Wells Fargo: Cryptos Like Internet in Late ’90s, Nearing ‘Hyper Adoption Phase’

Wells Fargo is drawing similarities to the adoption rate of the internet, calling crypto “early, but not too early”

The Wells Fargo Bank on South Lake Avenue. Pasadena, California. Credit: Shutterstock

- The banking giant, which handles around $1.9 trillion in assets, said crypto should be approached through professionally managed private placements

- Wells Fargo said it did not recommend crypto mutual funds, ETFs, grantor trusts and “individual cryptocurrency speculation”

Multinational financial services and banking giant Wells Fargo told investors Monday it did not think it was too early to get skin in the game for cryptocurrency investments.

In a report from the bank’s Global Investment Strategy Team, Wells Fargo said crypto users are growing rapidly around the world. Crypto appears to be near a “hyper-adoption phase,” similar to that of the internet during the mid-to-late 1990s.

“We believe that cryptocurrencies are viable investments today, even though they remain in the early stages of their investment evolution,” the company said.

The bank is making a recommendation to investors to approach crypto investments through professionally managed private placements, telling them to be “patient” while the industry continues to mature.

“We do not recommend any of the other current investment options, such as mutual funds, ETFs, grantor trusts and individual cryptocurrency speculation,” Wells Fargo said. The company added it was “hopeful” 2022 would bring about greater clarity on the regulatory front which could lead to “higher quality” investments.

Wells Fargo also said it did not subscribe to the “too late to invest” argument new investors feel when they first start poking around digital assets. That’s because performance numbers for most crypto are skewed as they’ve grown from “virtually zero,” according to the report.

The bank also points to crypto being a nascent industry and “relatively young investment space” with a large majority of projects being fewer than five years old.

Taking a page from the internet

Wells Fargo believes crypto is “early, but not too early,” in the investment stage, highlighting the need for investor education while also pointing to crypto’s adoption rates similar to that of the internet during the turn of the century.

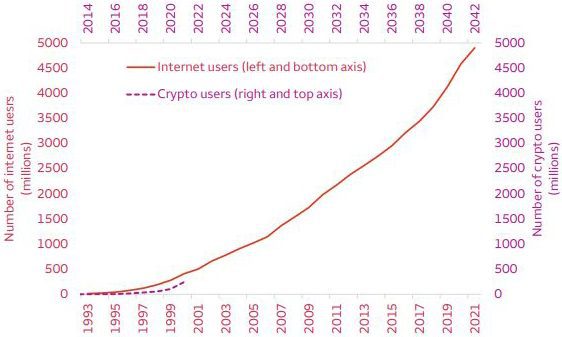

Internet usage history versus crypto users; Sources: International Telecommunication Union, Our World in Data, Crypto.com, Statista, Bloomberg and Wells Fargo Investment Institute

Internet usage history versus crypto users; Sources: International Telecommunication Union, Our World in Data, Crypto.com, Statista, Bloomberg and Wells Fargo Investment InstituteThe research draws parallels to the internet’s performance in the late ’90s and its technology S curve when the web’s use surged from 77 million in 1996 to 412 million in 2000. The bank believes crypto may have reached an adoption inflection point that bears resemblance to where the internet was back then.

The chart above, as published in the report, compares the global adoption rate of the internet beginning in 1993 and crypto users beginning in 2014.

“Based on this comparison alone, it appears that cryptocurrency use today may even be a little ahead of the mid-to-late 1990s internet,” the bank said.

“Precise numbers aside, there is no doubt that global cryptocurrency adoption is rising, and could soon hit a hyper-inflection point.”

Wells Fargo is no stranger to the crypto industry. Its report adds to musings penned last year when it called crypto a “viable investment asset” and said it would begin offering a “professionally managed solution” to its wealthiest clients. The banking giant followed up by registering a passive bitcoin trust with the US Securities and Exchange Commission in August.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.