Lightspeed Newsletter: Solana validators take aim at side deals

Solana validators voted in favor of a proposal that would send 100% of priority fees to validators

Shizume/Shutterstock modified by Blockworks

Howdy!

A member of the Kardashian orbit is on a social media blitz to promote her Solana memecoin, and it’s not even big enough news to justify running as today’s lead news item.

It’s a bull market for cryptos — and for interesting things to write about in newsletters.

Solana validators take aim at side deals

On Monday, Solana validators voted in favor of a proposal that would send 100% of priority fees to validators, a change from the status quo of sending half and burning half.

The rationale for such a move was partly that these priority fees — which users can pay to try getting their transactions confirmed more quickly — need to be paid in full to avoid “side deals” that circumvent the network’s formal process for creating blocks.

The proposal gives this hypothetical: If a validator knows they’re only going to make 50% from someone paying a priority fee, why wouldn’t the validator just take a tip via a side deal that’s 75% as large but of which they keep 100%? That way, both the validator and the user get a better deal, just arguably at the expense of efficiency and transparency.

Mert Mumtaz, CEO of Helius and host of the Lightspeed podcast, said he voted for the proposal, which is named Solana Improvement Document (SIMD)-0096.

Mumtaz told me the side deals are a real problem — though by definition they’re difficult to quantify.

A lack of concrete evidence for how common side deals are was one sticking point in the proposal’s discussion. As it turns out, there’s no Dune dashboard tracking collusion.

The proposal’s author said paying 100% of priority fees to validators won’t eliminate side deals in any case, but making incentives more straightforward is still worthwhile in its own right.

One evident tradeoff is that with less SOL being burned by design, the Solana network is likely to become more inflationary with the protocol’s implementation, which could put downward pressure on solana’s price.

One validator operator estimated SOL issuance would increase by 4.6% if 100% of fees were to go to validators.

Another forum member argued that raising the priority fee could prompt validators to begin manipulating priority fees upwards.

To be totally honest though, my first reaction to the news was more along the lines of: Wait, Solana holds governance votes?

Most major blockchains have some structured means of making software upgrades, but not all are governed through the sometimes-nettlesome process of voting. Ethereum’s EIPs, for instance, are implemented once developers and community members reach a consensus.

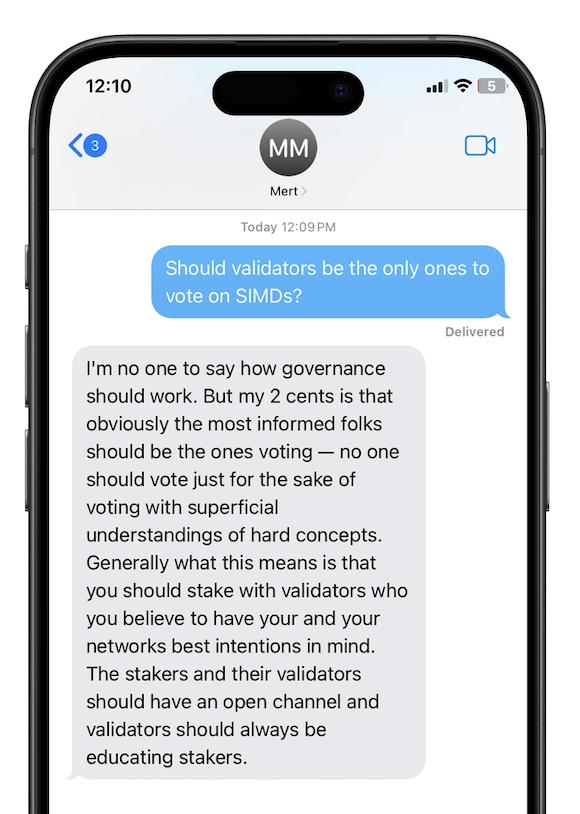

Only validators could vote on SIMD-0096, and their voting power was based on how much staked SOL a given validator oversees. There are only around two dozen SIMDs listed on the Solana Foundation’s GitHub. The specifics of governance are still a work in progress on the network.

Since voting can change the network’s economics, as we saw with SIMD-0096, who gets to vote and what they’ll vote on will prove pretty significant for who holds sway in Solana.

— Jack Kubinec

Zero In

Things will soon get a bit more lucrative for Solana validators:

Priority fees on Solana are additional — and optional — fees users can pay in order to have their transactions approved more quickly on the network. This type of activity is as old as blockchains itself; on bitcoin, users can pay a higher fee in order to make their transaction more attractive to miners. Miners then collect these higher payments when they discover a block.

On Solana, however, these priority fees are split upon block creation: half to the validator, the other half burned. Priority fees are paid on top of base network fees.

Soon, thanks to the approval of SIMD-0096, validators will collect 100% of priority fees. The proposal passed with 77% approval.

Expect the above chart, crafted by the folks over at Blockworks Research, to evolve over time.

How much additional money flows into validators’ pockets remains to be seen; as an optional fee, one might expect variance depending on what’s happening on the network and whether users are clamoring to get ahead of the proverbial line.

Either way, the governance approval represents a shift in Solana’s foundational economics — we’ll be watching to see how things shape up over time.

— Michael McSweeney

The Pulse

Caitlyn Jenner’s memecoin led the Olympic champ and parent to Kendall and Kylie to post a video assuring fans she hasn’t been hacked, take down an ad for a different token following backlash, and accuse someone apparently involved with $JENNER of scamming her.

Oh, and $JENNER has already seen tens of millions of dollars worth in trading volume.

The social response was, well, what you’d expect on a long weekend, but one X user in particular summed up the vibe pretty well.

— Jack Kubinec

One Good DM

A message from Mert Mumtaz, CEO of Helius:

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.