Ahead of halving, another bitcoin miner plots growth via site acquisitions

Las Vegas-based company is the latest to buy facilities as a way to boost growth before per-block bitcoin mining rewards are cut in half

Artie Medvedev/Shutterstock modified by Blockworks

CleanSpark is the latest bitcoin miner seeing growth through acquisitions in the lead up to the next Bitcoin block reward halving, happening in April. The company said that it expects the buys to help it double its hash rate in the coming months.

The Las Vegas-based company revealed agreements to purchase three bitcoin mining facilities in Mississippi for $19.8 million in cash. The buy is set to boost CleanSpark’s operating hash rate by roughly 2.4 exahashes per second (EH/s).

CleanSpark is also buying an additional facility for its campus in Dalton, GA. The acquisition and build-out of the new property is set to cost the miner about $7 million and add about 0.8 EH/s in hash rate.

Read more: Bitcoin miner CleanSpark to launch in-house trading desk: Bloomberg

CleanSpark’s hash rate stood at 10 EH/s on Jan. 31. The new acquisitions would raise that to a planned level of 13.2 EH/s.

Additional expansion at the Dalton site and at CleanSpark’s property in Sandersville, GA, would add an additional 0.8 EH/s and 6 EH/s in hash rate, respectively, according to the company. The acquisitions and expansions gives the firm the chance to hit a hash rate of 20 EH/s within the first half of 2024.

“With the addition of Mississippi to our portfolio, we are gradually increasing our geographic diversity and expect to apply our proven track record of success in this new and exciting operating environment,” CleanSpark CEO Zach Bradford said in a statement.

Diversifying geographically, as well as opening up new revenue streams, has proved a common strategy around the crypto mining segment, ahead of the next bitcoin halving. Slated for April, the halving is an event during which per-block rewards for mining bitcoin are set to drop from 6.25 bitcoin (BTC) to 3.125 BTC.

Read more: Bitcoin price tracking ahead of the past 2 halvings — now 3 months to go

CleanSpark’s acquisitions come after Marathon Digital closed a deal last month to buy two mining sites in Nebraska and Texas for $179 million in cash. That acquisition gives Marathon a chance to double its hash rate to about 50 EH/s in the next 18 to 24 months, the company said.

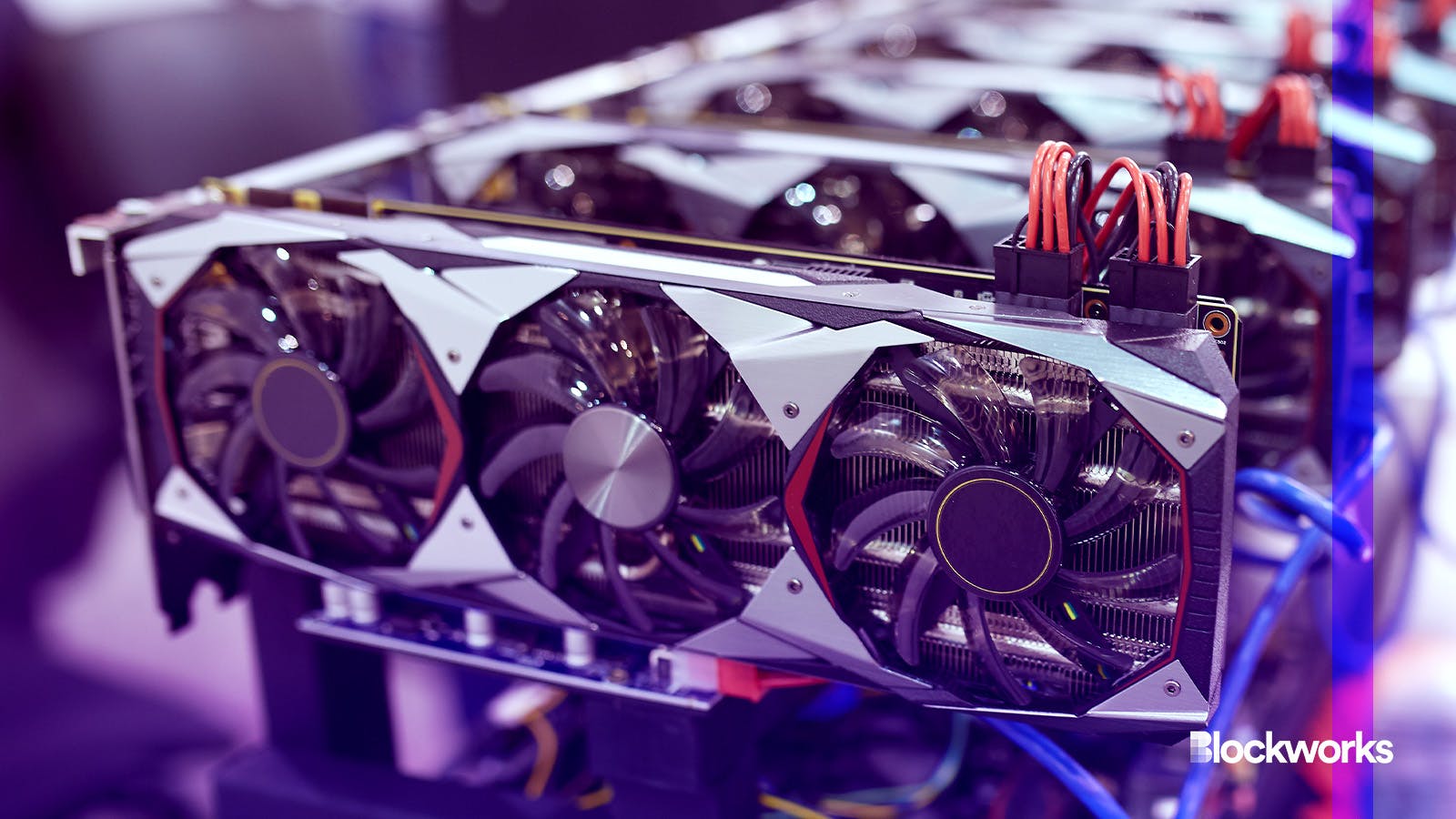

Miners have also been investing in new equipment to prepare for the halving.

A dozen bitcoin miners had purchased roughly $1.2 billion worth of machines in 2023, as of early December, according to BlocksBridge Consulting. The acquired machines totaled more than 70 EH/s in capacity.

Read more: Crypto miners keep busy ahead of halving with accelerated machine buys

CleanSpark committed last month to buying 60,000 Bitmain S21 miners, to be delivered between April and June. It also secured an option to buy 100,000 more machines at a fixed price by the end of the year. The deployment of all 160,000 machines would help CleanSpark achieve about 50 EH/s in hash rate.

The deal is similar to Riot Platforms, which bought 66,560 MicroBT machines in December. Riot has an option to buy 265,000 more machines as part of a plan that could help it increase its hash rate by 75 EH/s over the long-term.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown: Decoding crypto and the markets. Daily.

- 0xResearch: Alpha in your inbox. Think like an analyst.