Silvergate’s Payment Pipes Fuel the Digital Assets Revolution

The global crypto market cap is just over $1.4 trillion dollars, with daily volume around $126 billion, according to recent data from CoinMarketCap. But despite being an asset class larger than many of the world’s best known stocks, and almost the […]

Blockworks exclusive art by Axel Rangel

- Digital assets move at the speed of light, but existing payment rails just can’t keep up with demand from traders

- A hesitation to extend banking services to traders and digital asset-aligned money services businesses creates a niche market opportunity

The global crypto market cap is just over $1.4 trillion dollars, with daily volume around $126 billion, according to recent data from CoinMarketCap. But despite being an asset class larger than many of the world’s best known stocks, and almost the size of Silver, many banks would shudder at the thought of doing business with a digital asset trader.

So in steps Silvergate Bank. It’s one of the few banks on the market that would consider digital asset traders as clients, and has gone above and beyond by building tools specifically geared for them, specifically rapid payment settlement and access to credit.

A trader, for example, might need to move capital from one exchange to another to take advantage of arbitrage opportunities. With FedWire, that transaction would settle in a day, potentially too slow to take advantage of the opportunity.

In comparison, the Silvergate Exchange Network (SEN) allows for instant settlement of dollar-denominated transactions across its network while its counterpart SEN Leverage allows members on the network to collateralize their bitcoin holdings for dollars should they need to cross-leverage their digital assets into other asset classes.

The access challenge

“The inability to access capital quickly and cost effectively is one of the biggest challenges facing the digital assets industry. Because traditional prime brokerage doesn’t exist in the digital currency ecosystem, there’s a real need for a solution like SEN Leverage, which provides secure, institutional-grade access to capital,” Ben Reynolds, Silvergate’s Chief Strategy Officer, told Blockworks.

Reynolds has a point about market demand. During the last quarter, Silvergate Bank reported its income from digital currency customers increased approximately 40% to $3.3 million with 68,000 transactions flowing down its payment pipes.

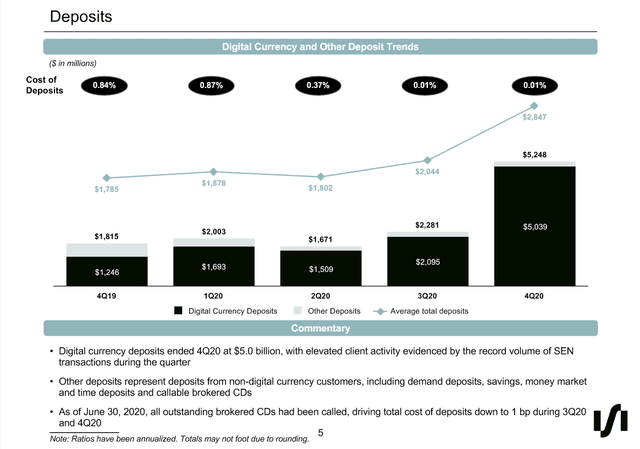

According to an earnings presentation from January 21, the bank had approximately $5 billion in digital assets deposits by the end of the fourth quarter of 2020 thanks to the bitcoin bull market and growth in DeFi.

Source: Silvergate Bank

Source: Silvergate BankWhile the company didn’t necessarily report a huge gain in customers, it’s notable that there were significant gains in deposit sizes — jumping almost three-fold, according to company filings. A big part of this is thanks to the growth in stablecoins; it’s the transactional bank for USDC and PAX.

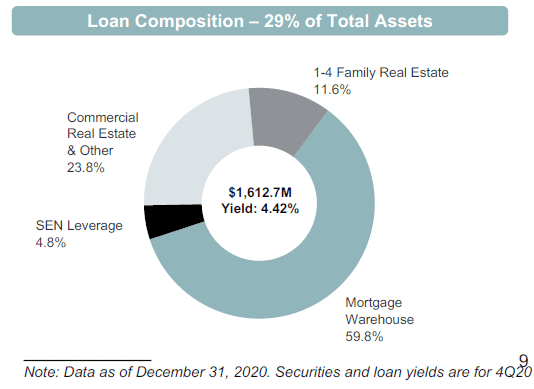

SEN Leverage, its credit platform which makes up just under 5% of its loan composition, reported a jump of $47 million in bitcoin-collateralized loans hitting $82.5 million. This has grown from $12.5 million at the start of the year.

Source: Silvergate Bank

Source: Silvergate BankBuilding blocks of the crypto market

“Silvergate is structurally important to the crypto ecosystem,” Matt Walsh, a partner at Castle Island Ventures, told Blockworks. “This represents the maturation of the crypto market and [Silvergate] represents one of the building blocks of this market.”

Institutional investors tend to agree. According to 13F filings, the number of funds holding Silvergate continues to grow quarter after quarter as do the shares held by these funds. Positions increased by just over 17%, while funds collectively bought 1.6 million more shares.

Michael Del Grosso, an analyst who covers Silvergate for Compass Point Research & Trading, argues the 240 billion in volume via SEN is evidence that the company is still in the “early days” of how it monetizes things.

Winning the regulatory game

Del Grosso also suggests that the company has another angle covered quite well: regulatory affairs. As the digital assets industry, particularly stablecoins, grow in value, lawmakers have taken a keen interest in regulating the sector.

While the crypto industry has signalled it isn’t happy with some of the proposed regulation like the STABLE Act, Del Grosso thinks that even if this Act passes — which he doesn’t think is likely — Silvergate is well-positioned to thrive considering the crux of the proposed legislation involves the requirement for chartered banks to play a commanding role in the digital assets sector.

Similarly, Isaac Boltansky, Compass Point’s regulatory affairs analyst, believes Silvergate’s experience in the space will satisfy watch dogs.

“Bank regulators are cautious by nature, which underscores the first-mover advantage for a bank like Silvergate that has deep experience in these markets,” he said.

Walsh at Castle Island Ventures sees Silvergate as an institution that’s figured out the regulatory environment, leaving it in a good position for a bull or bear market.

“Before Silvergate, crypto and money services businesses were red flags for banks,” Walsh said. “Silvergate has been a huge positive force for the industry.”