Circle and Unstoppable Domains Partner to Make USDC Exchanges Easier

In a similar aspect to how PayPal and Venmo made it easy for people to send US dollars to one another, Unstoppable Domains said their “.coin” usernames provide the same simplicity and accessibility

Unstoppable Domains co-founders Matthew Gould, CEO, (left) and Braden Pezeshki, full stack engineer; Source: Unstoppable Domains

- To date, Unstoppable Domains has sold more than 1 million blockchain domain names that are minted as NFTs on the Ethereum blockchain to give users full ownership and control over the names

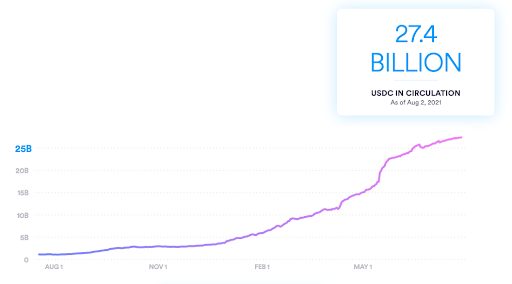

- The number of USDC in circulation increased 2640% to over 27.4 billion from about 1 billion on the year-ago date, according to CoinMarketCap data

Global financial technology firm Circle is partnering with Unstoppable Domains, a blockchain domain name provider, to introduce simpler usernames for stablecoin payments, the companies said in a joint statement Wednesday.

Circle is the principal developer of the USD Coin (USDC), the dollar digital currency with a market capitalization of more than $25 billion. Unstoppable Domains supports more than 200 cryptocurrencies across over 50 wallets and exchanges.

To date, Unstoppable Domains has sold more than 1 million blockchain domain names that are minted as NFTs on the Ethereum blockchain to give users full ownership and control over the names, the company said.

In a similar aspect to how PayPal and Venmo made it easy for people to send US dollars to one another, Unstoppable Domains said their “.coin” usernames provide the same simplicity and accessibility. USDC is a stablecoin, which means it’s backed by a fixed asset that provides the cryptocurrency with more stability. In this case, each USDC is backed by US dollars so for users with a USD bank account, the 1:1 ratio is always redeemable, giving it a stable price.

The partnership will help users replace the classic lengthy alphanumeric wallet addresses into “easily readable .coin” usernames so that it’s easier to transfer USDC across over 30 applications, wallets and exchanges to accelerate decentralized peer-to-peer transactions, it said.

“…We aim to make blockchain domain names the standard for digital currency transfers across all wallets and exchanges,” said Matthew Gould, founder and CEO of Unstoppable Domains. “Simple usernames combined with dollar-pegged stablecoins take the fear and risk out of spending crypto.”

The USDC market was launched in 2018 and has seen exponential growth in the past year. The number of USDC in circulation increased 2640% to over 27.4 billion from about 1 billion on the year-ago date, according to CoinMarketCap data. The stablecoin has also supported over $917 billion in on-chain transactions.

“USDC has grown dramatically in the last year, fueling commerce and payments activity across the internet,” Circle’s Senior Vice President of Marketing Josh Hawkins said. With the new simplified usernames, sending USDC can be as easy as sending an email and is a major step forward in making its payments accessible to all, Hawkins said.

Separately, in late June, Crypto.com announced it was joining forces with Circle to help users transfer fiat, or USD, in and out of the company’s app and exchange platform. The service requires users to deposit USD funds through a wire transfer and user-specific code via Circle and it will process, store and convert the USD to USDC. Those funds will be available in their crypto wallet on the platform within three business days, it said.

Want more investor-focused content on digital assets? Join us September 13th and 14th for the Digital Asset Summit (DAS) in NYC. Use code ARTICLE for $75 off your ticket. Buy it now.