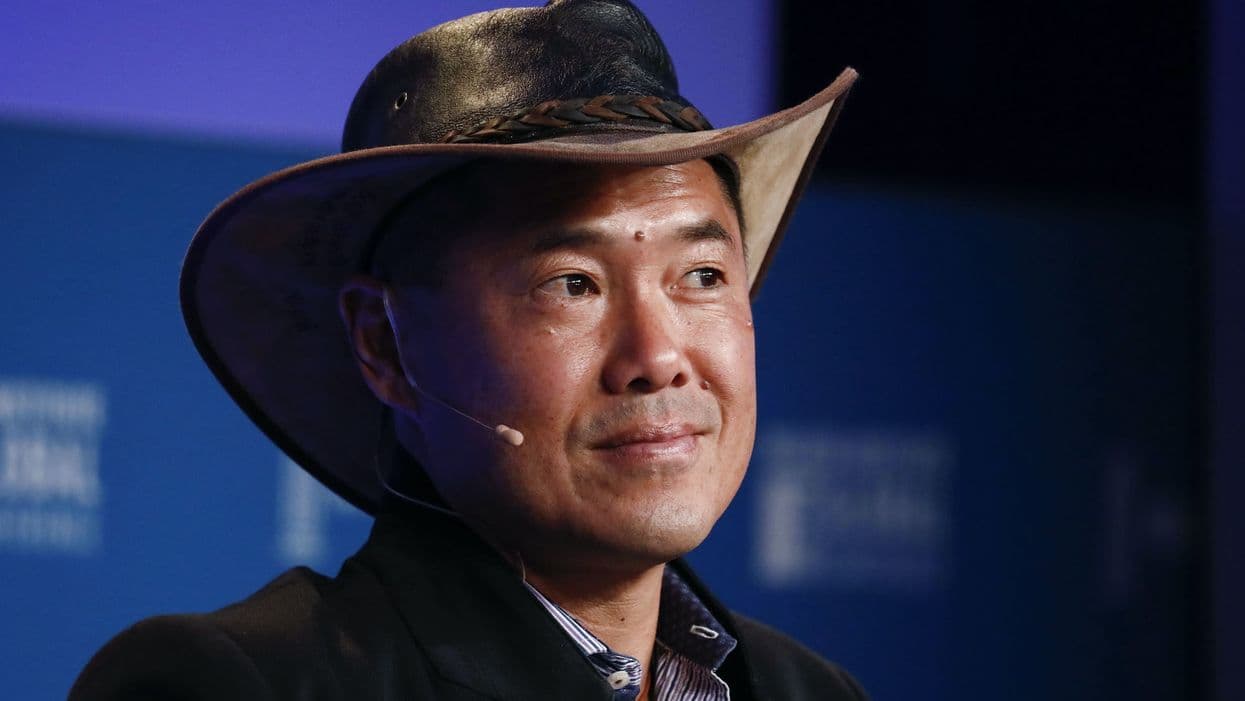

Angel Investor Bill Tai on NFTs, Nikola Tesla and Trusting Your Instincts

“The only time you can be really, truly successful is when you’re right and everyone else is wrong,” Bill Tai said about investing as a VC. “You have to trust your instincts.”

Angel Investor Bill Tai

- Tai was Zoom’s first VC backer

- Tai said more traditional investors may invest in crypto if there is a clear regulatory framework

NFT.NYC, New York City — Bill Tai has been a venture capitalist since 1991, having 23 of his startups become publicly-listed companies. He was an early investor in technology giants such as Zoom.us, Twitter/Tweetdeck and Canva. He is founder chairman of MaiTai Global, a kiteboarding community whose members have built tech companies with a combined market value of hundreds of billions of dollars, according to Forbes. Tai, a former general partner at Charles River Ventures, is a sponsored athlete in kiteboarding himself.

Additionally, he’s incredibly bullish on non-fungible tokens (NFTs). Tai began backing Dapper Labs in 2018, the group behind booming NFT collections such as CryptoKitties and NBATopshot.

After speaking at NFT.NYC on Wednesday, Tai chatted with Blockworks about investing in NFTs, being pitched by Nikola Tesla and “trusting your instincts.”

Chittum: You’ve been investing in NFTs for years now, specifically backing blue-chip projects like Dapper Labs. What investment advice would you give your younger self when you first started?

Tai: Just go hard, fast. I should have been even more aggressive on it at the time.

Chittum: As in, you should’ve been even more bullish when you began investing in NFTs?

Tai: Yes. You have to trust your instincts. I think if you know too much about the past, it doesn’t allow you to operate freely into the future. I had been a venture capitalist for over two decades, investing in hubs and the internet and web pages and all kinds of interesting things.

I just had this instinct about it, [about NFTs]. [I thought] this digital cat marketplace is going to go nuts so I wrote a check. The people that I would talk to about it thought I was nuts. They didn’t think I should write a big check, but I still did. However, the only time you can be really, truly successful is when you’re right and everyone else is wrong.

Chittum: As a VC, if you could be pitched to by one person dead or alive, who would it be?

Tai: Boy, that’s a hard one. I think it would be fascinating to hear and be pitched by both Thomas Edison and Nikola Tesla at the same time. They were both pioneering in the same field.

You know the story of Tesla. Some people think that he was really the pioneer. He just didn’t get the kind of institutional backing that Edison did to document his stuff. His concepts were there as early as Edison’s but no one really knew. People know who he is now because of the car company. But he was this incredibly genius inventor that couldn’t quite commercialize it where Edison went and created General Electric. I think it would be fascinating to hear Tesla talk about how he saw things and then try to figure out well, why didn’t he get traction?

Chittum: Let’s go back to the first time you heard the words non-fungible token. What did you think of the concept?

Tai: Well, probably the very first time I heard the term, it didn’t really mean that much to me, other than that it was an accounting layer. I had already been exposed to cryptocurrency blockchains. I had a general understanding of the ability to track on a distributed ledger.

Bitcoin, to me, was already a version of a non-fungible token. It just happened to be fungible within a collection of 21 million. The term NFT to me was just another accounting system, but it was kind of a master accounting system for everything.

Chittum: At that time, was there ever any underlying skepticism about NFTs for you?

Tai: Not at all. None. When I first started to understand blockchains, it was sort of the third step.

And what do I mean by that? Well, the first step was the ability to encapsulate and redirect the electrons in pieces of silicon from what used to be vacuum tubes. The second step was the ability to encapsulate information in the form of bits on the internet. And then this wave that we’re in, [the third wave] is the encapsulation of assets in a context aware cloud so I immediately saw it as an internet of assets.

Chittum: It’s widely known that there has been some reluctance from larger institutions to invest in crypto and potentially even more so in NFTs specifically. What do you think it would take to convince some of these more traditional investors to get more involved in the space?

Tai: I would say a clear regulatory framework and institutional scale of markets that provides enough liquidity where [investors will] feel safe about getting in and getting out if they feel like they’re wrong.

Chittum: Now that we are on our second day of the conference. What have been your biggest takeaways so far?

Tai: That the energy level that we all thought might happen to the cryptocurrency space in general, as it was ramping up into that failed crazy weird ICO wave, is back. And it’s real. And it’s distributed beyond just a bunch of techie people. It’s now becoming available in an emotional sense to mainstream people all over the world.

This interview has been edited for length and clarity.