HNT Remains Hot; DOT Holders Pledge Over $1 Billion: Markets Wrap

HNT continues its hot streak as new hotspots continue to come online, over $1 billion has been pledged by DOT holders for parachain auctions.

- HNT continues its hot streak as new hotspots continue to come online.

- Polkadot sees impressive demand for parachain auctions from DOT token holders.

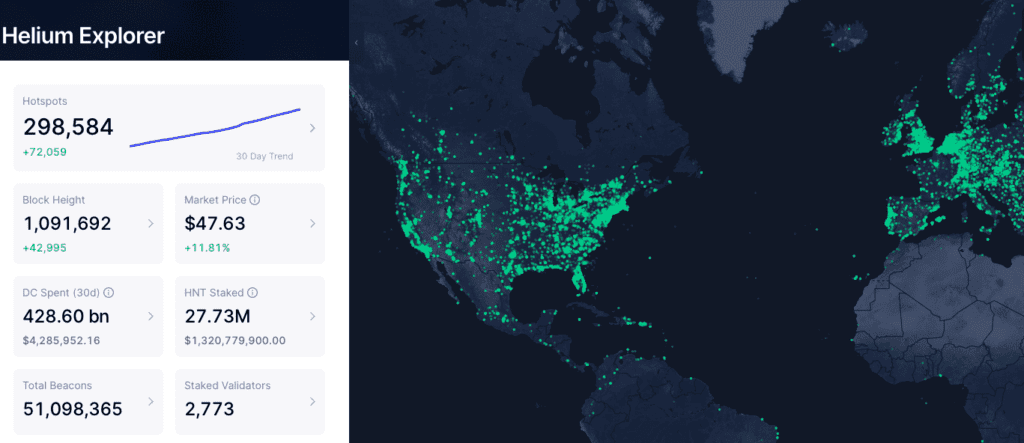

The Helium Network (HNT) has experienced massive growth over the last 30 days, leading to token appreciation.

Helium partnered with Dish Network to expand the number of hotspots.

The Helium Network uses various token incentives to bootstrap adoption.

DOT token holders pledged $1 billion towards crowdloans to gain exposure to Polkadot’s incoming parachains.

Coinbase reported disappointing earnings.

ETH flipped BTC on Coinbase in terms of volume traded and transaction revenue. Institutional activity is also picking up steam.

Latest in Macro:

- S&P 500: 4,685, -.35%

- NASDAQ: 15,886, -.60%

- Gold: $1,833, +.44%

- WTI Crude Oil: $84.55, +3.20%

- 10-Year Treasury: 1.439%, -.058%

Latest in Crypto:

- BTC: $67,600, +7.12%

- ETH: $4,806, +4.11%

- ETH/BTC: .0707, -.50%

- BTC.D: 43.89%, -1.17%

The Helium Network Overview

The Helium network (HNT) is a decentralized wireless network that enables devices anywhere in the world to wirelessly connect to the Internet and geolocate themselves without the need for power-hungry satellite location hardware or expensive cellular plans, according to the project’s whitepaper.

The HNT price has been on a tear over the past month, up 135%, and is currently trading near $47 per token. HNT has rallied since plans to partner with the well-known Dish Network, were announced on October 26.

The whitepaper said, “DISH becomes the first major carrier in the telco industry to join us in our mission by extending the Helium Network with customers deploying their own Helium 5G CBRS-based Hotspots.”

Helium is attempting to challenge current telecom incumbents who essentially hold a monopoly by incentivizing individuals to set up networking equipment in their homes. Helium is using token incentives to bootstrap a robust network of hotspots, which is quickly approaching 300,000.

Source: https://explorer.helium.com

Source: https://explorer.helium.comHNT token structure

The Helium Network, coined ‘The People’s Network’, utilizes two mediums of exchange to incentivize the development of a robust network: HNT and Data Credits.

