Top TradFi Institutions Lent Millions to Crypto Miner Core Scientific

A court filing shows an ad hoc group of creditors, including Apollo, BlackRock, and MassMutual, acquired secured convertible notes issued by the miner

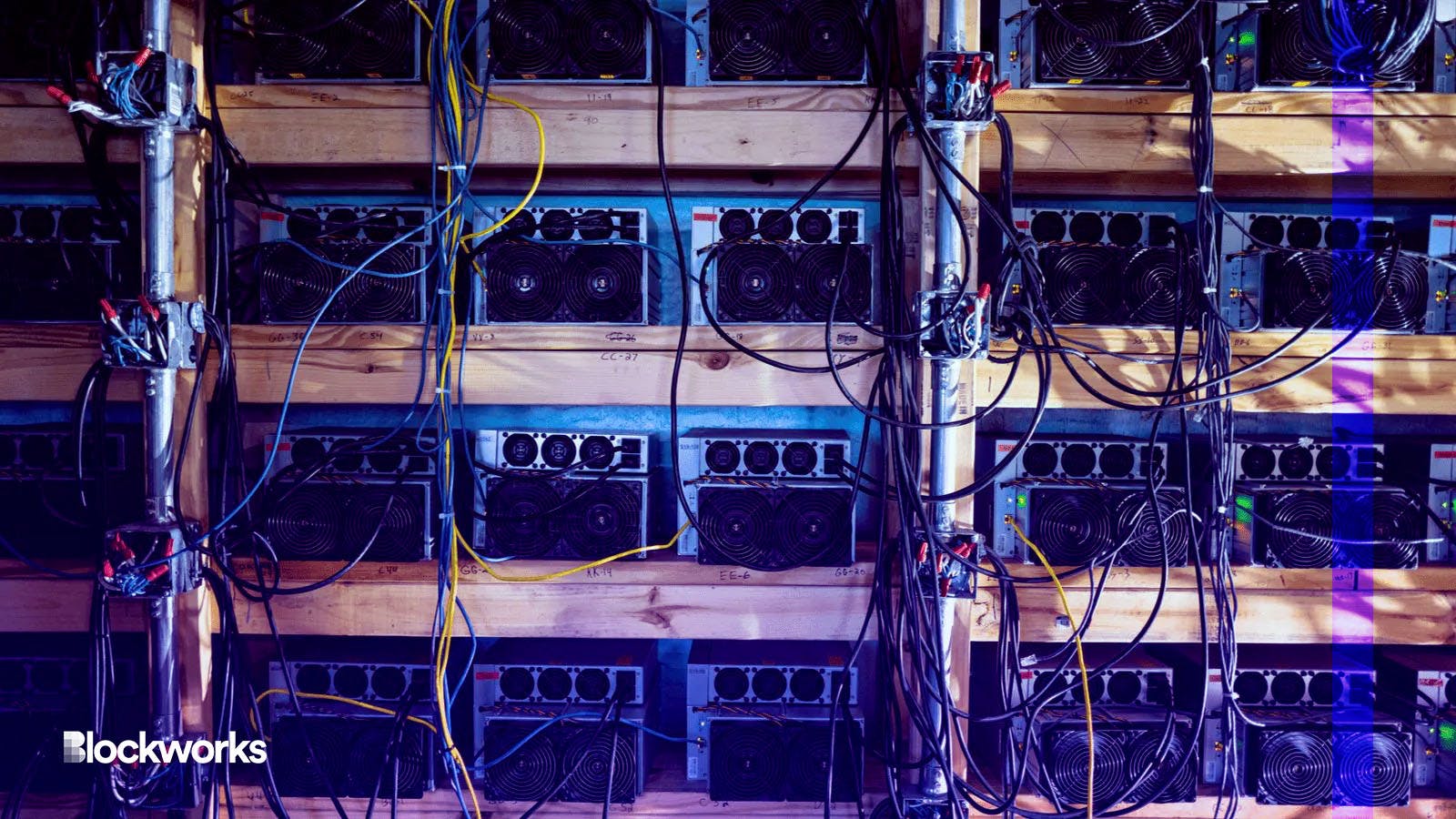

Crypto mining farm; Source: Shutterstock, modified by Blockworks

Core Scientific was lent millions by top traditional finance institutions, a move that helped the cryptocurrency miner thrive and build out its business.

BlackRock and Apollo Global Management are among a group of creditors that lent the miner $500 million by purchasing its convertible notes, a court filing published Jan. 18 showed. Bloomberg first reported the news on Tuesday.

The miner managed to raise capital as BlackRock snapped up $38 million of convertible notes via subsidiary-managed accounts in August 2021, the report said. Apollo acquired $33.6 million between April and August that year.

They also contributed $17 million and $6.1 million respectively towards debtor-in-possession financing (DIP) last year, which would allow Core Scientific to continue running during bankruptcy.

The creditors, referred to in the court filing as an ad hoc group of DIP financing lending, also included Gullane Capital, multi-strategy investment firm Ibex Investors and ICG Advisors.

“The members of the Ad Hoc Group are either the beneficial holders of, or the investment advisors or managers to, funds and/or accounts that hold disclosable economic interests in relation to [Core Scientific],” the filing reads.

Other members holding Core Scientific notes are MassMutual, Corbin Capital Partners, Jordan Park Group, Kensico Capital Management, Marsico, Sabby Volatility Warrant Master Fund and Toroso Investments.

The largest creditor was Ibex, which lent Core $97.9 million in April 2021 and another $10.1 million towards the DIP loan.

Core Scientific filed for bankruptcy last month after the company warned its cash resources would be exhausted by the end of 2022. Crypto miners struggled last year amid rising energy prices and broader macro trends affecting cryptoasset prices.

Earlier this month, the miner decided to free up hosting space by letting go of bankrupt crypto lender Celsius as a client.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.