3AC Co-founders Used Fund’s Assets for $50M Yacht, Bungalows

Kyle Davies wanted it to be “larger than any yacht owned even by Singapore’s richest billionaires.”

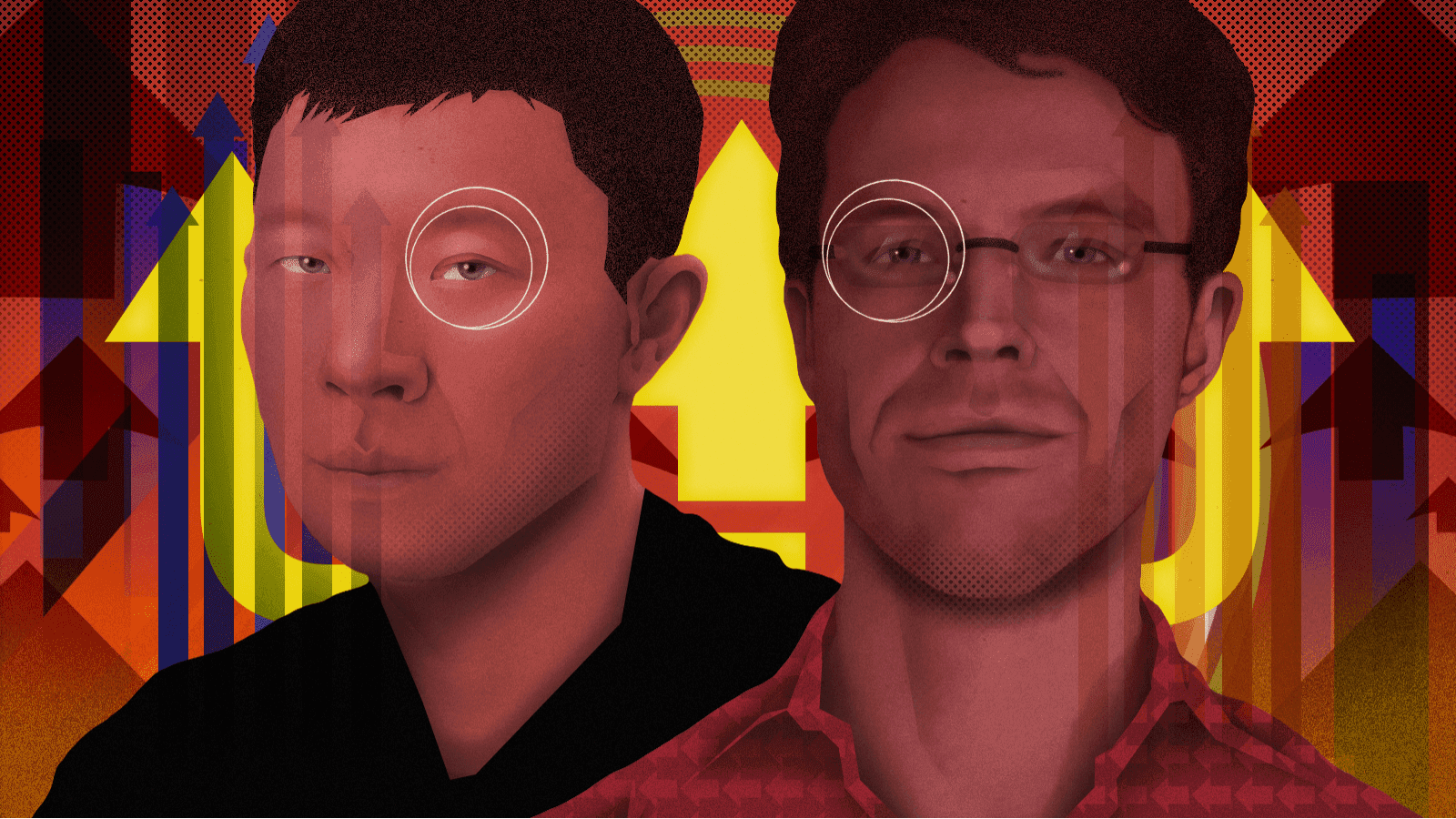

Three Arrows Capital founders Su Zhu and Kyle Davies | Blockworks exclusive art by axel rangel

- 3AC traded cryptocurrencies instead of responding to margin calls from lenders, according to a court document

- Digital Currency Group, parent company of Genesis, is the fund’s top creditor with a $1.2 billion claim

A 1,157-page affidavit drafted by liquidator Russell Crumpler and published by Three Arrows Capital’s (3AC) restructuring firm Teneo reveals several details about the embattled crypto hedge fund.

Co-founders Su Zhu and Kyle Davies made a down payment on a yacht worth $50 million, the document shows. The yacht was meant to be delivered in Italy sometime within the next two months, when the remaining payment would be due, according to one affidavit put forth by Blockchain.com, which reportedly lent $270 million to the crypto hedge fund.

Davies is said to have intended it to be “larger than any yacht owned even by Singapore’s richest billionaires.”

The co-founders are believed to have made the payment using borrowed funds while ignoring creditors’ attempts to contact them. The filing also shows Zhu and his wife purchased two Singapore “good class” bungalows — or prestigious housing — for between $28.5 million and $48.8 million in the last two years. These assets were provided as evidence that the co-founders may have been using company assets for personal purchases.

“The founders of the clearly insolvent company should not be allowed to deal with what may be assets of the company,” liquidators wrote.

Liquidators also say 3AC continued to trade cryptocurrencies instead of responding to margin calls from lenders. Separately, the fund is believed to have transferred $31 million in stablecoin USDC and $900,000 in USDT on 14 June to Cayman Islands-based company Tai Ping Shan Limited, which is owned by Zhu and Kyle Davies’ partner Kelly Kaili Chen.

Both Kaili Chen and Zhu are among more than 20 creditors that lent money to 3AC.

Liquidators ask for access to 3AC’s Singapore office as creditors list millions in claims

The filing shows 3AC owes $3.5 billion to about 27 crypto firms. Its biggest creditor is crypto brokerage Genesis, which loaned the fund $2.3 billion. Once 3AC failed to meet a margin call in June, Genesis sold collateral and hedged its downside, CEO Michael Moro said in a Twitter thread earlier this month.

Digital Currency Group, the parent company of Genesis, has filed a claim of $1.2 billion, nearly double Voyager Digital’s $674 million claim. Crypto exchange Deribit has an $80 million claim under the name DRB Panama, Kaili Chen’s claim amounts to $65.7 million and Celsius’ total claims come to about $40 million. Zhu himself has a $5 million claim.

Crumpler has asked for access to 3AC’s office, hoping liquidators will have some way to obtain cold wallets or information on the trading accounts of the company in order to freeze assets. “To prevent these from being removed, destroyed, damaged or modified (by Su Zhu, Kyle Davies or any other person with access), it is imperative that the Liquidators be granted immediate access.”

A filing from July 8 said Christopher Farmer, a senior managing director at Teneo, visited the Singapore office but found it empty with unopened mail pushed against the door. The office had occupants as recently as May or early June 2022, according to Farmer’s account, citing people working nearby. Meanwhile, according to the liquidators, Zhu and Davies haven’t been cooperating or answering questions posed to them.

Zhu disputed this on Twitter. In his first public communication in almost a month, he said on July 12, “Sadly, our good faith to cooperate with the Liquidators was met with baiting.”

3AC didn’t return Blockworks’ request for comment by press time.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.