San Francisco Fed President: Patience is ‘The Bravest Action We Can Take’

Supply chains should catch up with demand and ease inflation post-Covid, according to San Francisco Federal Reserve Bank President Mary Daly.

San Francisco Federal Reserve Bank President Mary Daly; Source: San Francisco Federal Reserve

- Ongoing effects of the pandemic causing elevated inflation level, said San Francisco Federal Reserve Bank President Mary Daly

- Raising interest rates today would do little to increase production, fix supply chains, or stop consumers from spending more on goods than on services, she explains

San Francisco Federal Reserve Bank President Mary Daly said that though overall inflation is at its highest level in 30 years, she expects a moderation in price pressures as the pandemic recedes.

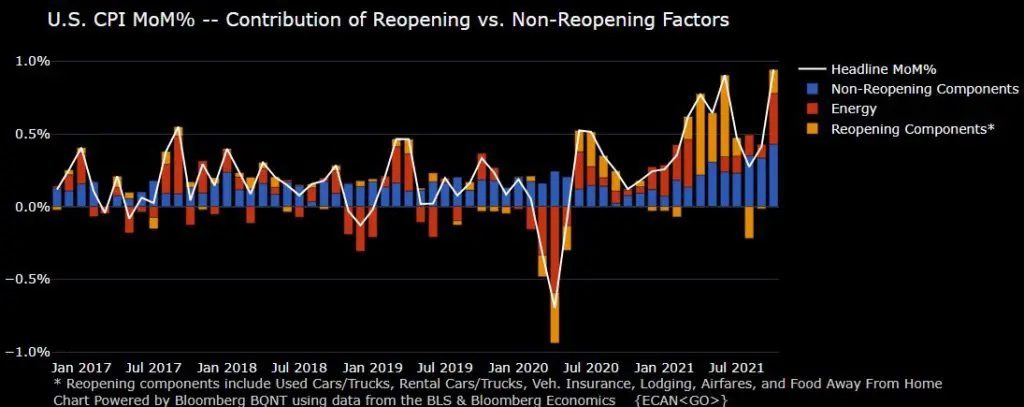

The annual inflation rate, which hit 6.2% last month, is the highest since November 1990, according to the US Bureau of Labor Statistics. The elevated inflation level is a clear result of consumers with income to spend demanding more goods than usual and suppliers struggling to keep up amid bottlenecks and labor shortages, Daly explained.

“During the worst economic shock in US history, demand [and] consumers have remained resilient,” she said during a speech on Tuesday at a gathering hosted by the Commonwealth Club of California. “Unfortunately though, the resilience of us as consumers has not been matched by the resilience of suppliers and supply chains. They’ve been far less robust.”

The Fed president noted that though unemployment is down, job openings are at all-time highs and wages are up in many sectors, the US is 4 million jobs short of its pre-pandemic peak. A record 4.4 million Americans quit their jobs in September, US Bureau of Labor Statistics data shows.

Though people, especially women and older Americans, have opted to leave the labor force as Covid-19 has affected schooling and childcare, workplace safety, transportation, and consistent hours and pay. Though some have suggested this trend is “a new normal,” Daly said, she expects people to return to the labor market as pandemic concerns go away.

She also predicts that consumers will likely pivot back to their normal bundles of goods and services and many households will move their savings back to historically normal levels. Production and supply chains should also catch up and repair, reducing bottlenecks and easing the pressure on prices, Daly added.

Raising interest rates today would do little to increase production, fix supply chains, or stop consumers from spending more on goods than on services, she argued. Should current high inflation readings and worker shortages turn out to be COVID-related and transitory, Daly added, higher interest rates would stunt growth, slow recovery in the labor market and unnecessarily sideline millions of workers.

“Reacting in response to things that aren’t likely to last will move us farther from – not closer to – our goals,” Daly explained. “…In the face of unprecedented uncertainty, the best policy is recognizing the need to wait. Although this can be hard, in the end, patience is the bravest action we can take.”

Her comments are fairly consistent with those made in recent months by US Federal Reserve Chairman Jerome Powell.

He has described the inflation rates, which currently exceed the Fed’s inflation goal of 2% annually, as “transitory,” noting during a Nov. 3 press conference that they are not due to a tight labor market, but rather due to shortages and bottlenecks coupled with strong demand.

Tapering of monthly bond purchases at a reduction of $15 billion a month will begin shortly, the Federal Open Market Committee said earlier this month. The central bank announced last year that it would increase its holdings of Treasury securities by at least $80 billion per month and of agency mortgage-backed securities by at least $40 billion per month until “substantial further progress” was made.

The next Fed chair?

President Joe Biden is expected to soon choose whether Powell will continue leading the central bank for another four years, as he is also evaluating appointing Lael Brainard to the position.

Brainard took office as a member of the Federal Reserve System’s Board of Governors in 2014 to fill an unexpired term ending in January 2026, according to a bio on the agency’s website. Before joining the Federal Reserve, she was the under secretary of the US Department of the Treasury from 2010 to 2013 and counselor to the Secretary of the Treasury in 2009.

Powell started his four-year term as chairman of the Fed’s Board of Governors in February 2018. He is also chairman of the Federal Open Market Committee, the system’s principal monetary policymaking body and was reappointed as a member of the Board of Governors in 2014 for a term that expires in 2028.

Biden’s decision could reportedly come as soon as this week.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.