Q&A: Kaiko Research Analyst on Ripple’s Legal Troubles and XRP’s Rally

Blockworks sat down with Riyad Carey, research analyst at crypto data firm Kaiko, to discuss the XRP case and what it means for the future of the industry

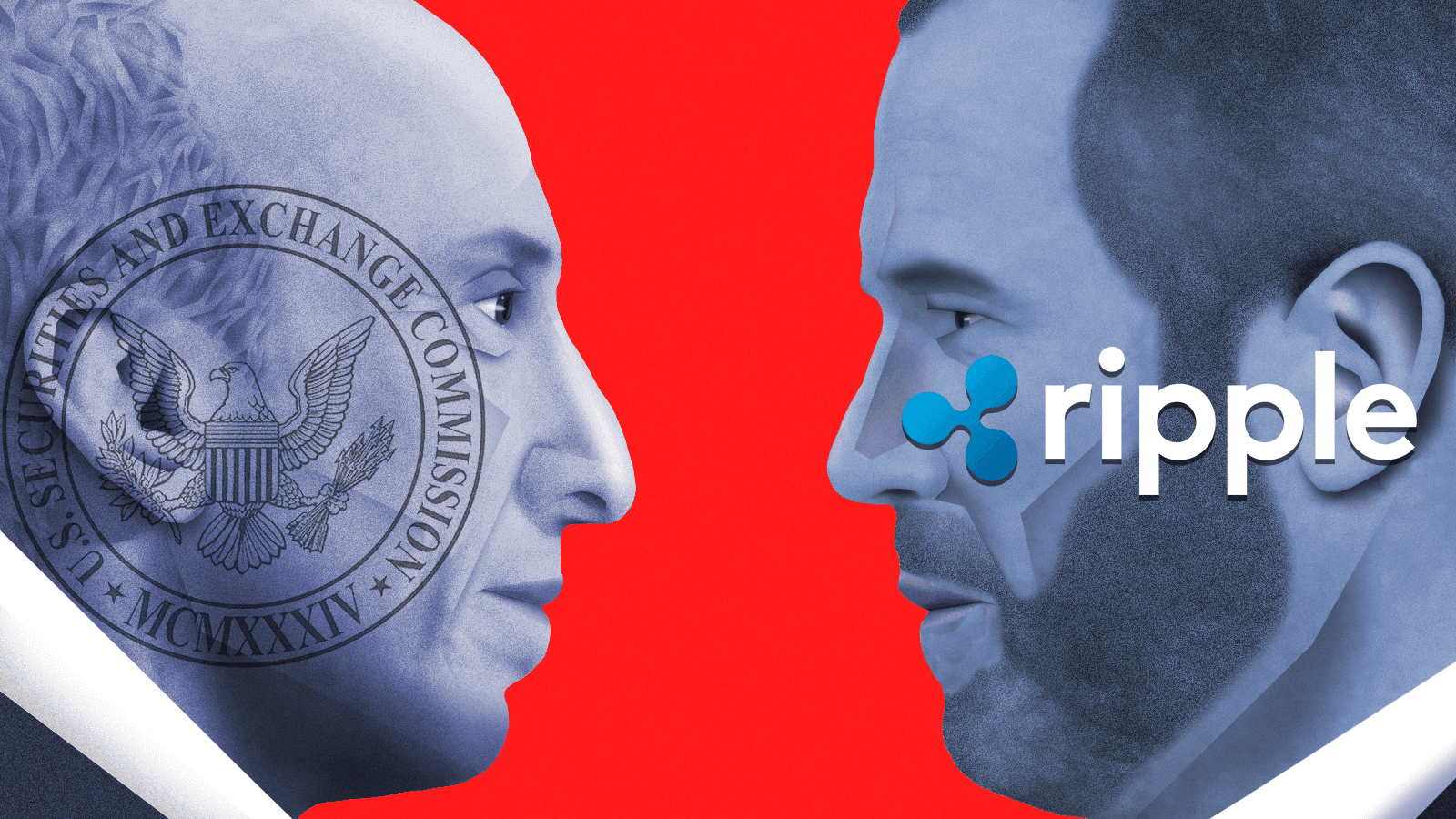

Blockworks exclusive art by axel rangel

- The SEC and Ripple Labs agreed to forgo a trial, opting for a summary judgment that could come before the end of the year

