Crypto miners continue ‘sprint’ for hash rate in lead-up to halving

Riot Platforms bought 31,500 more mining machines while CleanSpark has begun operating in Mississippi

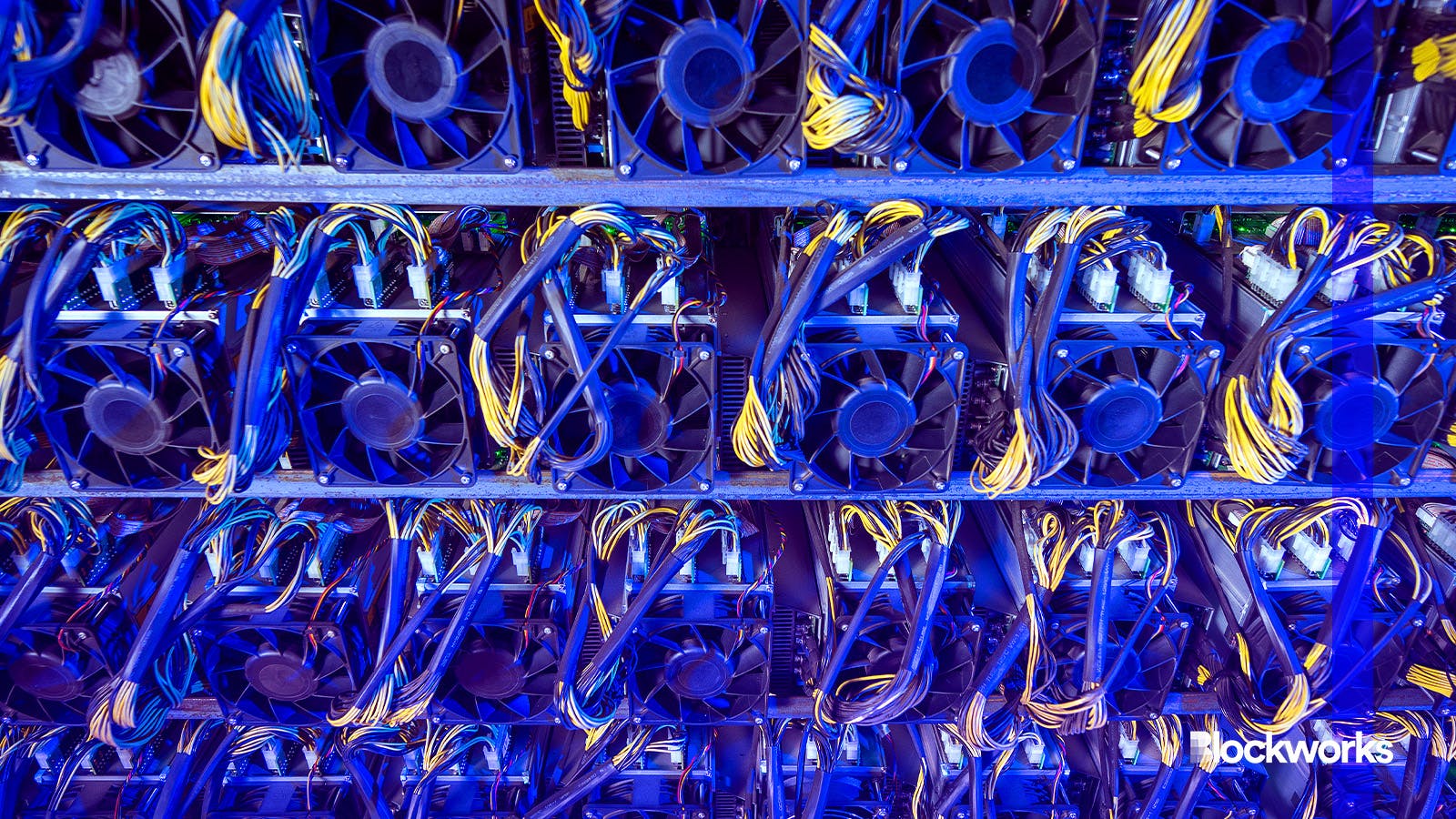

Mark Agnor/Shutterstock modified by Blockworks

Bitcoin mining giant Riot Platforms has bought more mining machines, while rival CleanSpark has closed its acquisition of three new facilities.

These moves by crypto miners are just the latest efforts aimed at boosting hash rate and optimizing efficiency as segment players prepare for the bitcoin halving.

Riot Platforms bought 31,500 more miners from MicroBT for 97.4 million. The purchase is set to up the company’s self-mining hash rate capacity at its facility in Rockdale, TX from 12.4 exahashes per second (EH/s) to 15.1 EH/s by the end of July.

Read more: How the halving could impact bitcoin’s price

The buy of M60S air-coolers machines comes as the company has identified “under-performing” miners Riot CEO Jason Les said in a Tuesday statement. Riot is set to replace 17,000 miners in the Rockdale facility in total, while adding 14,500 more.

Securing newer and more-efficient mining machines has been a key focus for larger mining firms ahead of the “disruptive” halving event, said Louise Abbott, a crypto-focused partner at Keystone Law.

“Many factors will contribute to the success of bitcoin miners, such as who has the lowest energy costs and the most efficient equipment,” Abbott told Blockworks. “The crypto industry is very much ‘dog eat dog,’ and the lead-up and aftermath of the halving will be no different.”

The company’s new hash rate target by the end of 2024 is 31 EH/s as it seeks to also continue building out its facility in Corsicana, TX.

The move comes after Riot revealed in December that the company had purchased 66,000 mining machines for $290.5 million. It noted that it had the option to buy 265,000 more MicroBT miners on the same terms in a deal that could help it surpass a hash rate of 100 EH/s in the long term.

Read more: Crypto miners keep busy ahead of halving with accelerated machine buys

Las Vegas-based competitor CleanSpark is also moving ahead with its hash rate expansion plans, noting Tuesday that its acquisition of three data centers in Mississippi was complete.

The purchases — as part of a $19.8 million cash deal — were set to expand CleanSpark’s operating hash rate by roughly 2.4 EH/s, the company said earlier this month.

“The teams have already racked miners, sending our fleetwide hashrate to over 15 EH/s, and we are hard at work as we sprint to add more hash rate as quickly as possible,” CleanSpark CEO Zach Bradford said in a statement.

Miner moves to increase hash rate and miner efficiency comes ahead of the next bitcoin halving, slated for April.

At that time, per-block rewards will drop from 6.25 BTC to 3.125 BTC, putting financial stress on miners.

Galaxy Digital analysts said in a Feb. 12 report that up to 20% of network hash rate from eight mining models could go offline after the halving due to the machines no longer being profitable.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.