SEC Case Against Ian Balina Hints Plan to Govern Ethereum

The SEC could be seeking legal precedent via the Ian Balina case, with claims that Ethereum activity is US-based due to node concentration

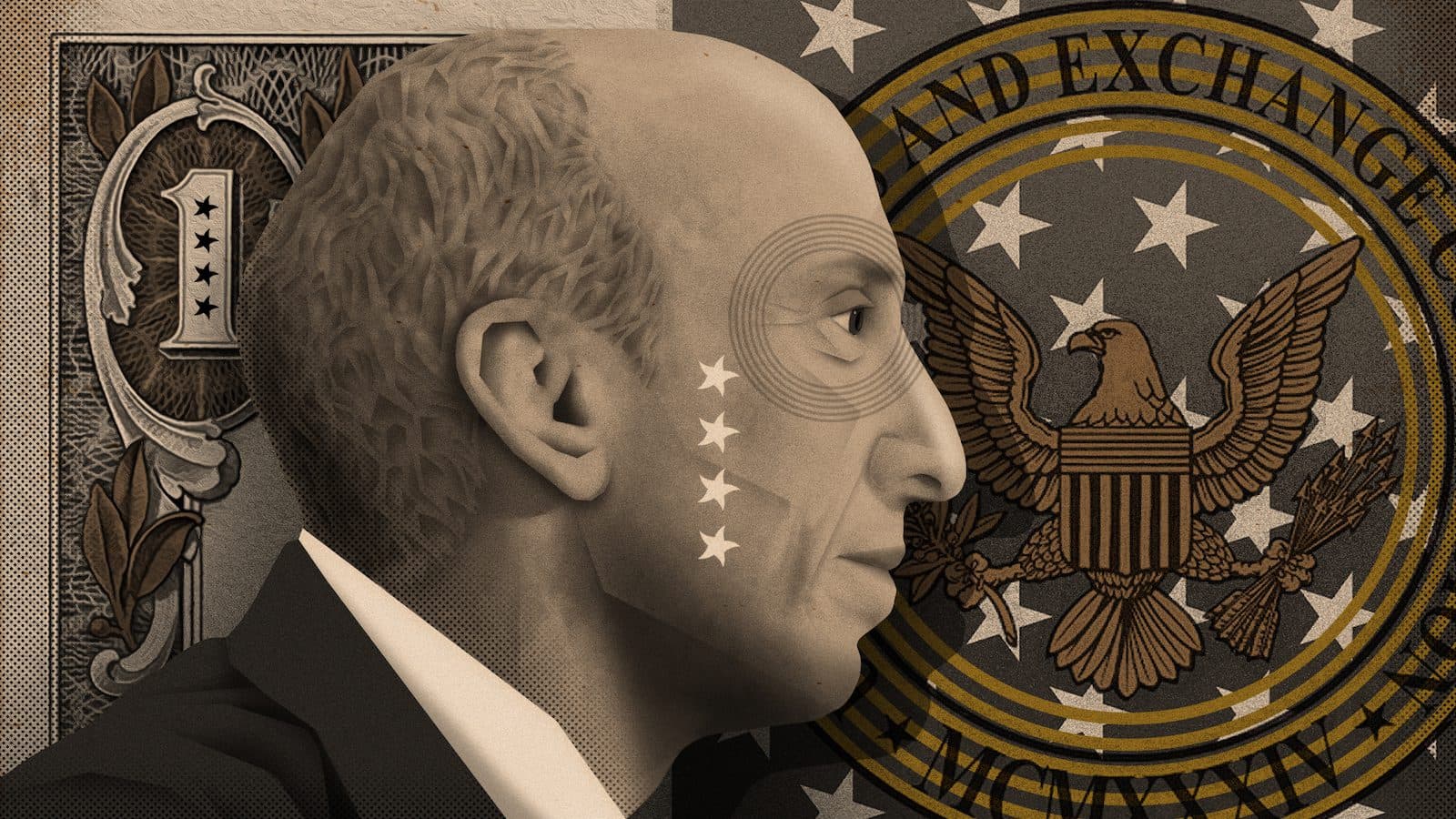

Gary Gensler, Chair, US Securities and Exchange Commission | Blockworks exclusive art by Axel Rangel

- The SEC seems to believe it holds jurisdiction over Ethereum activity as most nodes are US-based

- Any potential settlement between Balina and the SEC could set legal precedent moving forward

The SEC case against self-described crypto influencer Ian Balina has revealed how the regulator could further exert its jurisdiction over the Ethereum ecosystem: by claiming all transactions on the network occur in the US.

