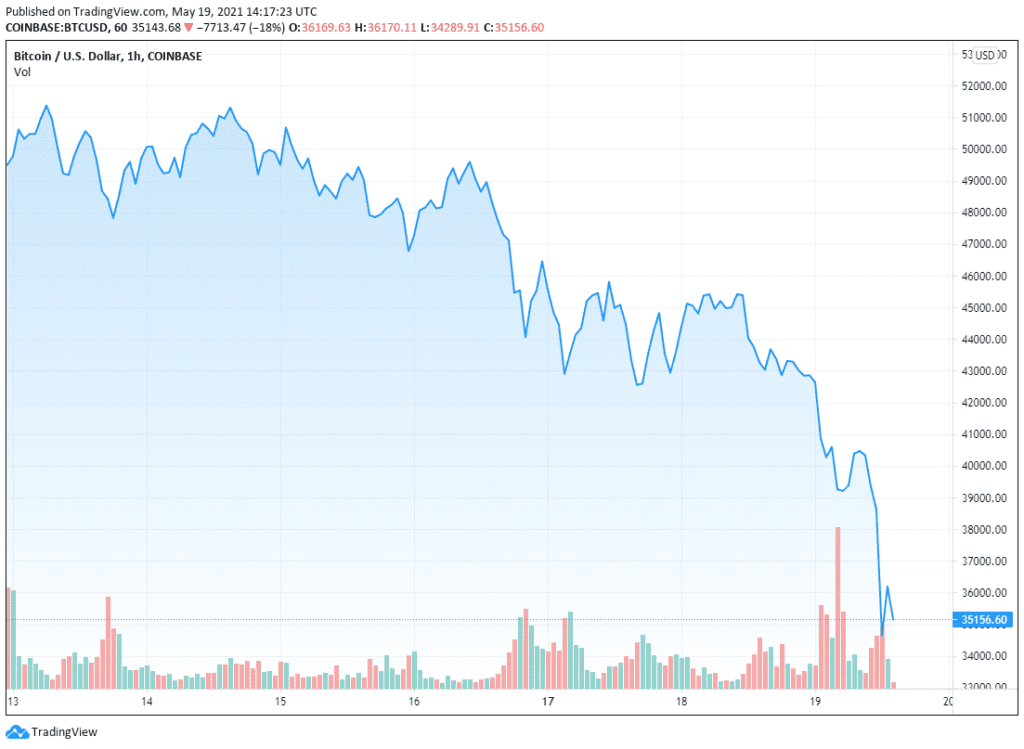

US Trading Opens with 25% BTC Tumble

Bitcoin price bottoms out at just over $34,500 after a volatile Asian session

Source: Shutterstock

- A massive retail driven sell-off pushed some of the largest centralized exchanges offline

- Institutions have become skeptical about bitcoin as its counterfactual ‘dirty’ image might be incompatible with ESG mandates

The price of Bitcoin took a tumble as US traders began their session Wednesday morning down by nearly 25%, eviscerating gains made during the bull market that defined the first quarter of the year.

Frenzied retail traders managed to knock some of the largest centralized exchanges offline, as nearly $8 billion of leveraged positions were liquidated in the past 24 hours. On derivatives exchange FTX, some orders on the book began touching the sub-$30,000 point as traders expected further price decay.

Currently BTC-MOVE contracts for May 19, a measure of the raw number of bitcoin’s movement, have hit almost $8000, up by 300%, a sign that traders expect high price movement and volatility throughout the trading day.

