Saudi mega-project commits to $50M investment in Web3 gaming firm Animoca

Animoca Brands is partnering with NEOM to develop global Web3 services and a hub, supporting tech growth in the economic zone and Riyadh

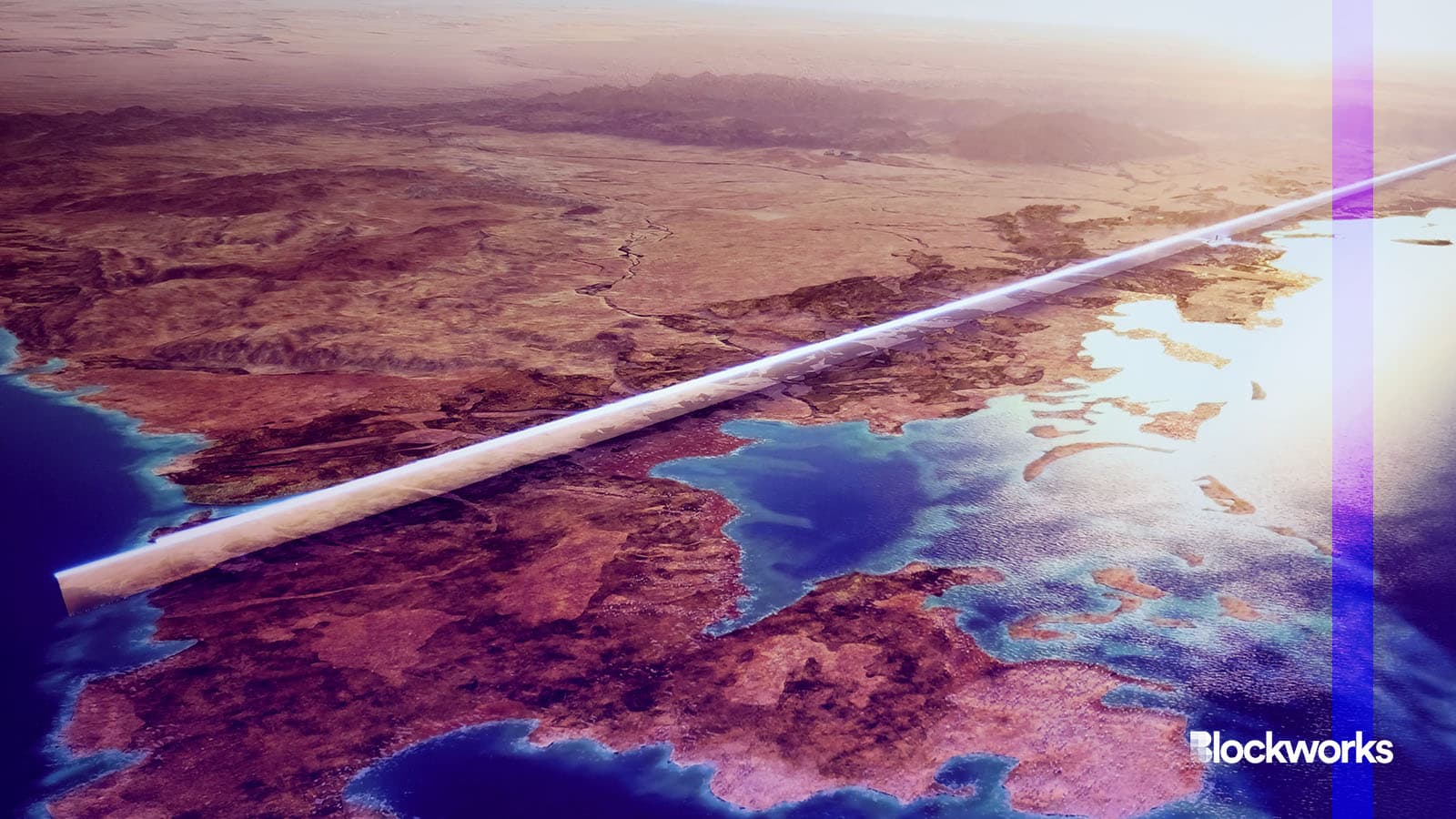

choi yurim/Shutterstock, modified by Blockworks

Saudi Arabia’s NEOM initiative has proposed a $50 million investment in the Web3 gaming and investment company Animoca Brands.

NEOM’s investment division has teamed up with Animoca to further Web3 projects in alignment with Saudi Arabia’s Vision 2030 strategy.

According to an announcement on Tuesday, half of the $50 million investment will come through convertible notes with a capped conversion price of $4.50 AUS per share, while the other half will be used to acquire Animoca shares from the secondary market.

Animoca’s share price is likely listed in Australian dollars as the firm was once listed on the Australian Securities Exchange (ASX). It was delisted from the ASX in 2020 due to non-compliance issues, yet it still trades on the secondary market.

The finalization of the financing agreement for the convertible notes is contingent on agreed conditions being met.

Read more: Crypto funding: Web3 gaming, blockchain security in focus

Animoca Brands will collaborate with NEOM to develop Web3 business services for global use, focusing on technological growth in the Saudi capital Riyadh and the NEOM area.

An Animoca Brands spokesperson did not reveal specific information regarding the projects they intend to undertake with the NEOM ecosystem, stating that the initiatives are still in the planning phase.

NEOM is an ambitious initiative launched by Saudi Arabia, and is designed to be a new-model international city and economic zone situated in the northwestern part of the country.

The project’s vision is for the city to be a hub for innovation, technology and sustainable development, seeking to diversify the Saudi economy away from its traditional reliance on oil.

Investing in Web3 initiatives would align with NEOM’s vision of being at the forefront of technological innovation.

Read more: Busan to build urban blockchain and digital asset exchange

“We are honored and excited to partner with and receive investment from NEOM, one of the world’s most ambitious projects seeking to use innovation and technology to redefine how we live, work, and play,” Yat Siu, Animoca’s executive chairman, said in a statement.

“We have always referred to the growth of the Web3 ecosystem as the emergence of a new meta-nation, and now NEOM could well become the first region to fully harness the power of blockchain,” Siu added.

Saudi Arabia has earlier disclosed investments in about 40 US venture capital firms, many of which are involved in crypto, blockchain and Web3 ventures.

Sanabil, associated with Saudi’s sovereign wealth entity, annually allocates about $2 billion to support businesses with innovative models.

This fund has stakes in firms such as Andreessen Horowitz (a16z), Polychain Capital and Peter Thiel-backed Valar Ventures.