Analyst James Wang: Ethereum is AWS in 2015

The report notes Decentralized Exchange volume increased by a factor of 76 times to $177 billion, while total value locked hit $52 billion, up from $800 million during Q1 2020.

Blockworks Exclusive Art by Axel Rangel

- Ethereum ‘posted earnings’ Monday that showed Ethereum is set to have an annualized run rate of $8.6 billion this year.

- If the protocol were a Software as a Service platform, all metrics would be impressive to investors

As more and more institutional investors start to eye the value capture Ethereum provides through its eponymous Ether token, James Wang, former ARK Investment analyst, has put together a mock quarterly earnings report that shows Ethereum is well on its way to being a giant.

According to his chart, ETH is comparable to where Amazon Web Services was in 2015.

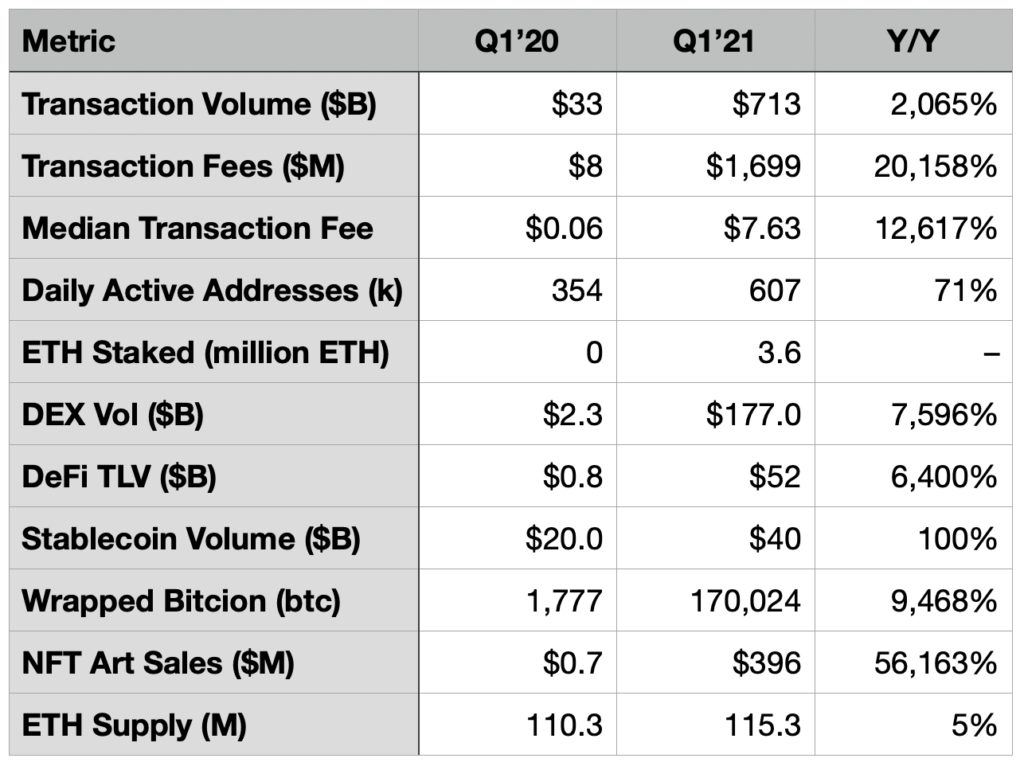

During the first quarter of 2021, Ethereum generated $1.7 billion in transaction fees, or revenue, up 200 times compared to the same time last year. This is largely due to the explosive growth of decentralized finance (DeFi).

The report notes Decentralized Exchange volume increased by a factor of 76 times to $177 billion, while total value locked hit $52 billion, up from $800 million during Q1 2020.

Source: James Wang

Source: James Wang

DeFi’s success ricocheted through other earnings metrics: daily active addresses increased 70% to 607,000 and transaction volume hit $713 billion compared to $33 billion from the same period last year.

However, this hasn’t come without significant growing pains — the median transaction fee increased by over 100 times to $7.63 in Q1 2021, compared with $0.06 in Q1 2020.

Ecosystem growth explodes

Wang’s report also notes that the ecosystem around Ethereum is growing just as quickly.

Metamask, a popular wallet used to trade many ERC-20 tokens and is commonly used by DeFi traders, hit 5 million monthly active users in April. All the while authorities in Ontario, Canada, which have so far been quite friendly to digital assets ETFs, approved four ether-based ETFs.

Looking forward to the rest of 2021, Ethereum is scheduled to introduce EIP-1559 to help the network meet its twin goals of “economic security and scalability.”

As Blockworks has previously reported, EIP-1559, a green-lit proposal by the Ethereum community, set to go live this summer with the ‘London’ hard fork on July 14, will replace the auction system with something akin to rent control on gas fees.

In addition, Ethereum is also set to switch from a proof-of-work algorithm — which favors miners as the nodes — to a proof-of-stake network where nodes are based on how much ether is held.

Thinking differently

The market has begun to view ether and bitcoin differently as the value of the two are no longer intertwined as recent data has demonstrated. This point is central to the reasoning behind the mock earnings statement. “The purpose of this release is to encourage analysts and press to cover Ethereum as they would a high growth software company rather than a speculative cryptocurrency,” said Wang.

Ether is up 10% over the last 14 days, according to CoinGecko, while Bitcoin is down 25% during the same period.