Core Scientific Expands Mining Fleet Post-Bankruptcy

Core Scientific will soon be operating over 207,900 bitcoin mining machines in total after a newly expanded contract with LM Funding

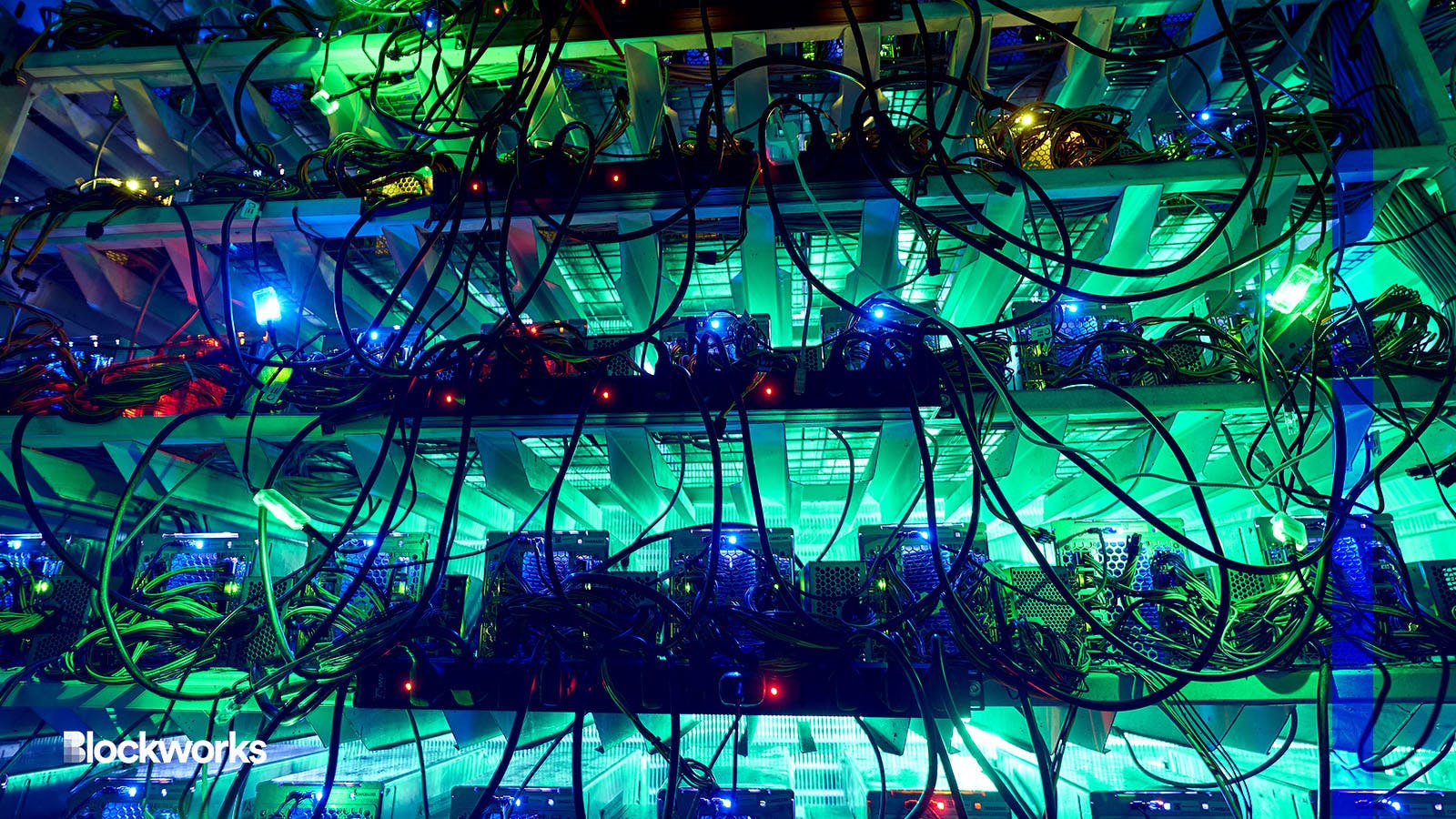

Source: Shutterstock / Artie Medvedev, modified by Blockworks

Austin, Texas-based Core Scientific expanded an agreement with crypto miner LM Funding to host 900 more bitcoin mining machines.

These machines are expected to become operational by the end of April, according to a press release from April 12.

With the expansion, LM Funding will now have a total of 3,900 machines hosted by Core, and 4,600 machines overall. The company didn’t mention where its other mining machines are being hosted.

The 900 new Core-hosted machines give LM Funding a total mining capacity of about 400 petahash.

A spokesperson for Core Scientific confirmed the contract to Blockworks.

Core filed for bankruptcy in December after suffering from an extended decline in the price of bitcoin, higher electricity costs and the failure of some hosting customers to honor their payment obligations.

Yet, the company said it would continue to mine bitcoin during the restructuring through its self-mining and hosting services, which remained “significantly cash flow positive on a debt-free basis.”

At the end of March, Core Scientific counted about 207,000 bitcoin miners — of which 52,000 were under co-location and 155,000 were under its self-mining business — giving the company a total potential hash rate of 21.8 exahash at its data centers in Georgia, Kentucky, North Carolina, North Dakota and Texas.

From its self-mining operations, Core minted 1,410 bitcoin (worth about $4 million) in March.

Meanwhile, bitcoin miners owned by Core’s customers produced 474 bitcoin in March.

At the time of its bankruptcy, Core had temporarily appointed its general counsel and chief compliance officer Todd Duchene as chief legal officer and president.

But earlier this week, the company asked a US court to approve Adam Sullivan as its new president. Sullivan was previously managing director at XMS Capital Partners. In his new role, he will be reporting to Core’s CEO, Mike Levitt.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.