CoinShares Survey: Ethereum Most Compelling For Growth

Many investors prefer the scale and decentralization of Ethereum compared to competing layer-1s, the firm’s investment strategist says.

James Butterfill, Investment Strategist, CoinShares

key takeaways

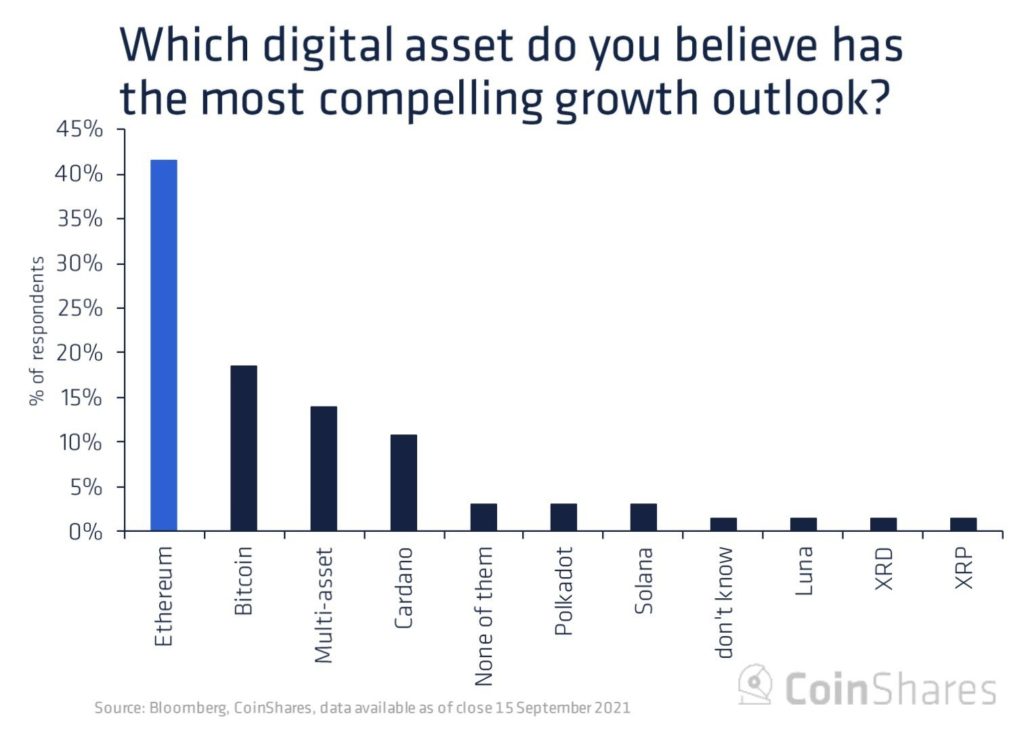

- 42% of respondants said they are most bullish about Ethereum, compared to 18% for bitcoin, investments into the two crypto assets are nearly equal, the report finds

- About 35% of investors see their investments into digital assets as mainly a speculative one, while 25% see it as a diversification tool

More fund managers see greater potential in Ethereum than bitcoin, according to a CoinShares report of survey data published Tuesday, despite the total value locked in Ethereum decreasing this year amid more competition in the layer-1 space.

Forty-two percent of investors see Ethereum as having the most compelling growth outlook, compared to bitcoin at 18%, the survey found. The findings come as market share of Ethereum investment products has risen from 11% at the beginning of the year to 26%.

“The conversations we were having two years ago were bitcoin and crypto is a joke,” CoinShares Investment Strategist James Butterfill — who authored the report — told Blockworks.

”A year ago it was, OK, bitcoin’s a really interesting concept, tell me more. And this year the trend I’m seeing amongst investors is, I want to look at the altcoin space, I want to diversify, I want to see what else is out there.”

The first report of its kind by CoinShares — with data as of September 15 — reflected the views of fund managers representing more than $400 billion in assets under management. Buterfill plans to publish a survey with the same questions every two months.

Despite survey respondents’ bullish feelings about ether, roughly the same percentage of fund managers reported investing in bitcoin. While the two largest cryptocurrencies by market capitalization remain at the core of digital asset investment portfolios, allocations to Cardano and Polkadot are increasing.

Jan van Eck, CEO of fund manager VanEck, said during a virtual panel last week that the big development for crypto in 2021 was ether’s performance and the Ethereum network’s upgrade from proof-of-work to proof-of-stake.

“People understand that a lot of the blockchain applications are built on top of this smart contract software” he explained.

Competition in the layer-1 space has heated up in recent months amid a growing demand for lower transaction fees and greater throughput than what the proof-of-work Ethereum network currently provides.

