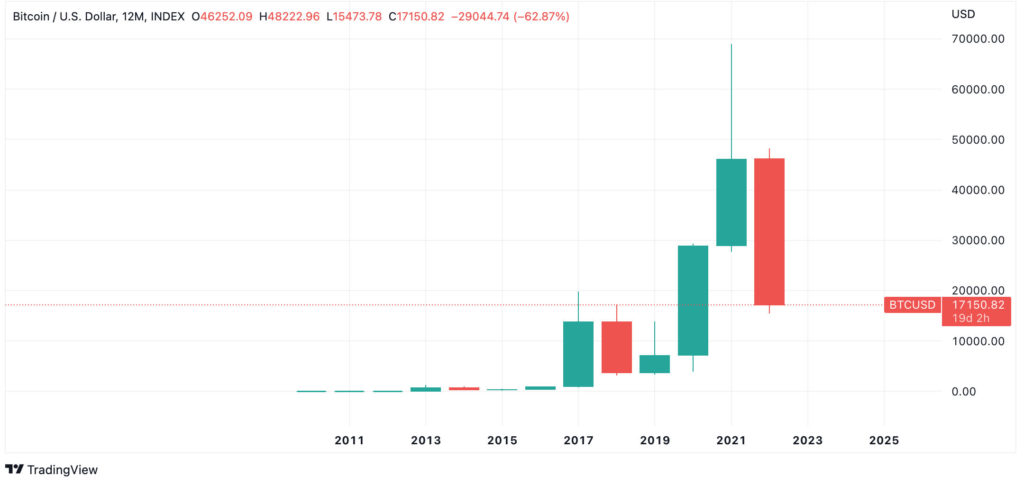

Bitcoin Price Set for First Yearly ‘Bearish Engulfing Candle’

What are the prospects for a “Santa Claus rally”?

Nixx Photography/Shutterstock.com modified by Blockworks

Bitcoin may not be moving much in terms of price lately, but it could be a lot worse, analysts say ahead of the end of the year.

The largest digital is also poised for its first-ever bearish engulfing pattern for the year, which occurs when a small up — or green — candlestick precedes a larger down — or red — candlestick that ‘engulfs’ the first. Candlestick price charts display the high and low prices of the token or security for a given period.

But, given bitcoin’s immaturity as an asset, it is difficult to pull trends from a yearly chart, traders caution. What is relevant, however, is another first — the fact that on a weekly scale, bitcoin has been solidly below its previous cycle highs.

The 2017 market peak in bitcoin on a weekly time frame was about $19,800 and it took about a year to find its eventual cycle low around $3,100 — an 83% drawdown. This time around, bitcoin’s fall from $65,000 to $16,000 represents a 75% decline in a similar period, and it’s now working on its fifth full week below the 2017 cycle top.

Bitcoin needs to hit around $29,000 before the end of 2022 to avoid the bearish engulfing candle on the yearly, a 70% jump.

Bitcoin needs to hit around $29,000 before the end of 2022 to avoid the bearish engulfing candle on the yearly, a 70% jump.

Breaking back above resistance at $17,400 may be an uphill battle this week, with the upcoming Consumer Price Index report expected Tuesday and the Federal Reserve’s rate decision due Wednesday. The expected 50 basis point interest rate increase, coupled with rising recession fears, paints a gloomy picture for cryptocurrencies and other risk assets in the short term.

“The world’s most fluid trading vehicle, bitcoin, has gained status in 2022 as a leading indicator and declined in a risk-off environment,” Mike McGlone, senior macro strategist at Bloomberg Intelligence, said in a recent note. “But the crypto may be transitioning toward a high-beta version of gold and US Treasury bonds.”

Bitcoin’s 260-day volatility is currently about four times greater than gold’s, a significant decline relative to 2018 when bitcoin’s volatility was about ten times greater than gold’s.

Plus, the risk-off sentiment that already exists in markets has not had as significant an impact on bitcoin as it could have, Hany Rashwan, CEO of 21.co, said during a Monday interview.

“It’s a pretty strong risk-off environment right now, not just in crypto, but across every industry,” Rashwan said. “We’ve been comforted, internally, by the plateauing of the bitcoin price, within a specific band.”

There could be light at the end of the tunnel, some data suggests, but bitcoin still needs to rally more than 40% in less than three weeks to avoid a bearish engulfing pattern.

“Bitcoin saw inflows [last week] totaling $17 million, sentiment has been steadily improving since mid-November with inflows since then now totaling $108 million, representing 2.1% of total assets under Management,” CoinShares analysts wrote in the most recent fund flows report.

“This supportive sentiment is in-line with deteriorating sentiment for the US dollar, highlighting their high inverse relationship. Also, short-bitcoin saw outflows for the second consecutive week totalling $3.9 million.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.