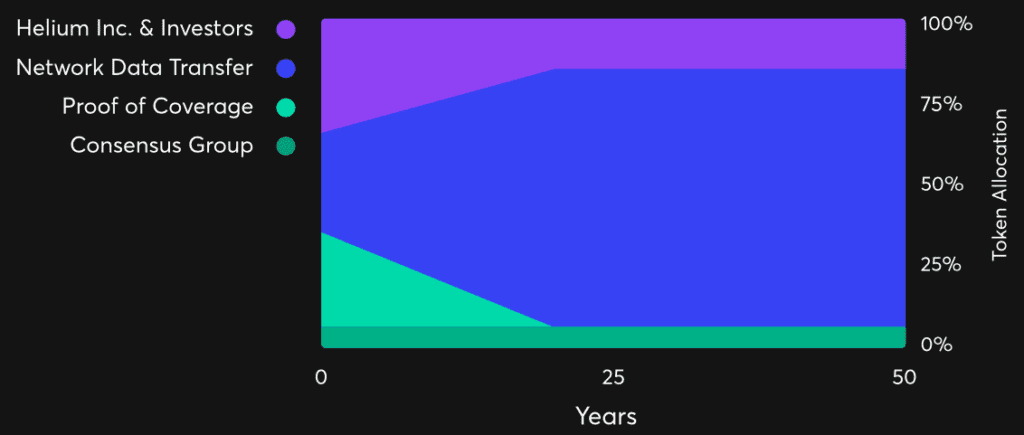

HNT is earned when hotspots provide and validate wireless coverage and transfer device data over the network. The HNT distribution over time can be best understood by the following photo:

Source: https://www.helium.com/hnt

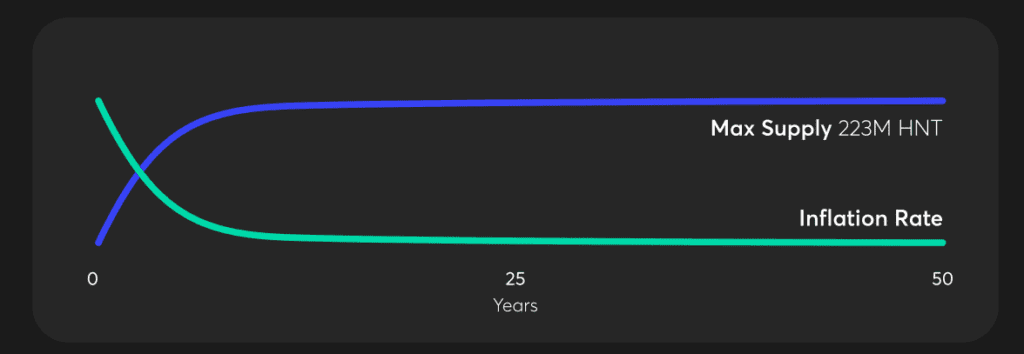

Source: https://www.helium.com/hntThe inflation rate of the HNT token is vast in the early years in order to attract enough people to set up hotspots. However, over time the inflation rate will trend toward zero once all 223 million HNT are in circulation. All HNT was mined from genesis, meaning no pre-mine, starting at a rate of 5M HNT/month and then halving every two years.

Once all of the HNT rewards do not sufficiently reward hotspot providers, net emissions will come into play whereby a pool of burned HNT will be recycled to subsidize nodes.

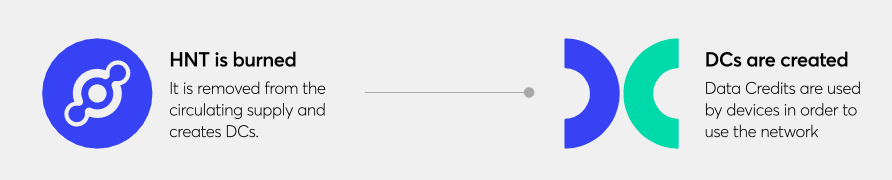

Data credits are used by devices to send data on the network and for blockchain transaction fees. They are created by burning HNT, are non-exchangeable, and tied to a single user. Data credits are the only payment accepted to send data over the helium network.

Whether the network design will be successful in building out a strong network of hotspots remains to be seen, but as of now, Helium appears to be on the right track.

DOT holders pledge $1 Billion

Polkadot (DOT), created in part by Ethereum co-founder and creator of the Solidity smart contract language Gavin Wood, is a blockchain designed to support various interconnected, application-specific sub-chains called parallelized chains, or parachains for short.

Blockworks previously reported on the highly anticipated parachain auctions launch on Polkadot, which further explains the details of the Polkadot funding structure.