Balina is accused of conducting an illegal sale of sparkster (SPRK) tokens during an initial coin offering (ICO) four years ago, which raised about $30 million from 4,000 investors.

Sparkster’s whitepaper detailed plans to launch a marketplace for “no-code software,” powered by an advanced form of smart contracts. Network participants would be rewarded in SPRK for “contributing spare capacity on their personal devices to the Sparkster Decentralized Cloud.”

Balina allegedly failed to disclose that he’d been paid to promote the ICO, which the SEC considers an unregistered securities offering.

Sparkster itself opted to settle. It now must return $30 million to investors and pay $5 million in fines. The firm’s token is now completely worthless, although a revamped version of its website remains online.

On Monday, Balina said he turned down a settlement with the regulator, and that he intends to fight the SEC’s “frivolous” charges laid out in a 23-page complaint filed earlier this week.

Among that complaint lies a snippet explaining how the SEC views Ethereum, particularly in relation to its power to prosecute based on actions within the network.

SEC: There’s more Ethereum nodes in the US than anywhere else

Sparkster conducted its ICO on the Ethereum network, raising ether in return for SPRK, an ERC-20 token.

During the alleged ICO scandal, US-based investors who sent their ether contributions to Balina’s pool were validated by a network of Ethereum nodes, described by the SEC as clustered “more densely” in the US than anywhere else.

The US is indeed home to 43% (3,371) of all Ethereum nodes (7,831), according to ethernodes.org, more than any other country. Germany comes in second with almost 12% (912), followed by France with 4.5% (351).

Due to Ethereum’s permissionless nature, anyone at all can connect their computers to the network by running client software, after which they become a node.

Still, the concentration of Ethereum nodes within the US is apparently enough for the SEC to consider any transactions on the network to have taken place within American borders.

As such, a potential settlement between the SEC and Balina would place Ethereum within the regulator’s scope, Ian Corp, attorney at law firm Agentis told Blockworks via email, making it much easier for the agency to sue over Ethereum activity.

“If the SEC is successful against Mr. Balina, which I anticipate it will be, I would not be surprised if they used this jurisdictional argument to oppose future jurisdictional challenges,” Corp said.

This is another example of the SEC going after “low-hanging fruit” that would bolster its arguments down the road against more prevalent projects, like Ethereum, the attorney added.

Balina could eventually settle with the SEC

Setting such precedent could bring other projects leveraging the Ethereum network, including NFT projects, money transmitters, sidechains, rollups and DeFi applications, under the SEC’s purview.

That could have wide-reaching implications for projects transacting on Ethereum. “Unfortunately, Mr. Balina likely lacks the necessary resources to adequately defend the allegations against him and will likely enter into a settlement,” Agentis’ Corp said.

Balina famously lost $2 million in various cryptocurrencies to hackers during a livestream back in 2018, claiming to have kept his private keys in notation app Evernote.

He regularly reviewed ICOs on his YouTube channel, which had garnered upwards of 116,000 subscribers throughout the 2017 and 2018 crypto bull market. He also controled a Telegram group with more than 25,000 users.

More recently, Balina founded Token Metrics, a startup which claims to wield artificial intelligence that “turns data into investment insights to help you beat the market.” Balina has appeared on CNBC’s Squawk Box multiple times this year to provide market commentary.

In any case, the SEC has recently ramped up cases against Ethereum-powered ICO projects from years prior. And in a bid to further police the crypto sector, the SEC established a new office last week designed to scrutinize crypto company filings. It also pledged to boost the number of crypto-focused officers by 50 in May.

Indeed, the SEC has long argued most cryptos are securities. SEC Chair Gary Gensler earlier this month reaffirmed all crypto barring bitcoin should fall under the jurisdiction of the Commodities Futures Trading Commission (CFTC).

Should a US bipartisan bill introduced last month be passed, the CFTC would be vested with greater powers to oversee both bitcoin and ether — a development that would be welcomed by the majority of industry participants.

Although, it will have little impact on projects and tokens deployed to the Ethereum network outside of ether, and especially so if the SEC sets precedent via the Ian Balina case.

Additional reporting by David Canellis

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.