Pantera’s Morehead: Bitcoin is Coming of Age, On Track to Hit $115,000 This Year

In his March 2020 investor letter, Pantera Capital’s Dan Morehead wrote: “Bitcoin was born in a financial crisis. It will come of age in this one.” Today, on a Pantera conference call, he said that bitcoin has come of age and […]

Dan Morehead, founder, CEO and Co-CIO of Pantera Capital

- Morehead says Fed money printing is driving crypto demand

- While the firm remains bullish on bitcoin, they recognize the potential of alternative digital assets and DeFi protocols

In his March 2020 investor letter, Pantera Capital’s Dan Morehead wrote: “Bitcoin was born in a financial crisis. It will come of age in this one.”

Today, on a Pantera conference call, he said that bitcoin has come of age and that there is plenty of steam left in its rally.

“We thought bitcoin and other cryptocurrencies would explode because of this money printing, and it’s definitely happened,” said Morehead, founder, CEO and Co-CIO of Pantera, on the call. “The other big thing that’s happened in the last 12 months is corporate treasuries are now very engaged in cryptocurrencies, particularly bitcoin.”

Today’s rally differs from 2017 in many ways; increased institutional interest, operational decentralized finance protocols and a more positive investor sentiment, to name a few, but Morehead stressed that the current financial landscape is pushing investors into store of value assets.

“The US is now printing more money each month than it did in the first 200 years of its existence, the chairman of the Federal Reserve said, literally, unlimited money printing was on the table,” said Morehead. “When you have a limited quantity of paper money chasing things, which are fixed quantities, like gold, real estate, the S&P 500 or bitcoin, the price of those things goes up dramatically. The price of cryptocurrencies is skyrocketing.”

Source: Pantera Capital

Source: Pantera Capital

At the start of the Covid-19 pandemic in March 2020, money supply increased significantly, which also coincided with the start of bitcoin’s current rally, Morehead said.

Following bitcoin’s surge to an all-time high of more than $61,000 last week, the largest digital currency retreated. Skeptics are bracing for a crash, but Morehead saw the value early on. He said the coin is right on track to hit $115,000 by August 2021, based on Pantera’s halving stock-to-flow prediction.

“In 2011, I got interested in bitcoin, it took a couple years to get my head around it, but I came to the conclusion that it was such a big disruption, such an asymmetric return, that we would pivot to finally be exclusively blockchain oriented,” said Morehead. “In 2013, we launched the first cryptocurrency fund in the US and the firm currently manages about $3.5 billion.”

Pantera’s Liquid Token Fund, a multi-currency hedge fund, is up 1,552% since March 2020. The Early Stage Token Fund, which focuses on developing blockchain protocols, and the Pantera Bitcoin Fund, a bitcoin-only investment vehicle, are up 2,014% and 754%, respectively.

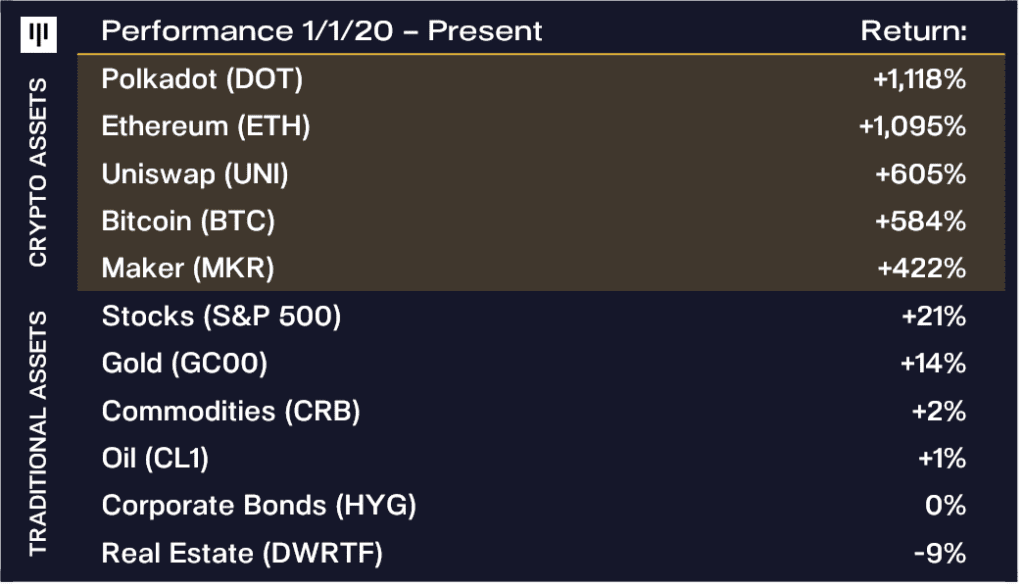

While the firm remains bullish on bitcoin, they recognize the potential of alternative digital assets and DeFi protocols. The DeFi space is rapidly growing, with some of the top platforms up 500% year-to-date.

“I think bitcoin is going to underperform on a relative basis,” said Joey Krug, Pantera Co-CIO. “All this stuff is going to go up, bitcoin is going to be a great investment, but I think ethereum and DeFi assets, and some of the other stuff in the space is gonna beat it on a relative return basis.”