‘Unfair, unworkable, unconstitutional’: Coin Center rebuffs Warren’s information request

A letter dated Jan. 14 refutes Warren’s negative characterization of its activities

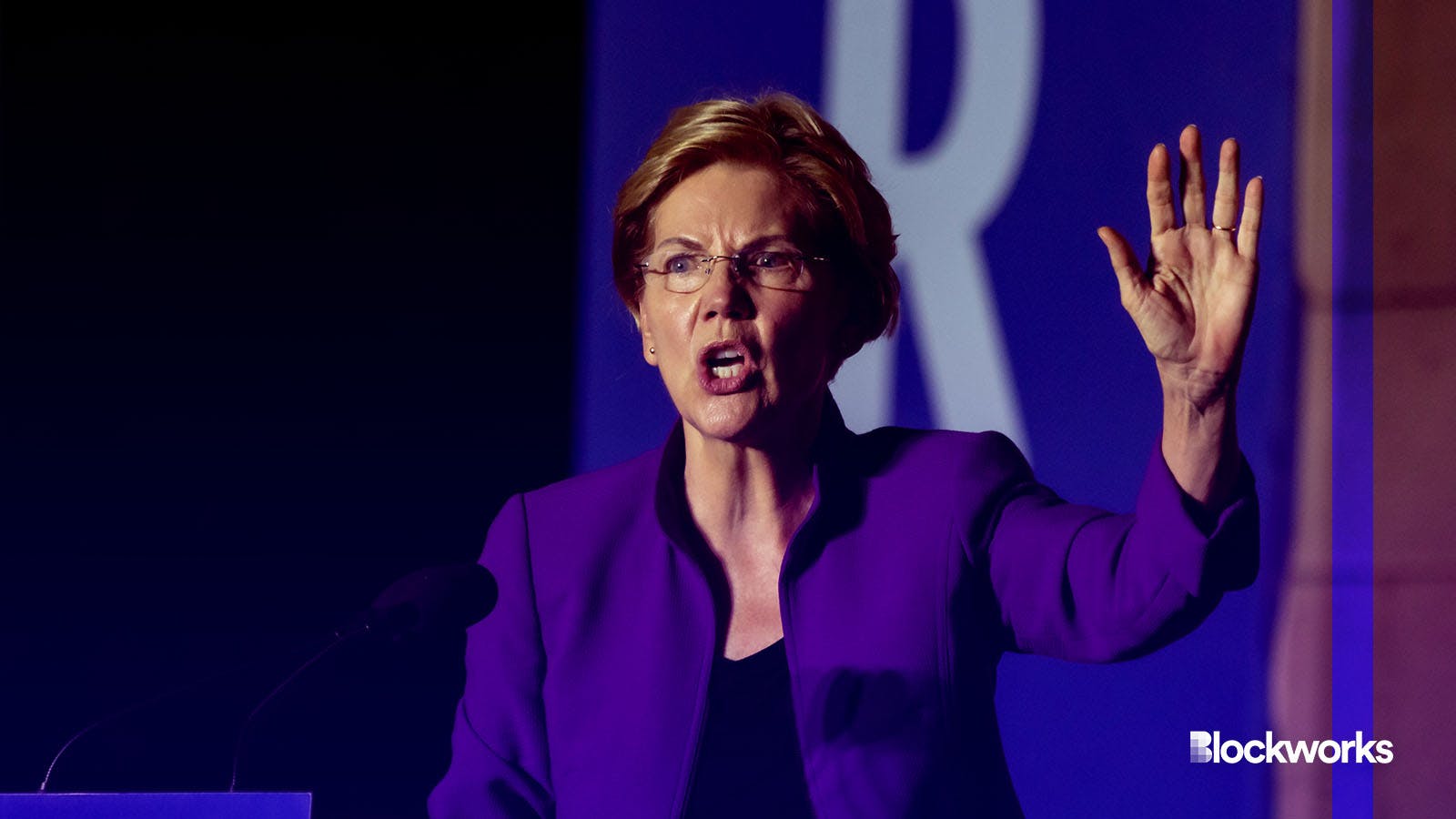

David Garcia/Shutterstock, modified by Blockworks

Crypto industry policy group Coin Center is pushing back against pressure from Sen. Elizabeth Warren (D-MA), who questioned the group’s opposition to her anti-crypto legislative efforts.

Jerry Brito, Coin Center’s executive director, said there was no obligation to answer questions posed in a December letter from Sen. Warren which he argues “discourages participation in important public policy debates.”

Warren wrote to Coin Center, the Blockchain Association and crypto exchange Coinbase on Dec. 18. 2023, accusing them of “spending millions…to stonewall common sense rules designed to restrict the use of crypto for terror financing.”

Read more: Senator Warren says crypto firms shouldn’t partner with ex-government officials

Brito rejected the characterization as inappropriate.

“Good policy-making can only happen when diverse voices and perspectives are earnestly welcomed and engaged, not baselessly accused of complicity in atrocities,” he wrote.

Sen. Warren is a proponent of both the Crypto-Asset National Security Enhancement and Enforcement Act of 2023 (the “CANSEE Act”) and Digital Asset Anti-Money Laundering Act of 2023 (DAAMLA), which she introduced.

Both measures were referred to the Senate Committee on Banking, Housing, and Urban Affairs in July, but have yet to be taken up and have no immediate prospect of becoming law.

Read more: What happened in Congress in 2023: Mid-session update

Coin Center regards both bills as “unfair, unworkable, and most importantly, unconstitutional.”

“The CANSEE Act would criminalize speech in the form of software publishing,” Brito wrote, while the DAAMLA “would also essentially ban software and permissionless blockchain networks.”

Therefore, he argues, opposing them “is not just proper, but indeed patriotic.”

If Sen. Warren is so concentrated about Hamas’ use of crypto for financing its activities, as her December letter contends, Brito questions why she does not focus on “securing more funding for FinCEN, the FBI and the DOJ’s crypto enforcement units.”

He also pointed to a bipartisan letter from 57 members of Congress addressed to President Biden and Treasury Secretary Janet Yellen in November specifically on the subject of Hamas’ financing, as action Coin Center supported.

Read more: Lawmakers butt heads on role of crypto in terrorist financing

Senator Warren’s office was closed for the Martin Luther King Jr. holiday.

Start your day with top crypto insights from David Canellis and Katherine Ross. Subscribe to the Empire newsletter.