The US dollar? Yeah, that’s a Ponzi scheme

We are blessed by Satoshi and Vitalik to have the best chance of excising the tumor that is the State from what money should be

ilikeyellow/Shutterstock modified by Blockworks

The primary malfunction in our modern-day monetary systems is the lack of ability to opt out. A citizen cannot raise their hand and proclaim, “I choose not to participate in this system which I was randomly assigned by birth.”

While one might argue that we (in most Western climes) can invest in alternative assets or currencies, the underlying truth remains that the dominant monetary system is thrust upon citizens without a genuine choice.

Assets in your brokerage account can be (and have been) seized. Your physical property can be repossessed by the State for whatever reason they declare. A citizen may not even be safe housing physical gold due to the complexities of storage and transfer. The State may also decide that simply owning a bearer asset like gold is illegal (Executive Order 6102).

Perhaps the most disheartening aspect of this entire dynamic is the individual’s powerlessness in the face of looming decline. A citizen, regardless of their awareness or financial acumen, has no say in the timing of the fall of an empire or the collapse of a currency. They are dealt a hand they are required to play and are hoping that they are a member of the generation for which the Ponzi scheme of State-Exclusive-Monetary-Systems persists. This movie has been made countless times throughout history, each time with a new cast, but with the same tragic ending.

Today, we face ever-increasing national debt, a growing deficit, and a regime of “higher for longer” interest rates.

The dollar, like all state-owned money, is a multi-generational Ponzi, where the benefit you receive from being part of the Ponzi decreases based on how late you’re born into the system. So the question becomes, “are you feeling lucky, punk?”

The transitory nature of institutions and their handmaiden: Money

None of us can escape the second law of thermodynamics: entropy. This natural law, which governs the tendency of systems to evolve from order to disorder, finds a curious parallel in one of man’s first creations: The State. It is a widely known but poorly digested fact that no human empire or institution has lasted forever.

Given that money is (heretofore) an extension of the State, citizens have been extorted into an abusive relationship that ties their wealth with systems that have a survival rate of ZERO. How many different dead men have had their faces emblazoned on our coinage?

Entropy, money and the state are intertwined — and the USD, like all fiat monies, is a multi-generational Ponzi scheme.

Since humankind began forming communities, we have been striving to create structures to impose order on its members. Yet, history stands as a testament that no human institution has escaped the destructive onslaught of entropy. Mighty empires like the Romans, which once seemed invincible, have crumbled and faded into the annals of history. Let’s discuss its decline through the lens of their money.

