Solana Continues to Slide Alongside Other Cryptos: Markets Wrap

The crypto markets had another rocky day. In the last 24 hours, Solana, fell 10.90% to $123.25 and Uniswap fell 10.58% to $19.04.

Source: Shutterstock

- Total crypto market cap fell 5.29% on day.

- The SEC may have served a Mainnet speaker a subpoena in New York Monday

Crypto markets once again experienced across-the-board losses on Tuesday with the total market capitalization at $1.82 trillion, a 5.29% decrease over the last day, according to CoinMarketCap.com.

Major laggards in the asset class once again include Solana, which fell 10.90% in the last 24 hours to $123.25, and Uniswap which fell 10.58% to $19.04 in the last 24 hours.

$SUSHI is also continuing its seven-day downward trend this week, trading at $9.30, down -11.59%.

DeFi

- Terra ($LUNA) is trading at $26.26, declining -6.4% and trading volume at $1,293,644,271 in 24 hours.

- Uniswap ($UNI) is trading at $19.71, shedding -7.5% with a total value locked at $4,154,251,786 in 24 hours at 4:00 pm ET.

- DeFi:ETH is 31.8% at 4:00 pm ET.

Crypto

- Bitcoin is trading around $41,584.32 down -4.37% in 24 hours at 4:00 pm ET.

- Ether is trading around $2,861.78, falling -5.29% in 24 hours at 4:00 pm ET.

- ETH:BTC is at 0.068, declining -0.87% at 4:00 pm ET.

Insight

Commenting on the downward trend, Oleg Smagin, Head of Strategy at Delio, said, “The main reason [for] an ongoing correction is [a] rising dollar that has dampened both bitcoin and altcoins. The prices on the stock market, forex and the market of commodities have all been affected as traders expect the monetary support to be reduced.”

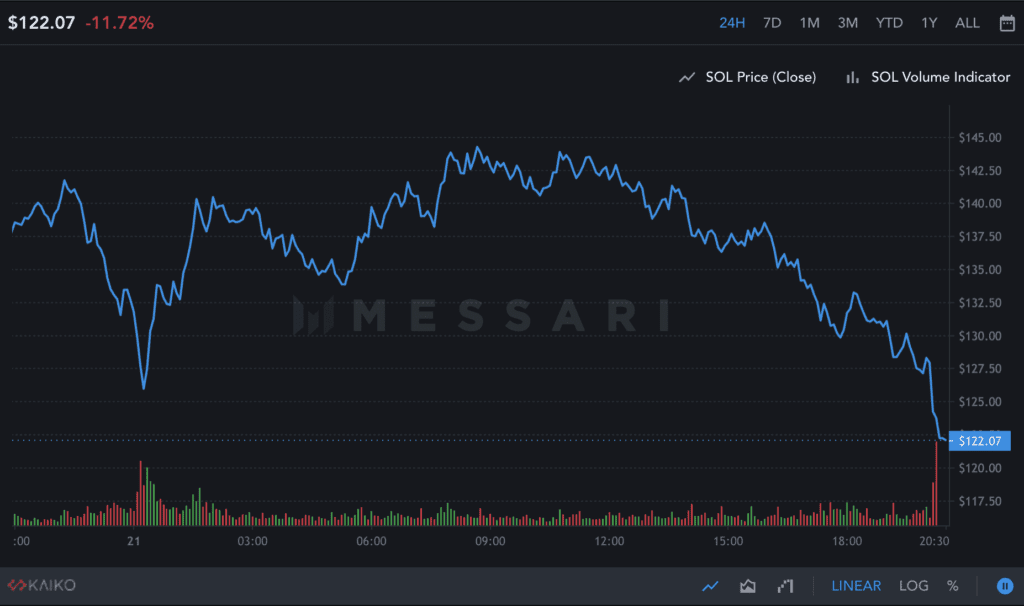

$SOL trading over the past seven days; Source: Messari

$SOL trading over the past seven days; Source: MessariEquities

- The Dow was down -0.15% to 33,919.

- S&P 500 fell -0.08 to 4,354.

- Nasdaq is up 0.22% to 14,746.

- The VIX declined 5.25% to $24.36.

Commodities

- Brent crude was up $74.53 per barrel, up 0.81%.

- Gold advanced 0.63% to $1,774.9.

Currencies

- The US dollar fell 0.06%, according to the Bloomberg Dollar Spot Index.

Fixed Income

- US 10-year treasury yields 1.326% as of 4:00 pm ET.

Insight

“Since the direction of the VIX and the S&P 500 are typically inversely correlated, a top on the VIX often lines up with a tradeable low for US large cap equities,” said Nicholas Colas, co-founder, DataTrek Research.

In other news …

The SEC may have served a Mainnet 2021 conference speaker a subpoena in New York Monday. Blockworks looked into what jurisdiction US regulators could have over foreign nationals.

We are looking out for

- Federal Reserve’s rate decision will be on Wednesday

- Federal Reserve Chairman Jerome Powell will discuss pandemic recovery, on Friday

That’s it for today’s markets wrap. Morgan will see you back here tomorrow.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.