decline, John Stefanidis, Balthazar’s CEO and co-founder, remains upbeat on the nascent technology, which took off in earnest toward the end of last year.

“What we’ve seen is obviously a decline in sales largely for…images and art, but what we’re starting to see is really cool and different applications of NFTs,” he said in a statement.

Macroeconomic factors including rising interest rates, contracting disposable incomes and market volatility were affecting people’s decisions to wait for future NFT use cases, which ultimately translated into fewer sales, Stefanidis added.

The shift in market sentiment since a historic rise in late 2021 and early 2022 — where the value of the entire NFT sector sat around $40 billion — has also impacted the market share of some of its biggest players.

Who’s who in the NFT zoo

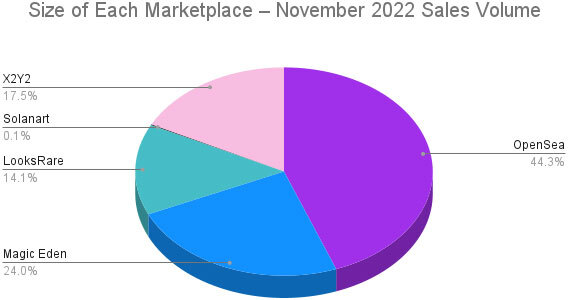

Source: Balthazar, DappRadar

Source: Balthazar, DappRadarMarketplace OpenSea, which had thrived on the success of its early mover advantage, witnessed a 1.6 percentage point decline in its market share for November when compared to the prior month. It still commands a dominant lead at 44%, DappRadar and Balthazar data shows.

Magic Eden and LooksRare, meanwhile, snatched up 12.1 and 2.5 percentage points respectively to increase their share of November’s sales volume.

To kick off December, unique active wallets engaging with all five platforms have also dipped considerably. OpenSea has witnessed a 47% decline in user activity while Magic Eden is down about 12.5% in the first days of the month.

Solanart’s UAW has dipped 25% in the previous four days, while LooksRare and X2Y2 have dropped 41% and 64% respectively, representing a slow start to the last month of the year.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.