Circle Hiring in Asia as USDC Demand Grows

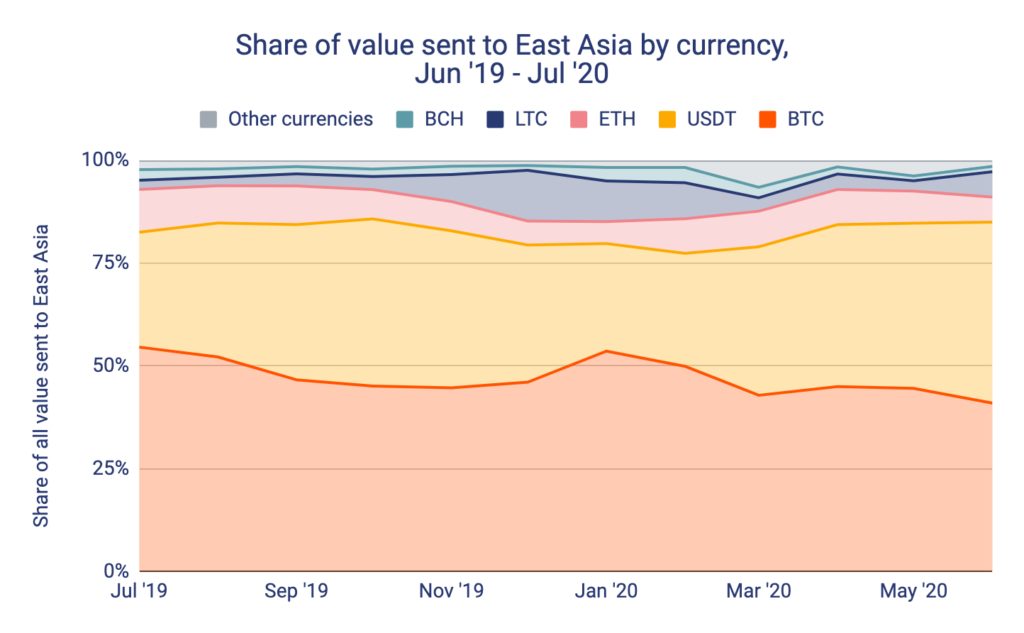

Stablecoin usage is especially high in East Asia, making up 33% of all value transacted on-chain, according to Chainalysis’ research from 2019-2020.

Circle CEO, Jeremy Allaire; Source: BusinessWire

- Circle is hiring multiple sales and analyst roles in Hong Kong, Singapore, Seoul and Tokyo

- Data shows that stablecoin use has exploded in Asia over the past three years, in parallel with the rise of digital assets as a whole

Circle is hiring in Asia as demand for stablecoins like USDC continues to grow. Multiple Circle job postings in Hong Kong, Singapore, Seoul and Tokyo indicate a need for sales and analyst positions in the region.

As digital assets have become an actively traded retail and institutional asset on the continent, stablecoins have risen. The People’s Bank of China’s decision to ban bitcoin exchanges in China in 2017 has accelerated the trend.

“There is a big demand for stablecoins in Asia as people still rely on stablecoins such as USDC and USDT to invest their funds into crypto,” MaiCapital’s Benedict Ho told Blockworks. “Banks in Hong Kong are not crypto friendly and likely to close your account with crypto flow.”

An effective on- and off-ramp

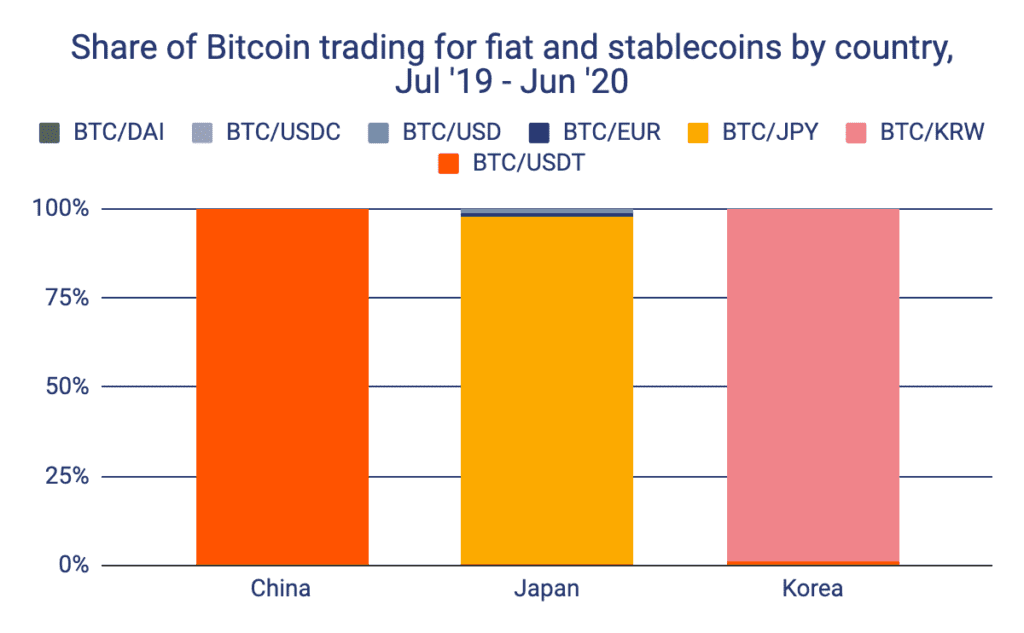

According to research done by Chainalysis, stablecoins, particularly Tether, have become an effective on and off ramp for Chinese users looking to swap their RMB for cryptocurrency. While Korea and Japan, both active hubs for crypto trading, have BTC-KRW and BTC-JPY currency pairs respectively, virtually all of China’s volume is denominated in USD-pegged Tether.

Source: Chainalysis

Source: Chainalysis

Chainalysis research also shows that USDT has been building a use case for remittances in China, as capital controls prove to be problematic for internationally-minded vendors doing cross-border commerce.

“Stablecoin usage is especially high in East Asia, making up 33% of all value transacted on-chain,” Chainalysis wrote at the time. “Tether is by far the most popular stablecoin in East Asia, making up 93% of all stablecoin value transferred by addresses in the region.”

Source: Chainalysis

Source: Chainalysis

Stablecoin as a tool of remittances isn’t just used by traders in China. Indonesia is home to a number of stablecoin projects creating digital versions of the Rupiah, the country’s local currency. Thailand’s monetary authorities are said to be working on a framework to allow for stablecoins to be licensed under the nation’s money transmitter laws.

Potential chilly Korean reception

Although the data shows that the market in East Asia has unbridled enthusiasm for stablecoins, South Korea, one of the continent’s hottest hubs for crypto, might be giving it a chilly reception.

Oleg Smagin, Global Business Manager at Delio, a Korean cryptofinance platform, said that although there is a certain level of demand for stablecoins in Korea, exchanges will shy away from listing them because of a perception that authorities will push back.

“This environment makes companies think twice before experimenting with stablecoins, especially because the government here has never been positive about this idea,” he told Blockworks.

Regardless of perceptions of stablecoins’ legal status in the country, Smagin says that many retail traders don’t feel the need for them. The Korean won is a fairly stable currency, and domestic money transfer fees are non existent while exchange withdrawal fees are cheap.

“You would rather withdraw cash from Upbit and put it again into Bithumb then transfer it directly from one platform to another,” he said.

But with a market cap for stablecoins closing in at $80 billion, and all the data showing demand for stablecoins is strong in Asia, Circle certainly has the time and resources to work on converting outlier markets and bringing them into the fold.