CFTC Preparing to Oversee Crypto, Behnam Tells Senators

At the same time, SEC Chair Gary Gensler doubled down on his stance that crypto tokens are securities

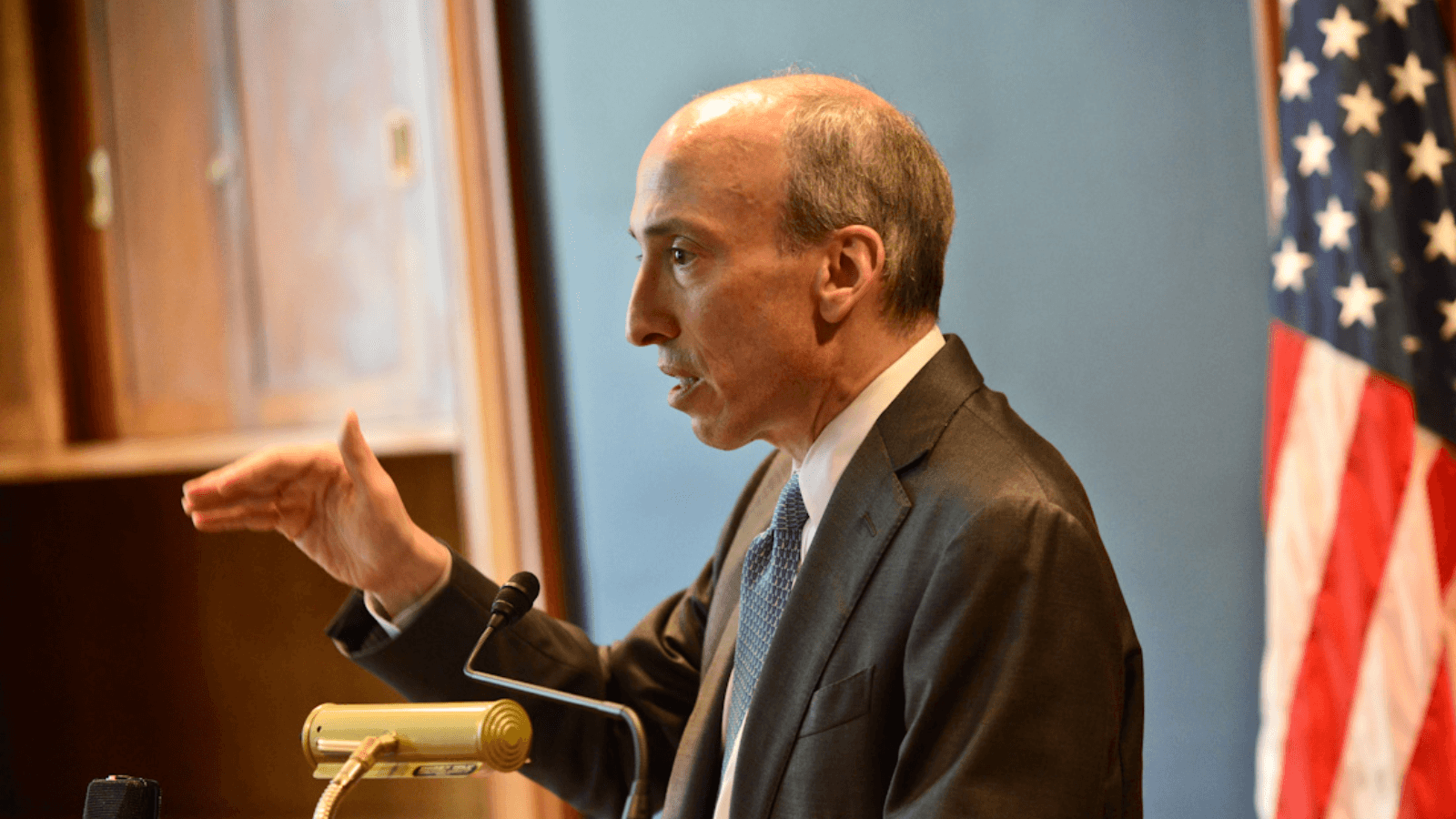

SEC Chair Gary Gensler | Third Way Think Tank/"Gary Gensler" (CC license)

- Two Senate committees heard from regulators, interested parties about crypto regulation Thursday

- Gensler said that the “vast majority” of crypto tokens are securities

In the Senate’s latest overture to crafting cryptocurrency regulation, two committee meetings on Thursday demonstrated that jurisdictional industry guidelines are still very much still up in the air.

The Senate Agriculture Committee heard from Commodity and Futures Trading Commission (CFTC) Chair Rostin Behnam and other cryptocurrency and banking industry professionals — while SEC Chair Gary Gensler appeared before the Senate Banking Committee.

Behnam told senators the CFTC has already started preparing to become the crypto industry’s watchdog.

“The volatility in the market, and its impact on retail customers — which may only worsen under current macroeconomic conditions – emphasizes the immediate need for regulatory clarity and market protections,” Behnam said in prepared remarks to the Agriculture Committee.

Gensler, who appeared before the Banking Committee at the same time, doubled down on his view that most crypto tokens and companies will have to work with his agency in some capacity.

“Of the nearly 10,000 tokens in the crypto market, I believe the vast majority are securities. Offers and sales of these thousands of crypto security tokens are covered by the securities laws, which require that these transactions be registered or made pursuant to an available exemption,” Gensler said in prepared remarks. “Thus, I’ve asked the SEC staff to work directly with entrepreneurs to get their tokens registered and regulated, where appropriate, as securities.”

The message was in line with remarks Gensler made ahead of the hearing. The SEC head said earlier this month he would support the CFTC overseeing cryptos that can be classified as commodities, namely bitcoin.

Agriculture Committee Chair Sen. Debbie Stabenow, D-Mich., and committee member Sen. John Boozman, R-Ark., presented legislation in August — the Digital Commodities Consumer Protection Act — that would place commodities under the CFTC’s jurisdiction. The bill only mentions bitcoin and ether as commodities and does not elaborate on the classification process.

“We are at a crossroads when it comes to crypto,” Christine Parker, vice president and deputy general counsel for Coinbase, said during the second panel before the Agriculture Committee.

Parker emphasized the need for clearer definitions and classifications, adding that digital asset commodities should be regulated by the CFTC and not through enforcement actions by the SEC. This appeared to be a nod toward Coinbase’s latest battle with the SEC over the classification of nine tokens as securities.

Despite ongoing discussions around jurisdiction, the agencies maintain they are committed to working together and share the same goals.

“The two agencies work very collaboratively,” Valerie Szczepanik, director of the Strategic Hub for Innovation and Financial Technology (FinHub) office at the SEC, said during a panel discussion at the Digital Asset Summit in New York Tuesday. “From my perspective, the agencies really want to get it right. It’s all about investor protection and market integrity and our two agencies want to cover the landscape so those goals are achieved.”

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.