Layer-2 Solution Immutable Closes $60M Series B Round

Immutable promises zero gas fees to improve NFT market, speed up transactions, and address carbon impact.

Blockworks exclusive art by Axel Rangel

key takeaways

- The Ethereum network continues to be strained under pressure from the growing NFT market and the established DeFi industry

- Immutable aims to expand its global engineering and sales team, and strengthen key partnerships with gaming companies

As transaction fees for NFTs grow to new heights because of the strained Ethereum network, layer-2 solution Immutable announced today that it had closed a $60 million Series B round led by some of the biggest names in crypto infrastructure investment.

According to a release from the company, the Series B round was co-led by BITKRAFT Ventures and King River Capital, with participation from Prosus Ventures, Galaxy Interactive, Fabric Ventures, Alameda Research, AirTree Ventures, Reinventure, Apex Capital, and VaynerFund. Immutable says this round will be primarily used to expand its global engineering and sales team, and strengthen key partnerships with gaming companies.

This brings Immutable’s total funds raised to $77.5 million. The company closed its Series A round in late 2019, raising $15 million in a round led by Naspers and Galaxy Digital.

“NFT trading is a terrible mainstream user experience right now. It’s expensive, illiquid, and the only existing scaling solutions compromise on the most important thing — the security and user-base of Ethereum. We want businesses to create their game, marketplace, or NFT application within hours via APIs, with a mainstream user experience. No blockchain programming required,” said Robbie Ferguson, co-founder at Immutable, in the release.

Layer-2 solutions are a way to take some of the pressure off of the Ethereum blockchain by moving execution outside the main Ethereum chain while keeping transaction data on-chain. This allows applications to keep the security-by-consensus of the Ethereum chain but significantly, if not eliminate, transaction fees.

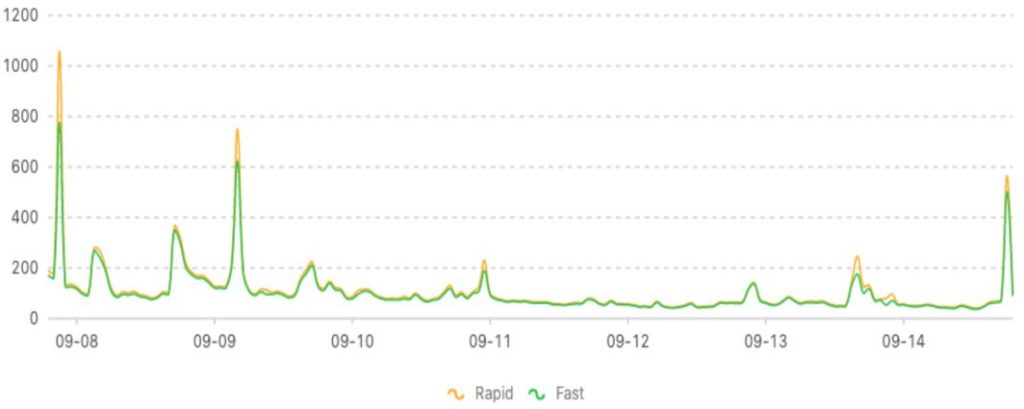

According to PumpMyGas.xyz, a tracker of gas fees for Ethereum NFTs, the gas cost for sellers on many of the largest NFT markets is now over $100 on top of gas costs for buyers which can range from $13 to $70. This creates a liquidity challenge for the industry, and prevents a low-cost NFT market from emerging.

On the Ethereum network itself, the average transaction fee reached an all-time high of $70 earlier this year as NFT mania hit full-swing, according to bitInfocharts, and is now at around $22, down from $60 earlier this month.

According to Etherscan, NFT marketplace OpenSea was the top “Gas Guzzler”, using $2.4 million in fees during the last 24 hours.

The price of Ethereum is currently at $3,360, down 1% in the last 24 hours.

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets?Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.