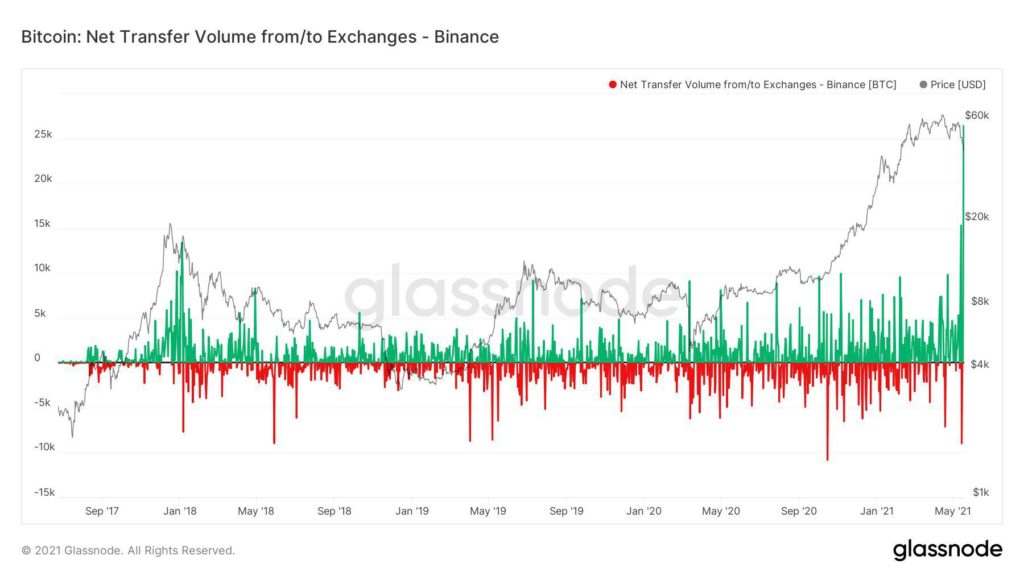

Data points to this being a retail-driven move at exchanges like Binance reported record traffic and inflows as retail investors make their moves.

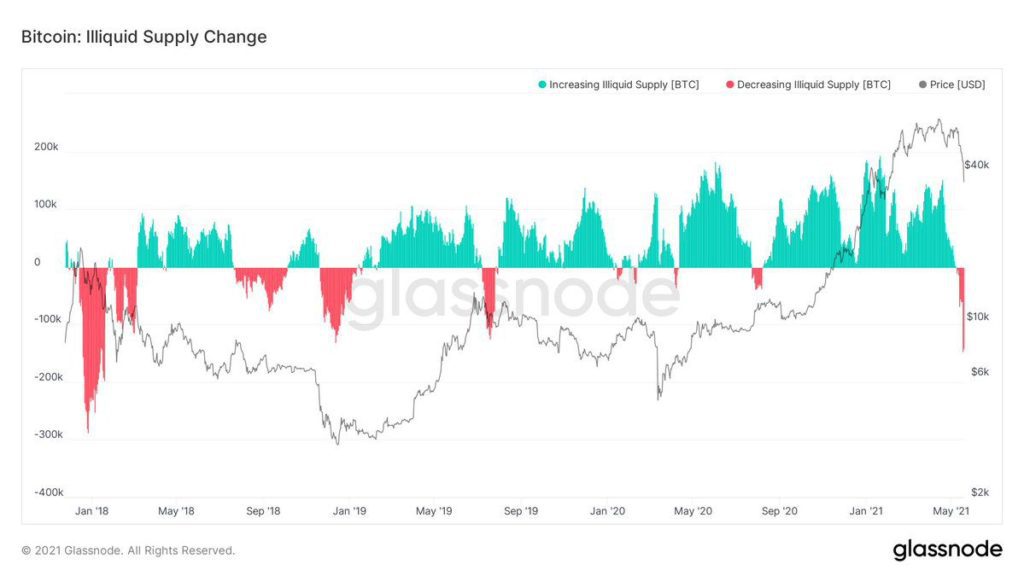

All the while illiquid supply of bitcoin, a measure of how much is locked away and inaccessible, saw a record drawdown — the highest since January 2018 when the market dealt with the rubble of a significant price correction as the ICO bubble burst.

USDT, an onramp for many crypto traders, also fell to 84 cents as it was seemingly knocked off its peg.

While bitcoin and ether had spent much of the last month de-coupling in value, ether seemed to fall in parallel down 23% in the last 24 hours according to CoinGecko.

But, the world’s computer had seemingly recovered as in the last hour prices jumped by approximately 12% to $2500. Gas Prices, the fuel to move Ethereum tokens on the blockchain, also hit a record high of 550 Gwei ($28.51) to 700 Gwei ($36.29).