What’s Stopping Institutions from Moving Headlong into Digital Assets?

Mercer is the CEO of LMAX Group, a global, high-growth financial technology company based in London

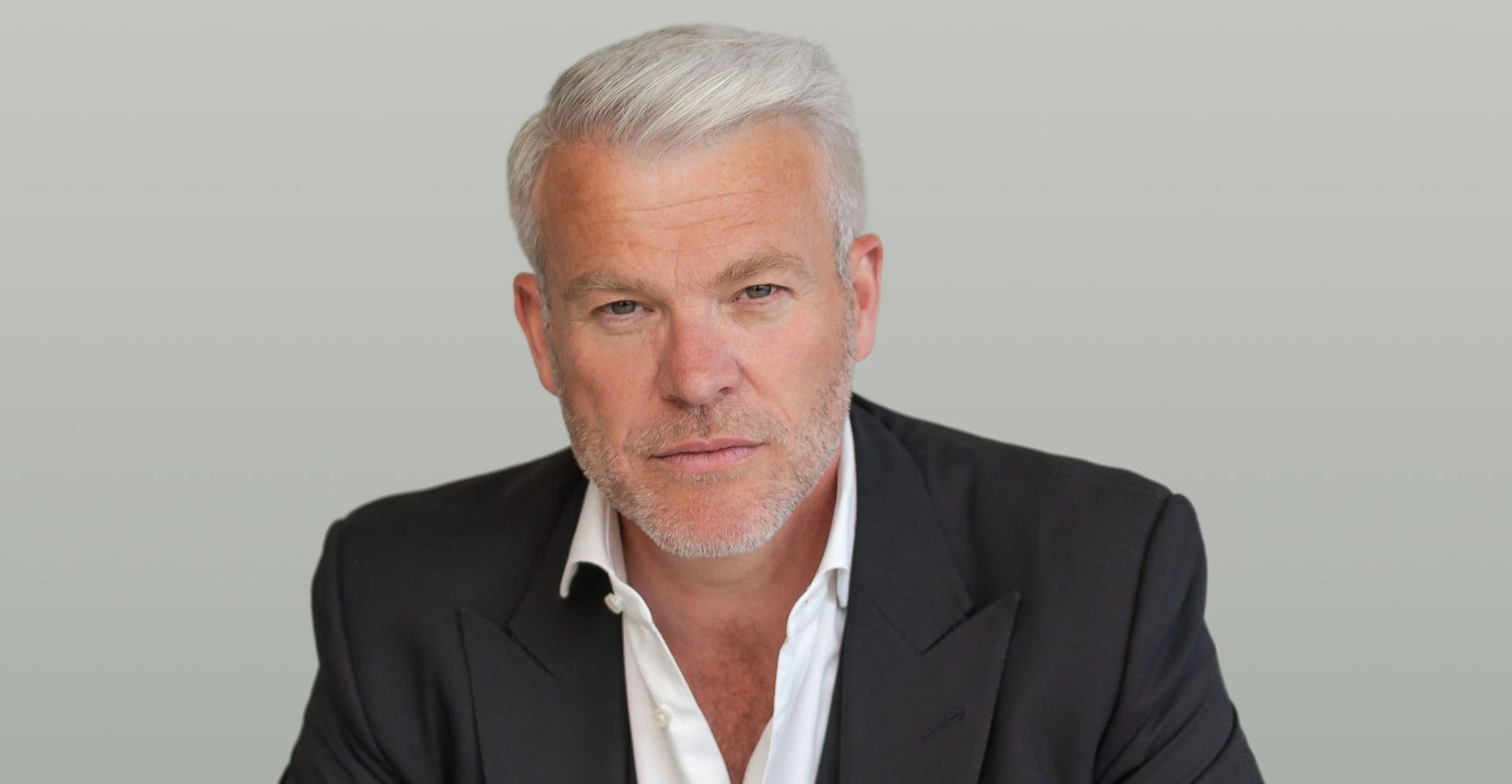

David Mercer, CEO, LMAX Group

In this video, Blockworks’ “Forward Guidance” podcast host Jack Farley sat down with David Mercer, CEO, LMAX Group, at Blockworks Digital Asset Summit in London to talk about the “three Ts and two Cs” stopping institutions from moving headlong into digital assets.

Mercer is the CEO of LMAX Group, a global, high-growth financial technology company based in London. A former City banking executive and currency specialist, he joined LMAX Group in 2011 and after a successful management buyout, rapidly built LMAX Group into the leading operator of institutional FX and cryptocurrency exchanges with offices in 11 countries and a global client base.

An outspoken industry commentator, David is a long-term champion of the UK’s fintech sector and passionate about supporting entrepreneurship in the UK.

Watch the full interview below.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.