Ethereum’s TVL dominance has dropped from 98.22% on Jan. 1 to 68.78%, as of Monday, according to defillama.com.

Buterfill said he was surprised that less than 5% of respondents labeled Solana (SOL) as having the most compelling growth outlook, but expects to see that number grow in future surveys. The coin has the seventh-largest market capitalization at about $48 billion, according to CoinGecko, and its price was up about 19% over the past seven days, as of 3:30 p.m. ET.

“Though not technically as quick as something like Solana, they like Ethereum because it’s much bigger and more decentralized essentially,” the CoinShares strategist said about some investors.

Brian Brooks, former CEO of Binance.US, noted in the same panel as Van Eck that while layer-1 competitors will battle Ethereum to be the smart contract platform king, bitcoin will remain as a coin crypto investors allocate to.

“Bitcoin is really the tracking stock of decentralization overall,” Brooks explained. “It is the relatively price-stable energy-based replacement for gold, and that’s always going to be there for a bunch of reasons.”

Who is embracing digital assets and why?

Respondents who have digital assets in their portfolio were mixed on whether they thought inflation was permanent or transitory, suggesting that some do not invest in crypto as a hedge against inflation, the report indicates.

About 35% of investors see their investments into digital assets as mainly a speculative one, while 25% see it as a diversification tool, it found.

“What it implies is that people are buying without looking at any fundamentals, and I don’t think that’s necessarily the case,” Buterfill said. “Maybe it reflects that investors still don’t fully understand the asset class, but they know there’s a lot of hype around it, and they want to be a part of that. It is a complex asset class to understand.”

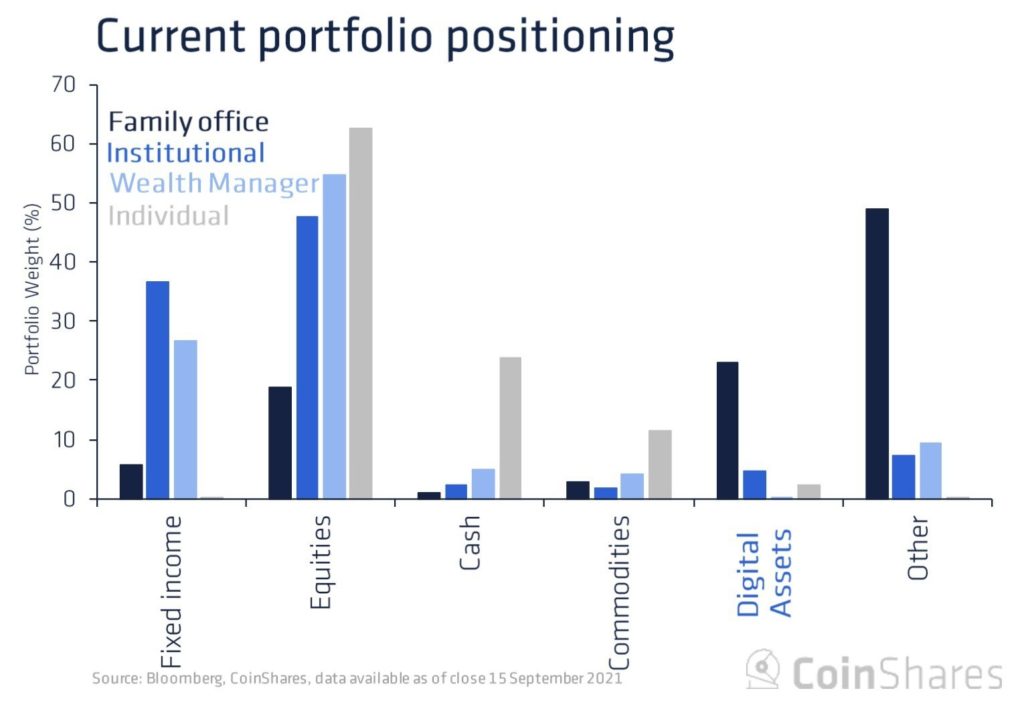

The report revealed stark contrasts in allocations to digital assets from different types of investors.

While family offices have the highest allocation to crypto at 23%, retail and institutional investors remain hesitant, with surveyed wealth managers allocating just 0.1% to digital assets.

Of the survey respondents who said they had not invested in crypto, 21% said regulation was the main reason, while 19% cited corporate restrictions.

Politics, government bans and regulation make up 58% of the perceived key risks for digital assets. Nearly 15% reported volatility as a key risk.

“I think it’s right for investors to be concerned,” Buterfill said. “It’s a known unknown. You can’t stick the regulators’ mindset into a spreadsheet and figure out what’s going to happen, so it’s just a case of sitting and waiting and seeing.”

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.