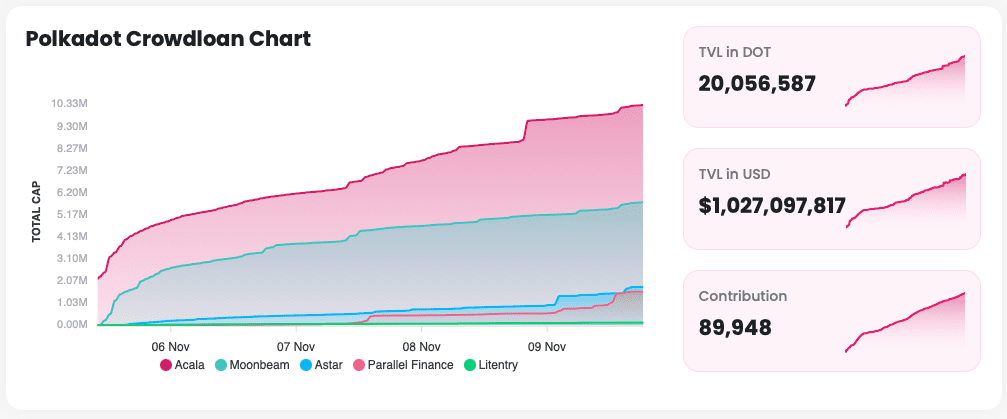

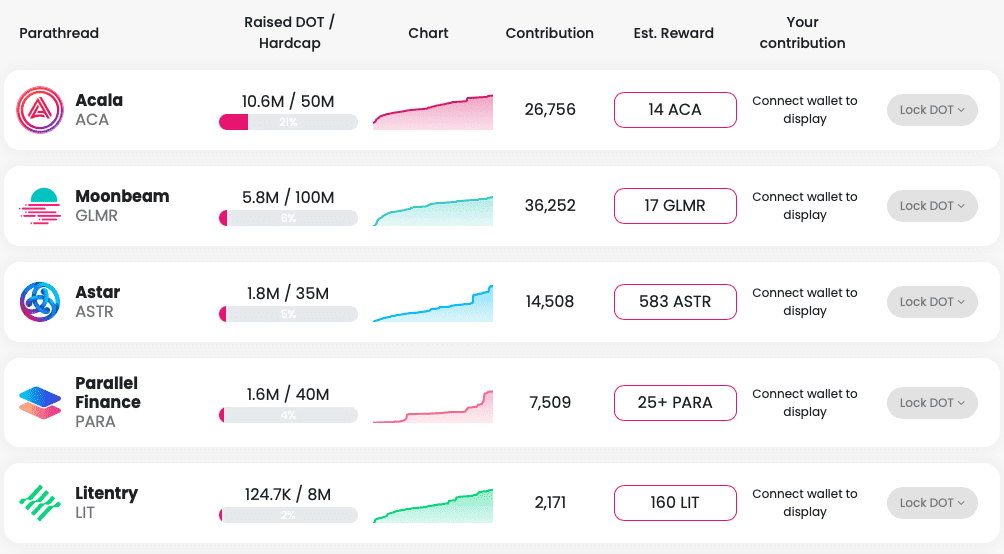

Nearly 90,000 DOT holders have pledged a total of $1.027 billion to participate in the crowdloans.

Source: https://dotmarketcap.com/auction/polkadot

Source: https://dotmarketcap.com/auction/polkadot

The three projects that have the most capital pledged are Acala, Moonbeam and Astar. An interesting tidbit regarding all of the top-funded projects is that they are all Ethereum Virtual Machine (EVM) compatible.

Source: https://dotmarketcap.com/auction/polkadot

Source: https://dotmarketcap.com/auction/polkadot

DOT was last trading near $51, up roughly 48% over the last 30 day period.

