Sam Altman’s World launches Mini Apps 1.2, lets devs build-to-earn

Tools for Humanity’s Developer Reward pilot program kicks off on April 1

OpenAI CEO Sam Altman | Saül Gordillo/"altmansam_051623gn13_w" (CC license)

Tools for Humanity, the for-profit firm behind Sam Altman’s crypto-powered World Network, has updated its “Mini Apps” with Mini Apps 1.2. The company is also launching a $300,000 Developer Rewards pilot program, Tools for Humanity exclusively shared with Blockworks.

Mini Apps version 1.2 makes mini apps load faster within the World mobile app, adds haptic feedback, enables customization, and allows you to pin your favorite mini apps to your phone’s home screen without needing to open the Worldcoin Wallet app, according to the company. Mini apps will also be accessible through the search bar on iOS. The app is currently available in 30 countries, including the US.

World now supports more than 150 mini apps, according to data provided to Blockworks. The vast majority of those are from third-party developers.

Tools for Humanity’s Developer Reward pilot program starts April 1, letting devs earn from a pool of $300,000 worth of Worldcoin or WLD to develop and update a mini app.

WLD price over time, from Blockworks Research

WLD price over time, from Blockworks Research

Devs can earn up to $25,000 a week in Worldcoin if they’re building a top-performing app, Tools for Humanity Chief Product Officer Tiago Sada told Blockworks.

Rewards will be distributed based on the number of World ID-verified users engaging with each mini app.

“Games have been popular,” Sada said of what’s been trending within the World ecosystem. AI apps/assistants, finance apps, lending apps, airdrop apps, payment apps that let you pay with WLD, and eSIM apps have also been gaining traction. They can be used with stablecoins or WLD, and transactions take place on World’s Ethereum L2, World Chain.

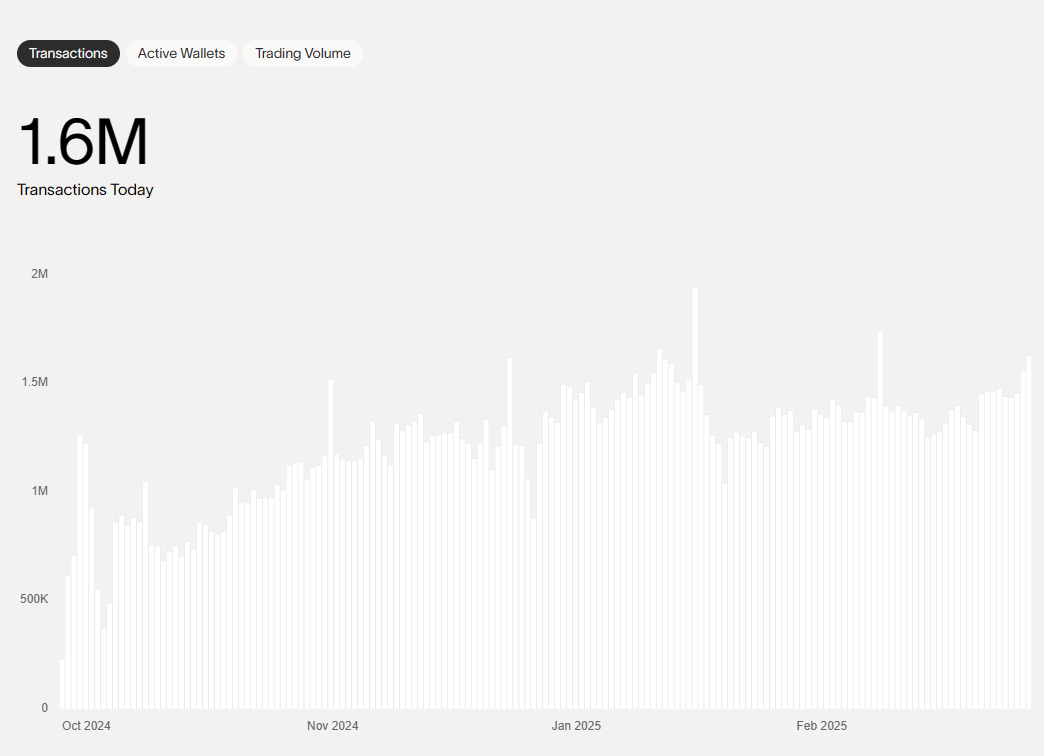

Transactions on World Chain, per World

Transactions on World Chain, per World

Sada said many of these mini apps are rewarding users as well, as opposed to extracting funds from them. User monetization will come eventually, but that’s not the focus right now.

Concepts like play-to-earn, tap-to-earn and move-to-earn have been challenging to balance over time, with token prices often crashing as earners cash out (like Pegaxy’s PGX, Notcoin, or Stepn’s GMT).

“It was really difficult to have a sustainable system,” Sada said, adding that now we’re seeing the emergence instead of apps “that are able to reward users for actions that are actually valuable for something, and developers can pay for that because it’s not going to be gamed.”

For now, the transactions side of things can be a bit tricky because of Apple and Google’s app store rules. Apple’s rules on mini apps, for example, state that in-app purchases are required for “digital goods or services to end users.”

“All the transactions that we support in mini apps go directly to developers. There’s some kinds of transactions — for example, buying an NFT — that would require in-app purchases. We do not currently support in-app purchases on mini apps,” Sada explained.

But he said transactions such as buying a plane ticket or an eSIM card with a credit card within a mini app wouldn’t incur the so-called “Apple tax” within the World app.

The main appeal of World right now over Telegram or X/Twitter is that it’s easier to tell who is — and isn’t — a bot. Telegram can also feel a bit overwhelming if you’re new to that world, and X is a sea of politics, memes, bots and chaos these days.

When I asked Sada for his thoughts on competitors like Telegram embracing bots across its app, he said: “I think chatbots and AI are awesome. You just want to know what is what.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.