- XRP is up more than 8,000% since its issuance but down 75% from its April 2021 all-time high

Nearly two years after the SEC filed a lawsuit against Ripple Labs and two of its executives for allegedly issuing an unregistered security, the battle seems to be approaching its end. Last month, both the regulator and cryptocurrency issuer agreed to allow a judge to issue a summary judgment, therefore bypassing a trial and hopefully settling the matter before the end of the year.

Even amid the drama, XRP, the token in question, is still up more than 8,000% since its issuance. Its liquidity somewhat miraculously has remained strong as well.

Blockworks sat down with Riyad Carey, research analyst at crypto data firm Kaiko, to discuss what the case means for the future of the industry and how to think about XRP’s recent price action.

Blockworks: What does the current court battle with XRP mean for the broader industry?

Carey: XRP was one of the earliest tokens to do an issuance, so I think this court case is pretty significant. It sort of speaks to the SEC and the stance it wants to take toward crypto. It’s a lot of years in the making, so I think the industry as a whole is probably watching it pretty carefully. But I wouldn’t panic or celebrate necessarily based on the outcome of this one court case.

Blockworks: If XRP is deemed a security, what could that mean for the rest of the industry? What should other issuers be thinking about right now?

Carey: I think XRP itself has sort of been treated as a de facto security since this court case started. It’s been delisted from the US exchanges, so it suffered the consequences already.

USD volumes are down, but that’s been supplemented by foreign volumes; Korean volumes, Mexican volumes, it has achieved some other adoption. I think token issuers would be wise to watch XRP and to think about what could be done differently. They should think about what were the main points that the SEC was looking at, to target XRP versus other issuers? The SEC only has a certain amount of bandwidth, so why did they choose to go for Ripple as opposed to other issuers? I think that’s important to consider.

Blockworks: What role do exchanges play in terms of deciding which tokens to list? How are their teams thinking about token classification?

Carey: I can’t speak to each exchange’s process, but I would say, generally speaking, they’re more mindful of what they’re listing now.

I used to work as a policy analyst, I would track the global regulatory developments, and it seemed like for about six months last year, every country around the world was warning the largest exchanges to not offer 100 times margin anymore. And so exchanges removed it, even the global exchanges that have historically not been super bound by regulations are being a little bit more mindful about their listings and the products that they offer.

But, in terms of XRP, I haven’t seen anything to indicate that the outcome of this trial would change anything significantly on a global scale.

Blockworks: What impact does regulation by enforcement have on the industry?

Carey: I think it kind of logically has a chilling effect in the US, but because it’s a global, decentralized technology, less activity in the US doesn’t mean that there’s less activity in general, it just means it moves elsewhere. But the thing is, people do want to innovate in the US, that’s just a fact of the world. It just puts projects in a tough situation where they don’t know what the rules are.

Blockworks: What have we seen with XRP in terms of price action? What does this signal?

Carey: Generally speaking, it’s moved with the broader market, but then the big catalysts have all been court related. Days where we have seen court filing and actions have all been the highest volume days of the year, so it does drive a significant factor in its price action.

XRP has seen legit, organic growth in the Mexican market, which at a time was the majority of its volume, which is super unusual. The Mexican exchange is Bitso, and XRP has been the majority of volume on the exchange consistently since March of this year. This is unusual as nearly every exchange we cover has BTC as the plurality of its volume.

People actually use XRP for cross-border payments, remittances and these types of transactions.

I was pretty surprised to see that the liquidity is still really good on the world’s biggest exchanges. There hasn’t been any noticeable disadvantage relative to its industry benchmark.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.