Inside the Anti-crypto Memo Keeping Lawmakers on Message

The leaked document suggests giving the SEC total oversight of the crypto industry

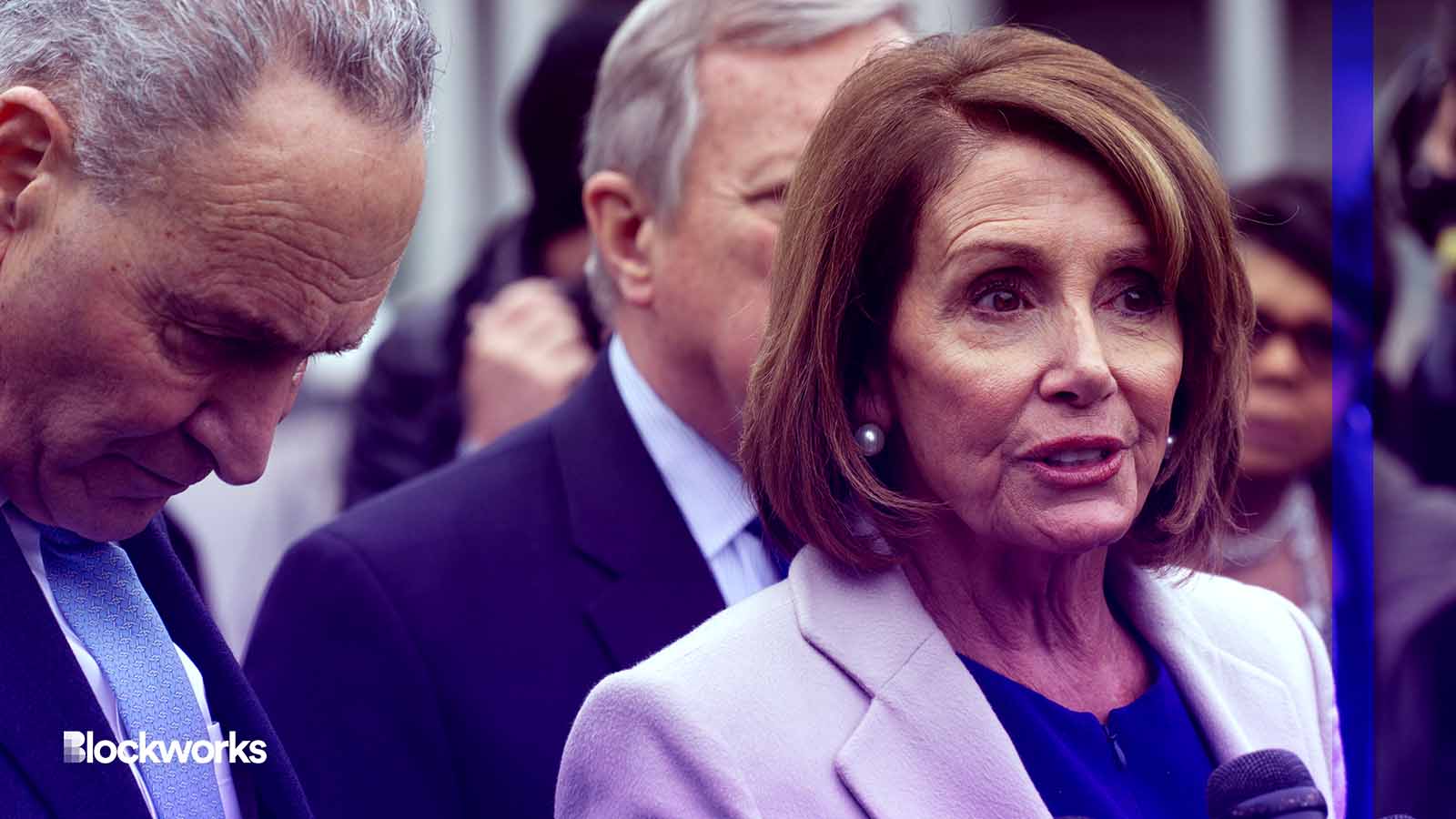

Michael Candelori/Shutterstock modified by Blockworks

The crypto industry is up in arms over leaked documents circulated by the Democratic party ahead of Wednesday’s joint House hearing on crypto policy.

The memo, sent to Democrat House Financial Services Committee members, encourages party members to support the notion of having the SEC be the primary regulator of the crypto industry.

It’s a suggestion crypto industry members find troubling, as SEC Chair Gary Gensler continues to take an aggressive stance on crypto token classification. Gensler has said he believes “most” cryptocurrencies are securities, although he faced additional criticism when he was unable to confirm ether’s status during an April Hill testimony.

The memo also encourages Democrats to dispel Republican’s claims that additional regulatory clarity is needed for the crypto space.

“The problem isn’t ambiguity – it’s mass non-compliance with existing laws,” the memo reads, referring to the common industry sentiment that crypto companies do not currently have enough guidance on how to safely operate.

“The US has a regulatory system that has worked well and sustained massive innovation in the financial system for decades,” the memo continues. “We can’t invent new accommodating regulatory structures simply because crypto companies refuse to follow the rules of the road.”

The language in the document furthers the narrative that Hill Republicans and Democrats are at odds when it comes to oversight over digital assets, Cody Carbone, vice president of policy at the Chamber of Digital Commerce, told Blockworks.

“The partisanship related to digital policies being elevated by Ranking Member Maxine Waters’ and her staff as it is extremely concerning,” Carbone said. “Moreover, it’s not reflective of the viewpoints shared with us by other Democratic members of the Committee and Congress as a whole.”

Rep. Waters during an April hearing on stablecoins slammed Republicans for not addressing Democratic concerns in their proposed stablecoin legislation.

The draft “in no way recommends the final work on stablecoins by negotiations between the two of us,” Waters said, adding that Democrats will have to “start from scratch.” In the four weeks since the stablecoin hearing, neither Waters nor her Democratic colleagues have released a draft or timeline for a potential bill.

On Wednesday, though, Waters took an apparently softer approach, noting in her prepared testimony that issues surrounding crypto “should be bipartisan concerns.”

“These should be bipartisan concerns, and legislation to address them should have a path to the President’s desk,” Waters said. “I hope this Congress, we can quickly return to developing legislation together.”

The leaked documents, released on Twitter, also slam Republican lawmakers for focusing on passing crypto legislation when their top priority, Democrats say, should be on preventing a US debt default.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.