China’s Global Bitcoin Hash Power Slips to 0%, Here’s Why

Cambridge Center for Alternative Finance puts hash rate in China at 0%, while the US currently has 35.4%

Blockworks exclusive art by Axel Rangel

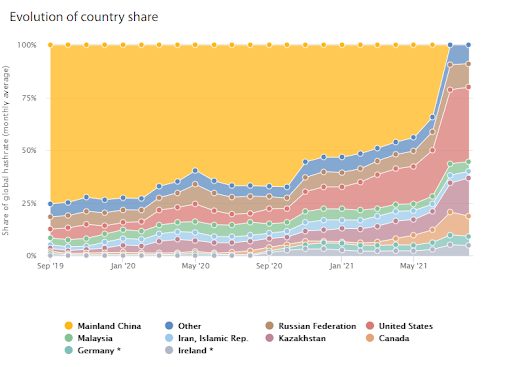

- Numbers from the Cambridge Center for Alternative Finance puts the hash power in the US at 35.4% as of August, up 16.9% from April

- Kazakhstan and Russia have both increased their share, with data showing Kazakhstan doubled its share to 18.1% and Russia at 11%

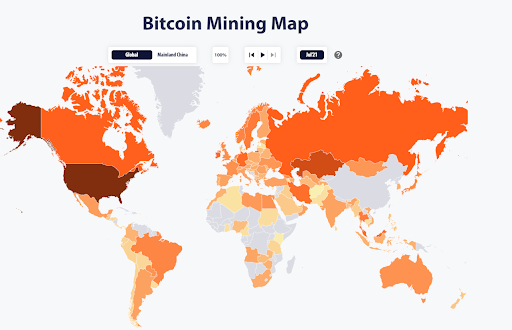

China now has virtually no share of the global bitcoin hash power, with the new world order of mining giants being the United States, Kazakhstan and Russia according to new data from the Cambridge Center for Alternative Finance.

Data from the Center shows the US now commands a 35.4% share (almost doubling from 16.8% at the end of April) with Kazakhstan at 18.1% (up from 8.2%) and Russia at 11% (up from 6.8%). After Kazakhstan is Canada (9.55%), Ireland (4.68%), Malaysia (4.59%).

Source: Cambridge Center for Alternative Finance

Source: Cambridge Center for Alternative Finance“The effect of the Chinese crackdown is an increased geographic distribution of hashrate across the world, which can be considered a positive development for network security and the decentralized principles of Bitcoin,” wrote Michel Rauchs, digital assets lead at the CCAF, in a note published online.

Source: Cambridge Center for Alternative Finance

Source: Cambridge Center for Alternative FinanceMining exodus from China

During the first half of 2021, regulators in China became progressively more hostile to crypto mining under the guise of carbon neutrality. While during the summer mining was done via hydropower in Sichuan, in the winter it migrated northwards to other provinces that relied on coal power.

In June, Qinghai, a northerly province that was once a mining hotspot, announced that it was prohibiting any new mining projects from opening up shop and ordered the shutdown of existing operations. A month prior, the State Council of the People’s Republic of China, a cabinet-level administrative organ, began ordering different provinces in the country to prepare to put a halt to mining operations.

May’s bitcoin crash, which liquidated nearly $8 billion in positions, and pushed the price of bitcoin down to almost $35,000, was partially blamed on market uncertainty emanating from news around China aggressively strengthening its mining ban.

Since then the price of bitcoin has recovered to $56,445, according to CoinGecko.

What’s next for decentralization?

With mining now out of China, and split between the US, Kazakhstan, Russia and the likes of Canada, is it ‘mission complete’ for decentralization? Not so, according to Brian Dixon, Chief Operating Officer of Digital Currency and Blockchain asset management firm Off the Chain Capital.

“With mining, there is going to be an ongoing evolution of the network and energy source innovation that will contribute to it for years to come. I don’t see the mining industry as having a ‘mission complete’ outcome as it will continue to grow and innovate each year around the world,” he told Blockworks by email.

Dixon believes that there is still room to strengthen decentralization over time, and doesn’t believe that Kazakhstan and Russia’s increase in mining share will negatively impact the network long-term.

“The Bitcoin community is strong in its conviction of maintaining a decentralized network and I think it will continue to work towards this goal,” he said. “There are geopolitical factors at play as well that could disrupt the mining network in any given country, which is why it is important that the network not become too big in one specific region or that could create challenges in the future.”

Are you a UK or EU reader that can’t get enough investor-focused content on digital assets? Join us in London on November 15th and 16th for the Digital Asset Summit (DAS) London. Use code ARTICLE for £75 off your ticket. Buy it now.