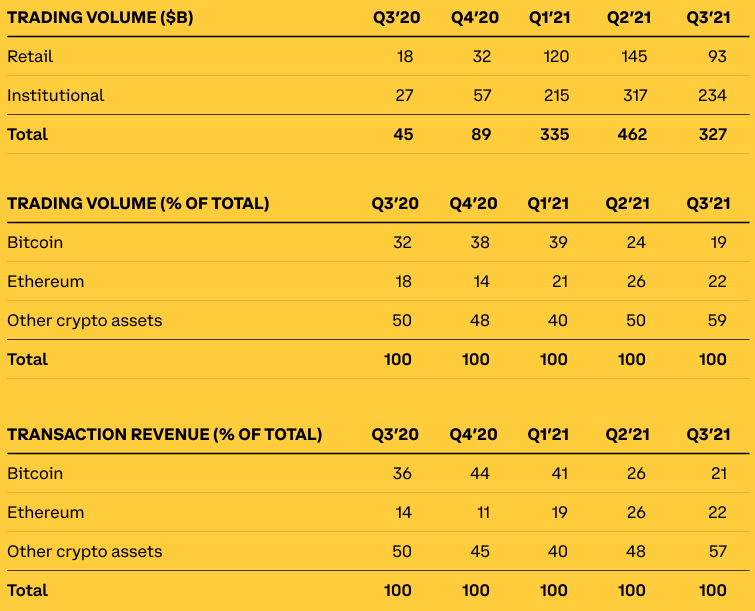

ETH flips BTC in Coinbase earnings report

Coinbase reported Q3 earnings after the close today, falling short of analysts’ expectations. They logged $1.31 billion of revenue versus the $1.56 billion expected, and an earnings per share of $1.62, versus the expected $1.79. The stock price tanked after hours, falling as low as 15% to $304 per share.

Interestingly enough, Ethereum beat out Bitcoin in terms of trading volume and transaction revenue. It is also somewhat surprising to see that other digital assets far outpace the volume of both Ethereum and Bitcoin.

In addition, institutional activity is starting to outpace Coinbase’s retail activity. Retail volume accounted for 40% of total trading volume in Q3 2020, but only made up 28.4% during Q3 of 2021.

Source: Coinbase Earnings Report

Source: Coinbase Earnings ReportNon-Fungible Tokens (NFTs)

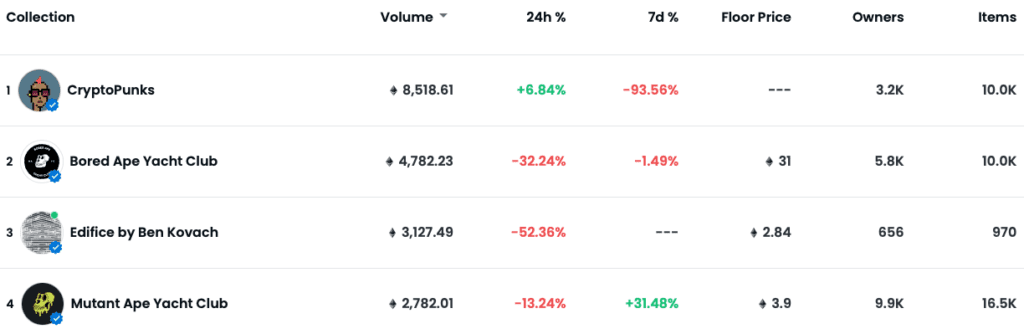

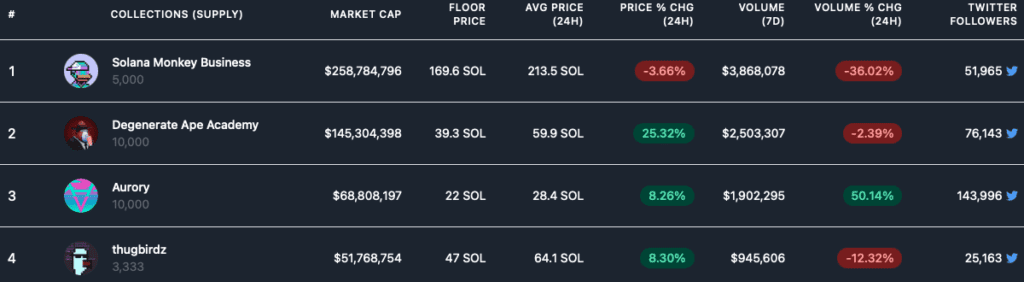

Trading data from OpenSea and Solanalysis of some of the top Solana and Ethereum projects can be found in the photos below:

Top Ethereum Projects

Top Ethereum Projects Top Solana Projects

Top Solana Projects If you made it this far, thanks for reading! I am looking forward to catching up tomorrow.

Get the day’s top crypto news and insights delivered to your inbox every evening. Subscribe to Blockworks’ free newsletter now.