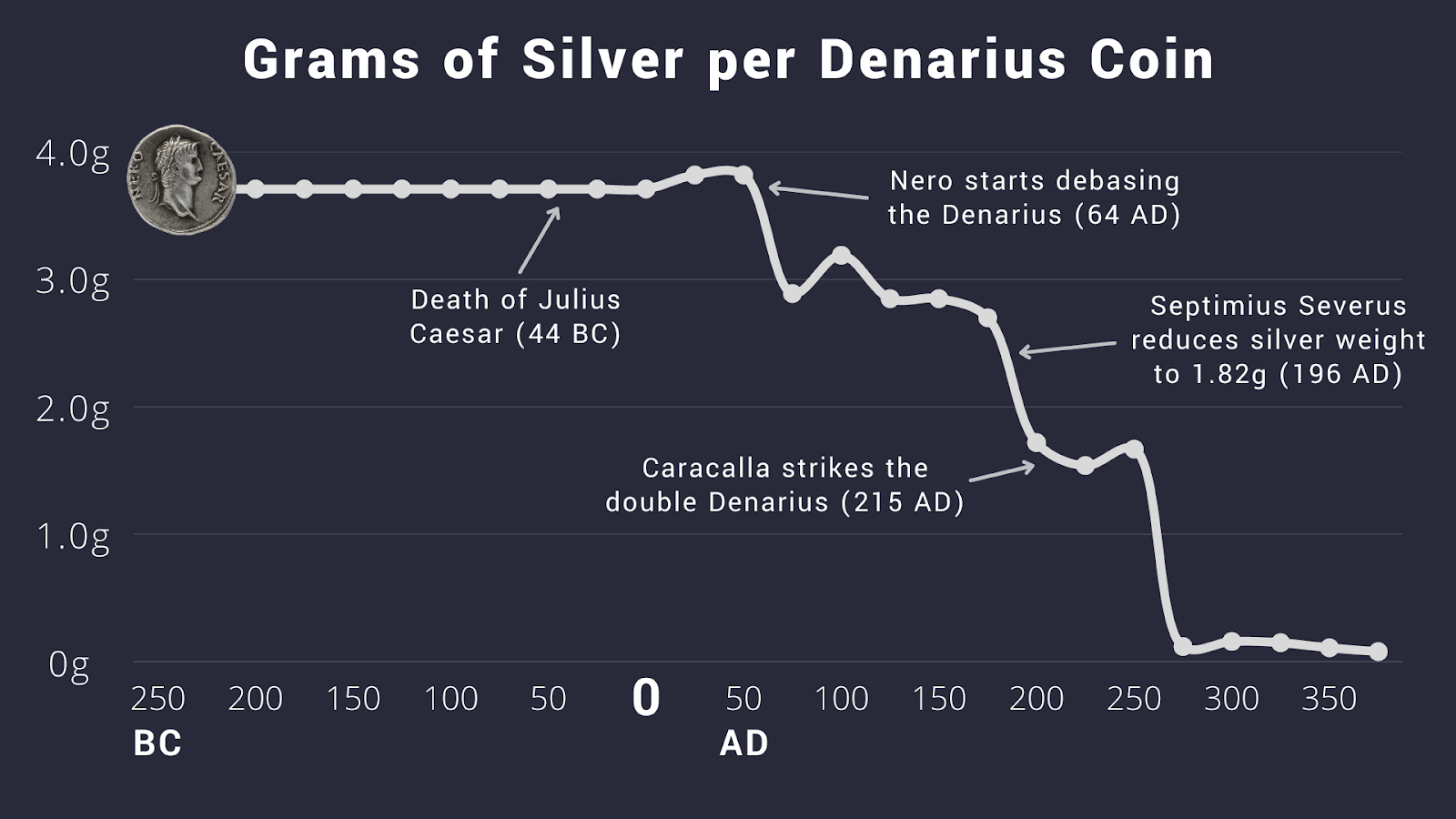

Souce: Vaulted

Souce: Vaulted

The first standout occurs during the reign of Nero (~54-68 AD). Emperor Nero reduced the silver content of the denarius to ~90%. This was a comparatively modest debasement, but arguably set a precedent for future regimes.

Following Septimius Severus’ reduction in coinage weights, Caracalla (180-217 AD) in response to growing distrust of circulating currency, introduced a new unit, “antoninianus,” which was supposed to be worth two denari but only had ~1.5x the silver content. These coins were ~50% silver by weight.

Finally, by the late third century, the Roman Empire was imperiled throughout a period defined by political instability, external invasions and economic decline. Roman leaders, especially in the provinces, debased currency to pay for increasing expenses. It’s believed that coinage contained only about 5% silver.

Read more from our opinion section: The US is losing the crypto race

This timeline serves to reinforce the idea that the State has wielded its power of seigniorage — their ability to mint money — as a tool to extend its own life at the expense of its people.

It seems relevant that increased information connectivity, productivity, travel and the invention of fiat currency has vastly increased the probability of cascade ecosystem failures for the state and its money.

The modern failures of the Weimar Republic (1920s), Hungary (1945-46), Brazil (1980s to Plano Real), Argentina (Lol, always), Yugoslavia (1990s), Zimbabwe (2000s), and Venezuela (2010s-20s) seem to argue this point.

The proverbial light at the end of the tunnel

Bitcoin. Decentralized finance. Non-custodial, asset-backed stablecoins.

Congratulations, you read those words, and you know what it means. We are blessed by Satoshi and Vitalik to have the best chance of excising the tumor that is the State from what money should be.

Blockchain-native assets are the first viable alternative in history to participating in the multi-generational Ponzi. This new breed of assets transcends the control, borders and even the existence of the State. Ownership and transfer are trustless and use is permissionless.

If you’re reading this, I implore you to remember why we are here. Money shouldn’t be left to chance, and money shouldn’t be a product of circumstance or luck.

Money shouldn’t be a Ponzi scheme.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.