84% of GPs and LPs are ‘optimistic’ about crypto markets: Survey

A Barnes & Thornburg survey shows that the regulatory clarity for crypto is leading to an uptick in interest from investment professionals

drserg/Shutterstock and Adobe modified by Blockworks

This is a segment from the Empire newsletter. To read full editions, subscribe.

84% of general partners and limited partners are feeling pretty good about crypto, a survey from Barnes & Thornburg found.

It’s also one of three areas highlighted by general and limited partners as being a part of the market that thrives in volatility.

In a similar vein, a whopping 85% of respondents said that they’re looking to invest in crypto this year, many of whom — 61% — noted that it’s thanks to the regulatory clarity. Woo-hoo!

But both the market growth and the innovative investment products offered are big draws for them as well.

Compared to this time last year, are you more or less likely to invest in cryptocurrency funds?

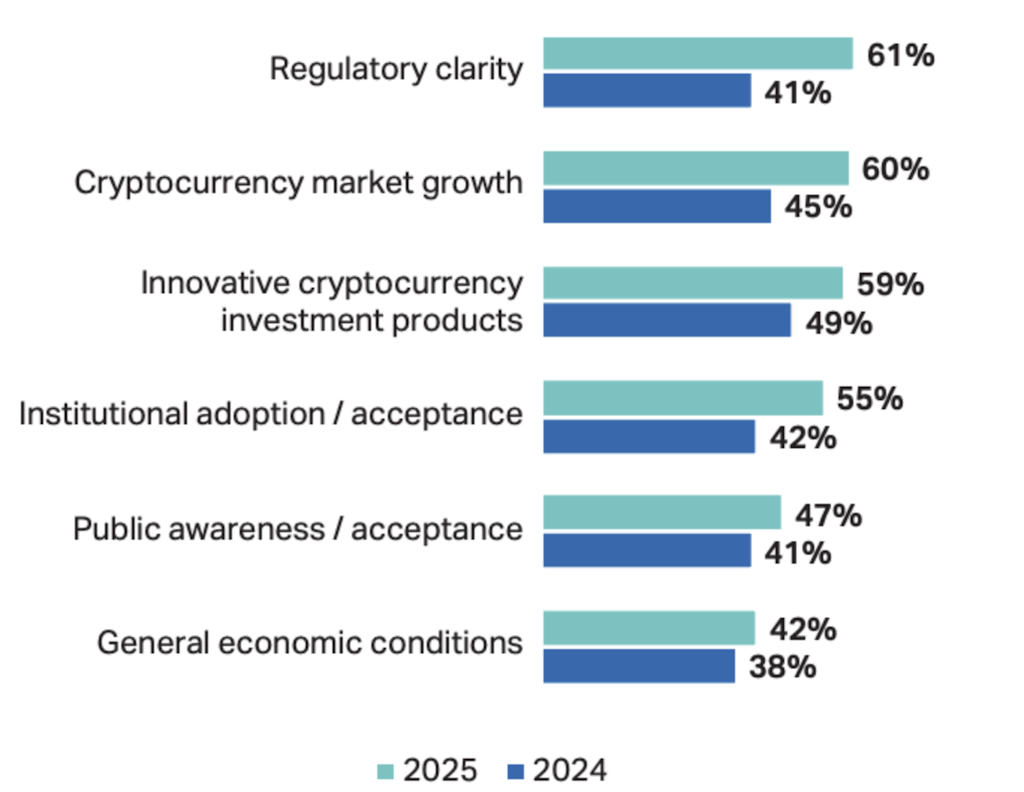

Here’s a chart comparing 2024’s responses to 2025’s, just in case you need to see the year-over-year change for yourself. I know we’ve become slightly desensitized to the growth that this industry’s experienced in the last year, but these numbers are pretty wild.

[Asked to those who are more likely to invest in crypto funds] What level of importance do you place on the following when deciding whether to invest in a cryptocurrency fund?

This gives you a better idea of what’s driving investments. Outside the top three motivators, institutional adoption is relatively high, which is understandable, given that general economic conditions are not as significant a driver.

Unfortunately, there’s not a clear reason given as to why investment professionals don’t see economic conditions as a big factor driving interest here. However, across the larger landscape, “nearly 75% of respondents say that the current economic outlook presents an investment opportunity.”

I’m going to put on my guessing hat here and say that I think this is probably tied to the fact that crypto has not proven that it’s a safe haven play in times of market uncertainty. If you need a solid example, take a look at the leg down bitcoin took in February after we started receiving the tariff headlines.

Mind you, that’s not to say that bitcoin hasn’t shown its resilience, especially since, according to Coinbase, it’s up 81% at the time I’m writing this newsletter.

If we zoom out, Barnes & Thornburg noted that the survey finds “ample room for optimism” across a number of sectors — from crypto to hedge funds. All of this is based on survey data collected in April and March from investment professionals, including GPs and LPs.

All in all, I think the data shows a pretty decent appetite for crypto, especially since a lot of the momentum for the industry is tied to regulatory clarity and the overall crypto market growth. Those are both big positives for the space.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.